Tune Vane | Jianyuan Schroder Fund He Shuai: New products quickly build positions, heavy warehouse pharmaceutical biological sectors

Author:China Fund News Time:2022.07.29

China Fund News Wang Yunlong

Editor's note: Recently, the Fund's second quarterly report has disclosed that the positioning movements and position changes of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

The high -winning player "He Shuai" once again handed over an excellent answer sheet in the second quarter. Previously, He Shuai was recognized by investors because of his management products for 6 consecutive years.

Looking forward to the market outlook, He Shuai believes that the uncertainty of the economic level has not been completely eliminated. After the trough of the second quarter, many listed companies need to observe whether they can return to higher growth rates and expectations in the second half of the year. "We judge that such companies and industries will not be too much, so we will focus more on structural opportunities."

In this issue of [Warehouse Vane], Fund Jun will explain the second quarter report and position adjustment of the Schrodie Fund He Shuai.

In the second quarter, He Shuai exceeded 20 billion yuan in the size of the product in the second quarter

The second quarter report shows that in the context of the Shanghai and Shenzhen 300 rose 6.21%in the second quarter, He Shuai managed all the products to win the Shanghai and Shenzhen 300 with its performance.

Among them, Hai Shuai only established the same performance in Jiaoyin Rui and the three -year holding of the three -year holdings in early March of this year. The net value in the second quarter rose 16.76%, and the intersection industry also acquired 13.30%of the net value growth rate in the second quarter.

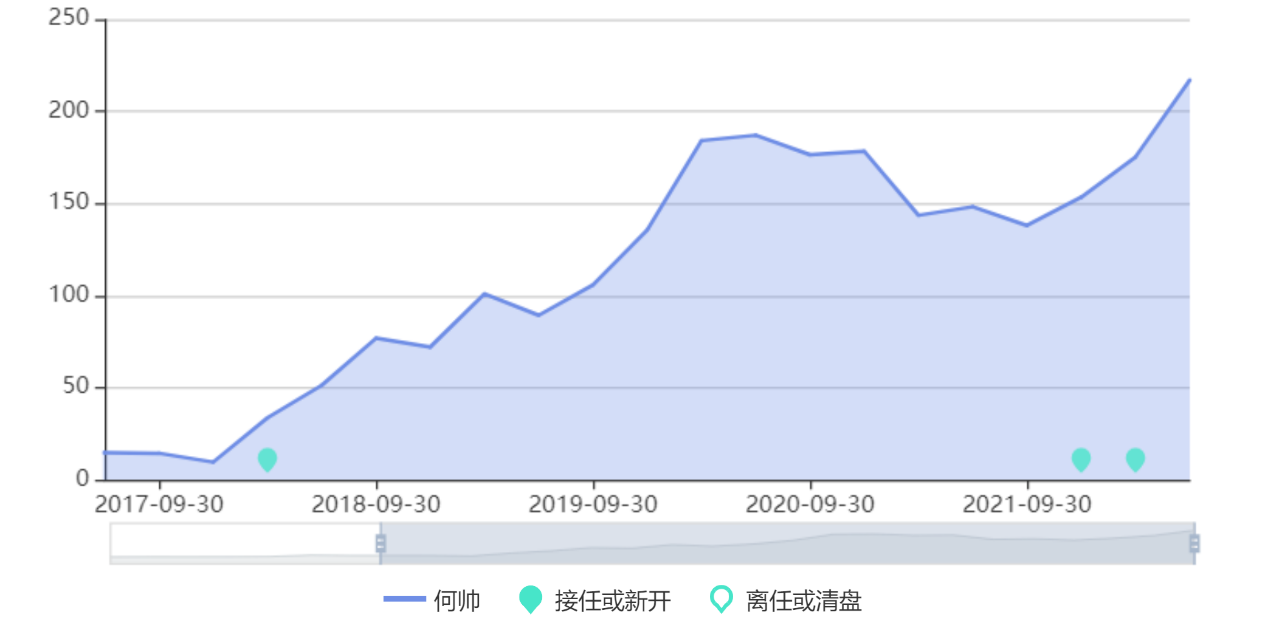

At the same time, He Shuai has also risen in the management of products. At the end of 2017, He Shuai was still in charge of the product scale of only 955 million yuan. In the first quarter of 2019, He Shuai successfully exceeded the tens of billions. At the end of the second quarter of this year, He Shuai successfully exceeded 20 billion yuan in the size of the product, reaching 216.99 to 216.99 100 million yuan, setting a record high in personal history.

