V View Finance Report | Limited for 3 days in a row!Mingzhi Electric shouts: Robot business revenue is relatively low

Author:Zhongxin Jingwei Time:2022.07.28

Zhongxin Jingwei, July 28. After the daily limit of three consecutive trading days in a row, Mingzhi Electric announced on the evening of the 28th that the company's mobile robot -related business revenue accounted for a relatively low overall operating income, which will not produce major operating performance in the company's current operating performance. influences.

According to the public market data, Mingzhi Electric Stocks have increased by more than 20%within three consecutive trading days on July 25, July 26, and July 27, 2022, and the daily limit on July 28.

Mingzhi Electric said that in view of the recent fluctuations in the company's stock price, the short -term increase in the stock price was significantly higher than that of the SSE A -share index in the same period.

Mingzhi Electric pointed out that it is concerned that the media will associate the company's hotspot concept of robotics related markets. After self -inspection, the company's mobile robot -related business mainly involves the company's main subsidiaries of the company's control motor and its drive system business sector. The products are mainly used in logistics and warehousing service robots (AGV/AMR), commercial service robots and industrial service robots. In 2021, the operating income of the company's mobile robot -related business was 103.1341 million yuan, accounting for 3.8%of the company's operating income; the company's mobile robot -related business revenue accounted for a relatively low overall operating income of the company, and it would not have a significant impact on the company's current operating performance.

Mingzhi Electric emphasizes that the company's current production and operation activities are normal, the internal production and operation order is normal, the company's fundamentals have not changed significantly, the company's main business structure has not changed significantly, and the company has not changed significantly in recent operations.

In addition, Mingzhi Electric mentioned that in the first quarter of 2022, affected by the sharp rise in international freight expenses, the transformation conversion of the company's new and old production bases, and the sharp adjustment of the RMB exchange rate on the US dollar year -on -year, the company realized the net profit attributable to shareholders of listed companies 3912 3912 10,000 yuan, a year -on -year decrease of 31.44%.

Mingzhi Electric also said that as of July 28, 2022, the company's stock closed price of 30.64 yuan, and the rolling price -earnings ratio was 49.19. According to the data released by the CSI Index Co., Ltd., the company's industry classification "C38 Electric Machinery and Equipment Manufacturing", the latest rolling price -earnings ratio is 35.71. The company's rolling price -earnings ratio valuation is higher than the average level of listed companies in the same industry.

Mingzhi Electric's organs show that Mingzhi is a comprehensive manufacturer in the field of sports control, which was founded in 1994. From factory automation professional components to smart LED lighting drives, from the intelligent management system of large factory equipment to the control execution agency of automobile communication equipment, it is committed to providing customers with various solutions.

According to Wind data, as of March 31, 2022, the total number of shareholders of Mingzhi Electric was 13,467. (Zhongxin Jingwei APP)

- END -

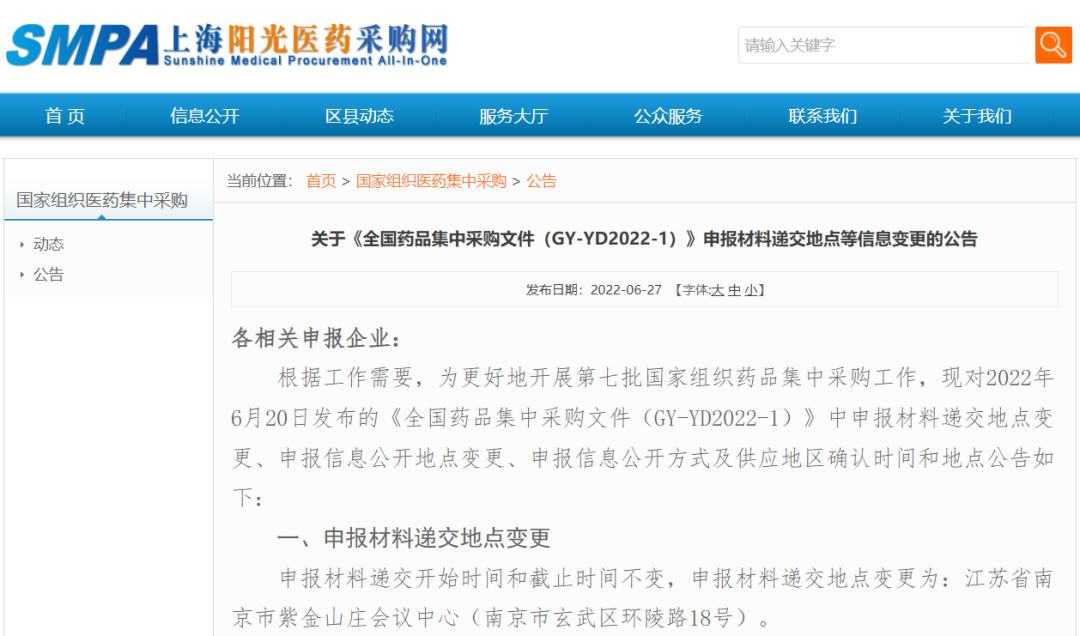

The seventh batch of collecting bids and opening the bidding place to Nanjing

On June 27, Shanghai Sunshine Procurement Network issued an announcement that the ...

Praise of the first version of the People's Daily: Jilin's support for production increase

Promote the protection and utilization of black soil, promote the simultaneous imp...