International gold prices are sharply shocked, what happened to gold?

Author:China Economic Network Time:2022.07.29

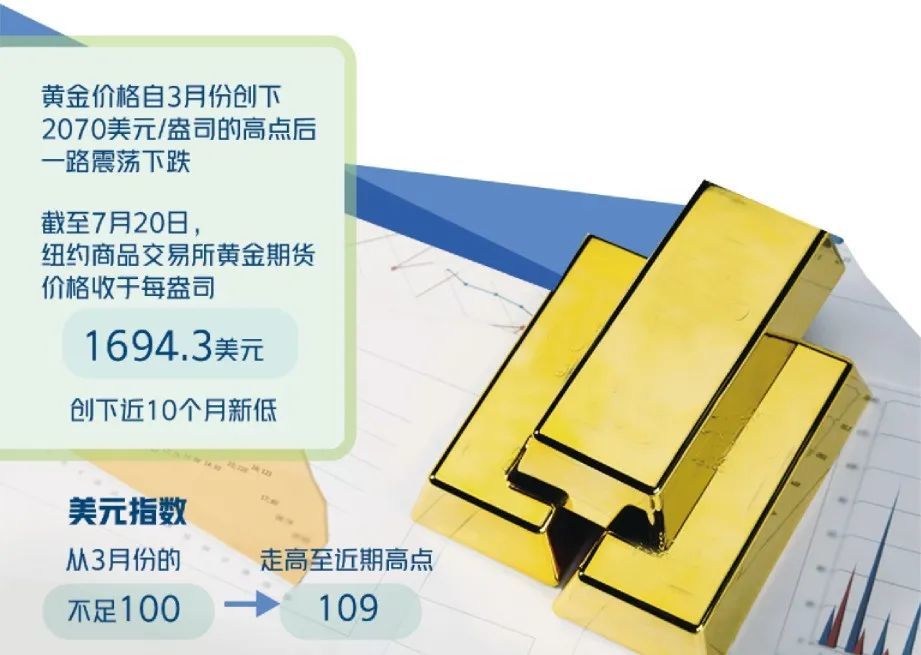

Since the beginning of this year, it has been affected by multiple factors such as the overwhelming of the epidemic, the international geopolitical conflict and the adjustment of the Fed's monetary policy adjustment, and the price of gold has fluctuated significantly. Since the high point of $ 2070/ounce in March, international gold prices have fallen all the way. As of July 20, the price of gold futures on the New York Commodity Exchange closed at $ 1694.3 per ounce, a new low of nearly 10 months. However, in recent days, it has risen slightly.

Gold is a traditional risk shelter. After the outbreak of the Russian and Ukraine conflict, the market is expected to rise in gold prices. The reality is that the international gold price has soared to 2000 US dollars per ounce. People in the industry generally believe that there are many factors affecting gold prices. After the second quarter, the focus of the market has turned to the Federal Reserve to raise interest rates. With the continuous rise of U.S. inflation, the expectations and intensity of interest rate hikes have gradually strengthened. The top prices have fallen.

Zhou Maohua, a macro researcher at the Financial Market Department of Everbright Bank, said that at the end of February this year, the geographical situation was tight and the U.S. high inflation expectations once boosted the demand for gold investment. Appeal. At the same time, under the expectations of the Federal Reserve's interest rate hike, the US dollar liquidity tightened, resulting in a strong appreciation of the US dollar, which also formed a negative effect on the price of gold.

Generally speaking, the price of gold has a reverse relationship with the US dollar trend. After the Federal Reserve raised interest rates, the US dollar strengthened, while the price of gold denominated in the US dollar fell. Since the Federal Reserve announced in March of this year, it announced that the benchmark interest rate was raised by 25 basis points. In the context of continuous strengthening of the US dollar interest rate hike, gold performed weakly.

New York gold price trend chart. (Site screenshot)

"The continuous decline in gold prices this year is caused by multiple factors." Xia Yingying, a valuable metal analyst at Nanhua Futures, believes that first of all, the situation in Russia and Ukraine turned to "tugging", and the risk aversion gradually faded down On the downward value, from less than 100 in March, the US dollar index has risen to recent highs 109. The market has continued to increase the Fed's interest rate hike expectations, and global economic recession is concerned about the increase in risk aversion in the US dollar. In addition, the US decade inflation expectations have fallen to 2.3%to 2.4%. Compared with the current reality inflation pressure of more than 9%, it reflects the significant results of the Fed's inflation expectations, which also suppresses the demand for the purchase of gold.

The recent report issued by the World Gold Association also pointed out that the stronger dollar, weak commodity market, and decline in the position of investors may be the three main reasons for the recent decline in gold prices.

Data show that as of July 18, the world's largest gold ETF holding has dropped to 1009 tons, a drop of nearly 100 tons from the position of the position in April.

In this regard, the World Gold Association believes that investors' concerns about the US economy have shifted from "high inflation" to "recession", which has also led to the adjustment of its investment portfolio, which corresponds to gold accordingly. At the same time, many traders regarded $ 1,800/ounce as an important support gate. After the price of gold fell below the pass, it might cause chain flat positions and additional warehouse transactions. Summer is usually a season when gold performs weak, and India has suddenly increased gold import tariffs, which enhances the pessimistic level of traders.

For the next stage of gold price trends, experts have different opinions, but they all believe that this will depend on the balance between multiple factors in the future. "In the short term, gold will still be under pressure in the third quarter, because it is still difficult to determine whether U.S. inflation has been at the top. Although the price of commodities represented by crude oil has fallen to a certain extent, the CPI low base effect in the third quarter in the third quarter of the third quarter has effect The risk of inflation will still increase the risk of inflation. "Xia Yingying said.

Zhou Maohua also believes that from the trend, the trend of gold is still under pressure. At present, the Federal Reserve is in the middle of interest rate hikes, the European Central Bank's interest rate hike cycle is expected to start, and the global interest rate center has risen. In addition, high inflation and high interest rates have gradually appeared in European and American demand. The tightening of the financial environment and high interest rates will weaken the attraction of gold investment.

A senior gold investment analyst at Caibai shares told reporters that he predicts that gold prices are expected to be between $ 1680 and $ 1,700 in the short term, and there is a trend of repair. It is expected to achieve rising.

For investors, investment in gold should be more cautious and rational at this stage. "Due to the recent global geopolitical situations, global inflation, economic and policy prospects are still high, market expectations are expected, market fluctuations are fierce, and gold prices can predict further decline. Investors should strengthen potential risks, moderate moderate risks, moderate moderation Reduce the leverage of related varieties and optimize their own asset investment portfolio. "Zhou Maohua suggested.

- END -

I like the new landmark of Yunnan | "Poetry and Far" on the Snowy Plateau, which turned out to be in the town of Diqing ...

EditorLandmarks are not only the concentration of the image, personality, temperam...

[Typical Weihai] "Promoting the spiritual construction of the craftsmanship" | The cultivation of the craftsmanship spirit