Qilu Bank plans to initiate a wealth management subsidiary of 1 billion capital injection. At present, there are more than 20 small and medium -sized banks waiting for small and medium -sized banks.

Author:Capital state Time:2022.07.30

On July 28, 2022, Qilu Bank (601665.SH) issued an announcement of the establishment of a wealth management subsidiary.

The announcement disclosed that Qilu Bank held a board meeting on July 28, 2022 to review and approve the "Proposal on the establishment of a wealth management subsidiary" and agree to the company's full assets to establish the establishment of Qilu Financial Co., Ltd. (tentative name), registered capital 10 10 100 million yuan, authorized senior management to handle related specific matters.

The place of registration of wealth management subsidiaries is intended to be Jinan City, Shandong Province, with 100%shares of Qilu Bank. The scope of business is: to publicly issue wealth management products for unspecified public, invest and manage the property of entrusted investors; invest in non -publicly issued wealth management products for qualified investors, invest and manage the property of entrusted investors; wealth management consultants and consulting Services and other businesses approved by regulators.

Qilu Bank said that this investment is an important measure for the company to implement the latest requirements of regulatory agencies and promote the healthy development of the wealth management business, which is conducive to further improving the company's wealth management business structure, strengthening the risk isolation of wealth management business, and better realizing the "entrustment of people's entrustment The service tenet of the service "for money". The establishment of wealth management subsidiaries is in line with regulatory policy orientation and the development trend of the banking industry at home and abroad, and it is also in line with the company's own strategic development plan, which is conducive to the company to enhance the level of comprehensive financial services and enhance the ability to serve the real economy, value creation and overall anti -risk.

In 2021, the Annual Report of the Bank of Zilu was discussed. As of the end of the reporting period, 92 years of continuous wealth management products, the balance of wealth management products was 68.488 billion yuan, and all of them were net worth wealth management products.

According to the Bank of Qilu, during the period, the bank's handling fee and commission income increased by 43.55%year -on -year to 1.05 billion yuan, which was mainly driven by the business development of wealth management. At the same time, Zilu Bank also focused on creating the "Quan Psychological Finance" asset management brand to meet the needs of different customers.

According to statistics from the "Annual Report of the Bank of China Wealth Management Market (2021)", as of now, a total of 29 banking financial management has been approved for construction. These include 6 state -owned banks, 11 joint -stock banks, 7 urban commercial banks, 1 rural commercial bank, and 4 China -foreign joint ventures.

(CITIC Jiaotou)

Among them, 7 financial management subsidiaries initiated by the city commercial bank are Ningyin Finance, Hangyin Finance, Huiyin Financial Management, Nanyin Financial Management, Su Yin Financial Management, Qingyin Financial Management and Shangyin Financial Management; The only one of the wealth management of the Rural Commercial Bank is currently.

"New Regulations for Asset Management" Since its implementation, bank wealth management business supervision has also been deepened step by step, and small and medium banks represented by urban agricultural and commercial behavior have also accelerated in layout of wealth management sub -business. In the second half of 2021, Bank of Beijing, Bank of Xi'an, and Bank of Guiyang have successively announced the establishment of financial management subsidiaries.

Among them, the registered capital of the Bank of Beijing's wealth management sub -registered capital is 5 billion yuan. Earlier, the largest city commercial bank wealth management was Shanghai Bank of Shanghai Bank of China, with a registered capital of 3 billion yuan.

According to incomplete statistics from CITIC Construction Investment, as of 2021, 20 urban agricultural and commercial banks that have been established but have not been disclosed have reached 20.

(CITIC Jiaotou)

In addition, at the 2021 performance conference held in May this year, Xu Jianping, chairman of Lanzhou Bank, also said that in the future, Lanzhou Bank will actively carry out the application of financial licenses such as financial subsidiaries and consumer finance companies within the scope allowed by regulatory policies to be allowed , Create professional comprehensive financial services capabilities.

According to the analysis of CITIC Construction Investment, from the future, the establishment of wealth management subsidiaries may be the necessary conditions for small and medium -sized banks to continue to carry out wealth management business and independently issue wealth management products. By setting up wealth management, small and medium -sized banks not only help improve the resource allocation capabilities in the development of small and medium banks, but also help the development of sales and the promotion of cooperation.

However, CITIC Construction Investment also mentioned that for small and medium -sized banks, due to corporate governance, investor protection, and channel competition, a series of problems may also face more challenges.

