1307 insurance intermediaries behind the cancellation of the insurance agency: the supervision changes "more scattered"

Author:Zhongxin Jingwei Time:2022.07.28

Zhongxin Jingwei, July 28 (Sun Qingyang, Zhang Yizhen Intern Zhou Sijing) The Beijing Banking Regulatory Bureau recently issued an announcement to cancel the permit of 366 insurance intermediaries. Experts said that under the stricter supervision of income decline, the number of insurance intermediaries in the insurance intermediary agencies increased, and future insurance intermediaries must develop specialized services to services and standardized management.

After the income declines, actively cancel and increase

According to the "Announcement on the License of Insurance Intermediaries such as Beijing Yixia Society Co., Ltd." issued by the Beijing Banking Regulatory Bureau, three insurance agencies have intended to be canceled. Together with these three professional intermediaries, there are three insurance companies that are mutual agencies and 360 insurance -part -time agencies.

Some media sorted out and found that 1,307 insurance agencies have been canceled insurance intermediary licenses since this year. Since July alone, there have been 569 institutions that have been canceled in insurance agencies, of which 517 institutions have been canceled permit for "the administrative license validity period has not continued", accounting for 90 % of the total number of cancellations.

Peng Haoran, a professor at Lingnan College of Sun Yat -sen University, told Zhongxin Jingwei Research Institute that due to the impact of the epidemic, in recent years, some insurance intermediary agencies have difficulty in operating, and the situation of active cancellation has increased.

Hao Yansu, a professor at the School of Insurance, Central University of Finance and Economics, also told the Sino -Singapore Jingwei Research Institute that since this year, the income of some insurance intermediaries engaged in life insurance business has declined. The regulatory authorities have applied for the cancellation license of small and medium -sized insurance intermediaries in accordance with regulations and withdrawn from the market. "In response to this part of cancellation, can the insurance intermediary license be appropriately extended, and the system of compliance with the compliance constraint can help the insurance intermediary agencies help the public to handle relevant personal insurance business to prevent the life insurance business of life insurance in uncertainty and form a 'removal insurance. 'The situation of the regulatory authorities is worth considering. "

In addition, the CBRC's regulation on the issue of "scattered" in insurance intermediaries is also an important reason for the increase in the cancellation of insurance intermediaries. The CBRC's intermediary department issued the "Notice on Printing and Distributing Insurance Intermediaries'" Disposal "issues in June" (hereinafter referred to as the "Notice"), which requires insurance intermediaries nationwide The scattered institution will increase the retreat.

Industry rectification and strengthening clear retirement

Statistics show that in the first half of 2022, the relevant penalties of the supervision and punishment insurance institutions were announced in total, with a total of 1,246 of the relevant penalties, with a cumulative penalty of 146.6 million yuan, 667 penalties, and 946 penalties. Compared with the same period in 2021, in the first half of 2022, the number of fines, no amount, penalties, and penalties in the first half of 2022 have increased.

Peng Haoran said that the rectification specifications for insurance intermediaries are mainly to investigate and deal with the three major categories of problems that cannot be exhibited normally. First, the "three -none" insurance intermediary legal person who cannot operate normally, no place, and business without business, and no business Institutions and branches; Second, the legal entities and branches that do not meet the current regulatory requirements include the incomplete information system of the institution, incomplete information governance, incomplete information security mechanism, and incomplete information system construction. Legal institutions such as disorderly control and control of branches and such as "joining" and "affiliation".

"Among them, the CBRC specially emphasizes the financial authenticity of the insurance business, the compliance of the Internet insurance business, the compliance of the intermediary channel business of insurance companies, and the focus on fictional intermediary business, false listing costs, etc. Illegal and illegal acts were remedied. "Peng Haoran said.

The level of compliance awareness and professionalization is to be improved

Can we solve the insurance chaos? Zheng Bingwen, director of the World Social Security Research Center of the Chinese Academy of Social Sciences, said in an interview with the China New Jingwei Research Institute that from the perspective of the development of the insurance industry in the past two or three decades, insurance intermediaries played a great role in the development of the insurance industry. According to statistics, in 2021, insurance intermediary channels realized premium income of 4.2 trillion yuan, accounting for 88%of the national total premium income. It means that most of the premium income comes from intermediary channels. The service of insurance intermediaries is directly related to the development of the insurance industry. The quality of insurance intermediary services is closely related to the protection of consumer rights and interests.

At the same time as the agency agency, Zheng Bingwen suggested that other problems existing in insurance intermediaries must be paid to.

He pointed out that the market system of insurance intermediaries has not been improved. The number of insurance agents and sales personnel exceeded 9 million. Although the insurance intermediary market is more competitive, the entire market system is still in the preliminary stage.

Second, the awareness of compliance operations in insurance intermediaries is relatively weak. Some intermediaries use the insurance platform to implement illegal sales behaviors, or to pick up handling fees and convenient for newly established companies, or some intermediary agencies with monopoly resources and industry backgrounds. Normal market order. There are also some intermediary agencies, and the relationship with insurance companies is based on interests. The institution uses its own insurance business resources to speculate between several insurance companies to hype handling fees, resulting in a high handling fee.

Third, the professional level of the talent of insurance intermediaries needs to be improved. On the whole, some of the staff of the intermediary agencies have a low level of education, and the professional background of many practitioners is not related to the insurance industry, and even without special training.

Peng Haoran suggested that due to strong information asymmetry between the two parties of the insurance market, the standard, efficient, and professional insurance intermediary agencies are essential for the entire insurance industry.In the future, insurance intermediaries need to improve the quality of employees and develop in the direction of service professionalism and standardization.(Zhongxin Jingwei APP) This article is original by the Sino -Singapore Jingwei Research Institute, and the copyright of Zhongxin Jingwei. Without written authorization, no unit or individual may be reprinted, extract or use in other ways.

- END -

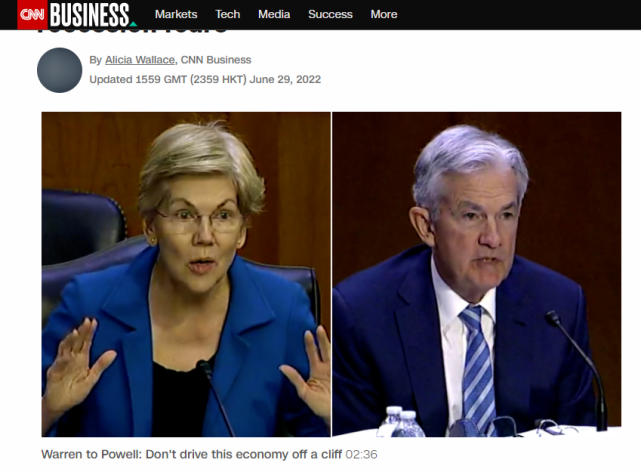

The GDP data was finally amended, showing that the economic atrophy of the United States in the first quarter of 1.6%

Based on the United States CNN and Reuters reported on the 29th, the US Department...

Jiangmen Customs widely collects enterprises' "urgent and sorrowful hopes" issues to promote foreign trade to maintain stability and improve quality

Jiangmen Customs has a policy combined boxing to deepen the reform of customs clea...