In the second quarterly report of the product, He Shuai pointed out that the market expected in the second quarter of 2022 has experienced great changes, from pessimism at the beginning of the season to relatively optimistic at the end of the quarter. The GEM index rose by 33%from a relatively low point, of which automobiles, new energy and other sectors performed better. This steering stems from the gradual elimination of the epidemic and the government's strong policy support.

The overall stock position decreases

The concentration of heavy positions rises slightly

From the perspective of the position, as a fund manager of the "absolute income" style, He Shuai's rights and interests are not extreme.

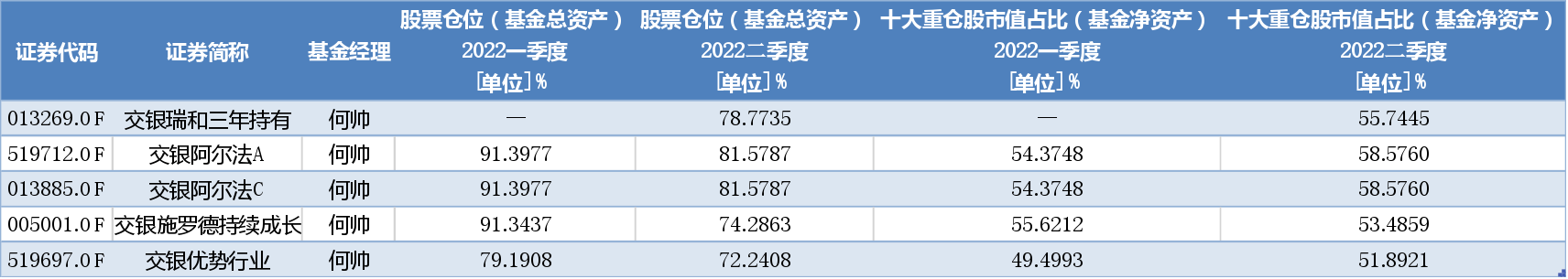

The second quarterly report shows that except for the newly issued in early March, the remaining products managed by He Shuai have declined in the second quarter. Among them, the Stock Alpha stock position was reduced from 91.40%at the end of the first quarter to 81.58%at the end of the second quarter, and Schroder's continued growth from 91.34%at the end of the first quarter to 74.29%; while the stock position position of the Bank of Communications, the stock position position of the bank's stock position Basically, it was flat, rising slightly from 72.19%at the end of the first quarter to 72.24%. The overall attitude is relatively cautious.

Despite the decline in stock positions, the concentration of the top ten heavy stocks in He Shuai has increased. Among them, the top ten heavy stocks of Alpha's top ten heavy warehouses increased from 54.37%at the end of the first quarter to 58.58%at the end of the second quarter. Schroord's top ten heavy warehouse holding shares held from 55.62%at the end of the first quarter to 53.49%.

Heavy warehouse shares are fine -tuned compared to the first quarter

New products are faster to build warehouses, heavy warehouse pharmaceutical sectors, and incorporate two Hong Kong stock standards

From the perspective of heavy warehouse holdings, He Shuai's overall position holding the stocks is not long. After the product heavy positions were clearly adjusted in the first quarter, He Shuai once again adjusted the heavy positions in the second quarter. "In the second quarter, the Fund continued the layout of March. We believe that from the perspective of the long -term period, they still have 'cost -effectiveness'." He Shuai said in the second quarterly report of the product