Therefore, banks with a large scale of wealth management business can strive for the opportunity to set up financial management. For banks that have a small scale but do not want to give up the wealth management business, CITIC Construction Investment suggests that you can consider obtaining a wealth management company license with other banks or asset management companies in a joint manner. After the establishment of wealth management of small and medium -sized banks, it should give full play to its own advantages, promote strengths, and continue to open up the market, and tap the potential.

- END -

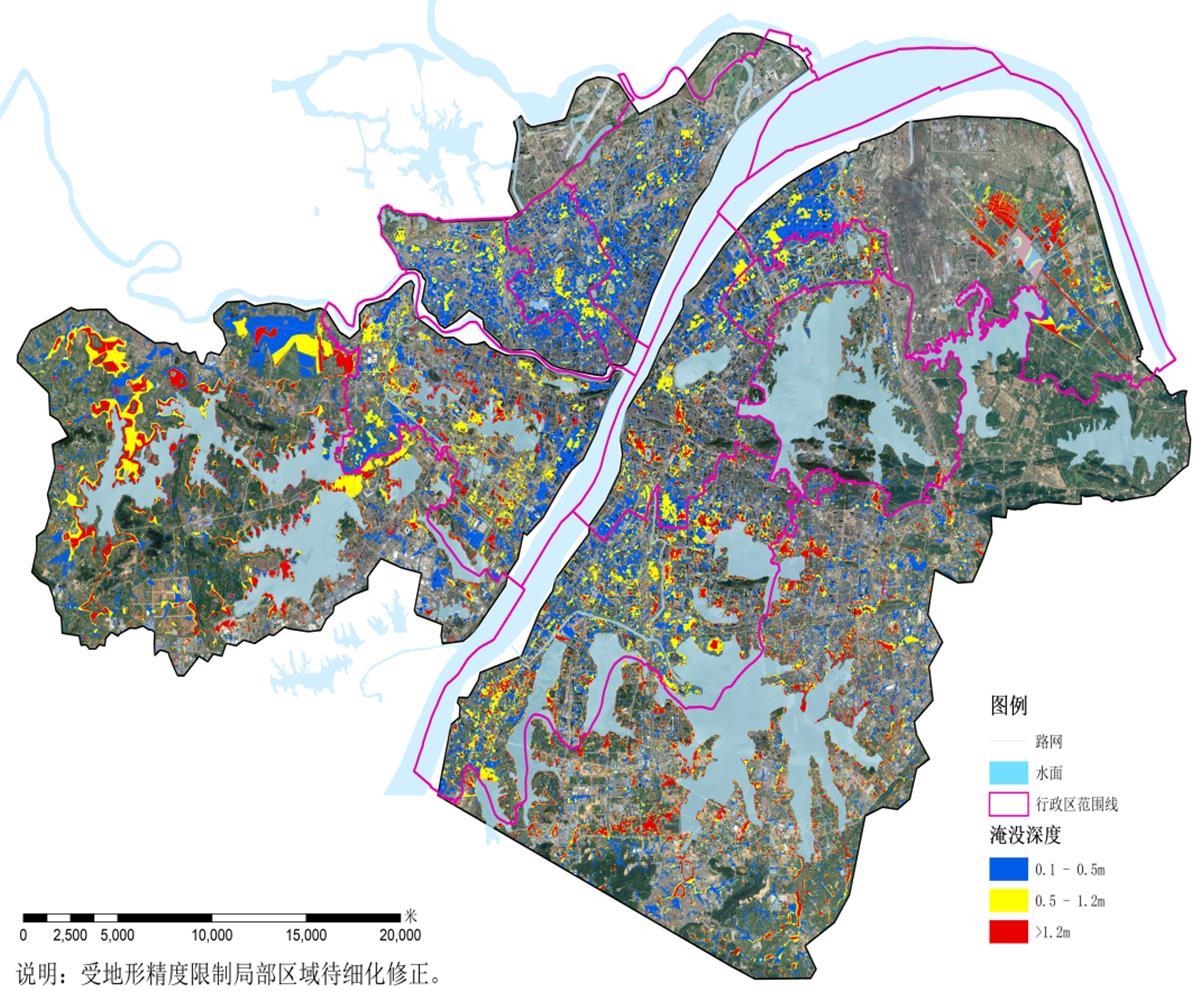

Where is the rainy rainfall, where is it easy to cause waterlogging?Wuhan delineates 21 risk areas

Jimu Journalist Pan XizhengIntern Xiang YuchenOn July 6, the Wuhan Municipal Gover...

How is good melon seeds released?

● Hu Yang.com reporter Guo Xuewei Tang Yuanyuan Bing Corps Daily all -media reporter Wei Changfeng Wei WeiMelon seeds, people often eat, are the weapons of spending time. Speaking of Beitun Haichua