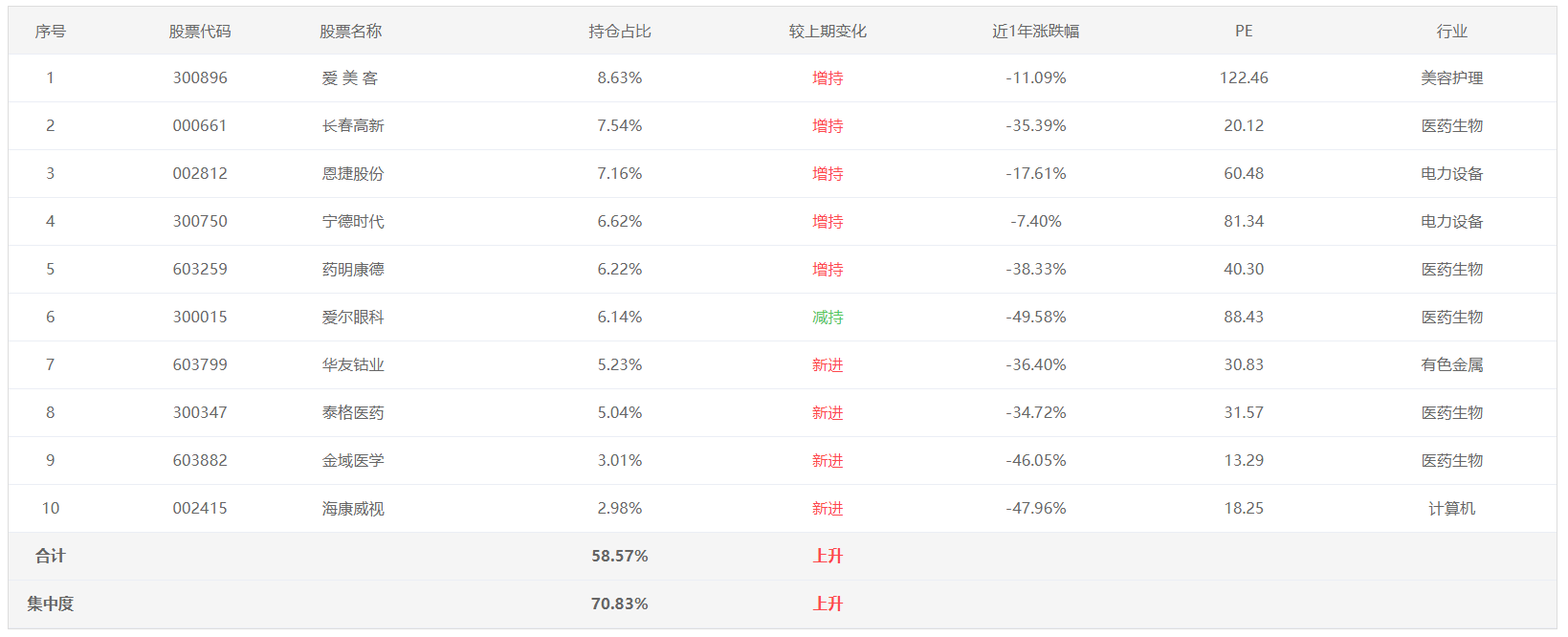

The second quarterly report shows that although there are slight differences in the second quarter, Aimei, Changchun High -tech, Enjie, Ningde Times, Yaoming Kangde, El Ophthalmology, Huayou Cobalt and Tiger Medicine have occupied He Shuai's management products ten The eight seats of the heavy storage stock. Among them, both Huayou Cobalt and Tiger Medicine were both handsome held for the first time.

In addition, He Shuai's three products of Alpha, Alpha, Schroord, and Bank of Communications, and Bank of Communications have been managed for the first time. At the same time, Alpha, Alpha, the first heavy warehouse holding Jinyu Medicine and Schrodil Schroder's continued growth of the first heavy warehouse holding Ziguang Guowei and Jiaotong Bank's advantageous industry for the first time to hold Jianlong Weina.

The top ten heavy stocks of Alpha

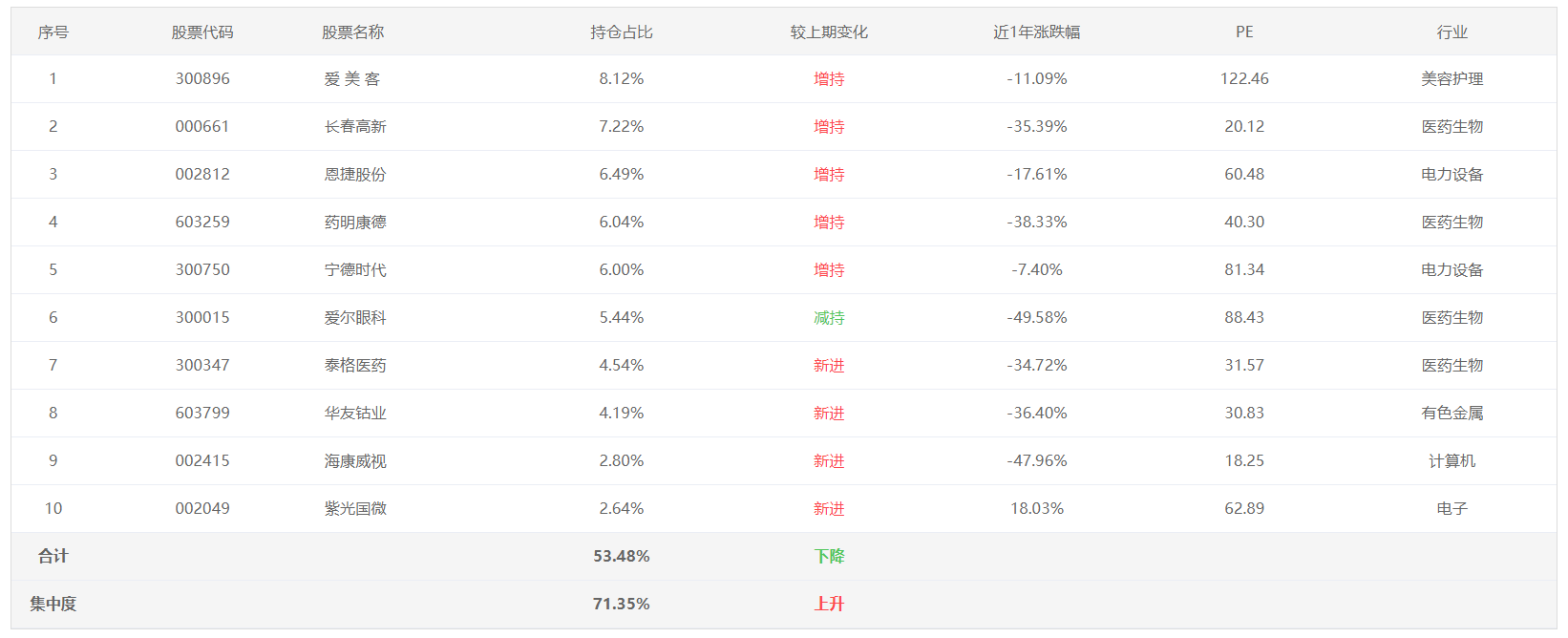

Traffic Bank Schroeda continues to grow in the top ten heavy stocks

The top ten heavy warehouse stocks

It is worth noting that He Shuai managed the Bank of Communications and Rui and the three -year holding of the three years.

Among the top ten heavy warehouses disclosed by this product, in addition to the eight heavy warehouses mentioned above, He Shuai also holds two Hong Kong stock markers, namely Yaoming Biology and Hygia Medical, both It belongs to the medical biological sector. In this way, in the list of the top ten heavy warehouses of He Shuai's new products, medical targets occupied 6 seats.

Traffic and Ruihe and the top ten heavy stocks in three years

"After the Fund was established in early March 2022, we built their positions quickly, and the main direction was medical services and new energy. At that time The competitiveness of advantageous enterprises is obvious and valuation is more attractive. "He Shuai wrote in the product second quarterly report.

At the same time, He Shuai said that due to the scope of investment in Hong Kong stocks, more outstanding companies can choose. Focus on structural opportunities

Digger a company with high growth rate and expected company

Looking back at the market performance in the second quarter, He Shuai pointed out that the market expectations in the second quarter of 2022 have experienced great changes, from extreme pessimism at the beginning of the quarter to the relatively optimistic at the end of the quarter. "The GEM index rose by 33%from a relatively low point, of which automobiles, new energy and other sectors performed better." In He Shuai's opinion, this steering stemmed from the gradual elimination of the epidemic and the government's strong policy support.

Looking forward to the third quarter, He Shuai believes that the uncertainty of the economic level has not been completely eliminated. After the trough of the second quarter, many listed companies need to observe whether they can return to higher growth rates and expectations in the second half of the year.

"We judge that such companies and industries will not be too much, so we will focus more on structural opportunities." He Shuai said.

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Guangxi introduced a package policy to protect the market subject

On June 30, the reporter learned from the press conference held by the Autonomous ...

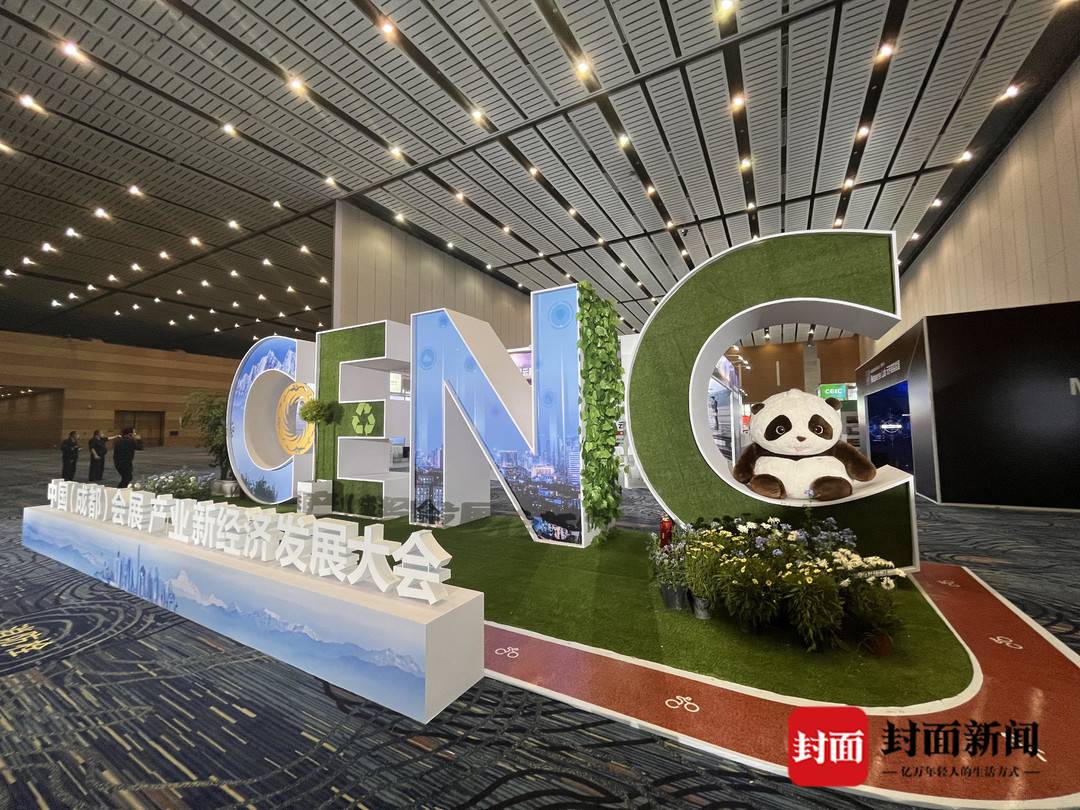

Blow the warm wind for the industry!China (Chengdu) Convention and Exhibition Industry New Economic Development Conference opened

Cover reporter Ma MengfeiOn June 17, the China (Chengdu) Convention and Exhibitio...