Weifeng Electronics IPO: Financial data "fights", the gambling agreement is cleaned up or incomplete

Author:Discovery net Time:2022.07.28

The contradiction between the multiple financial data disclosed in the Weifeng Electronics Prospectus and the inquiry letter is worrying. Not only that, there were investment institutions on the eve of Weifeng Electronics IPO "assault", and the gambling agreement was cleaned or incomplete.

On April 8th, Weifeng Electronics (Guangdong) Co., Ltd. (hereinafter referred to as: Weifeng Electronics) will pass the GEM on the Shenzhen Stock Exchange.

Public information shows that the number of public issuance of Weifeng Electronics does not exceed 18.32 million shares, accounting for 25.01%of the company's total share capital after the issuance. It is planned to raise 604 million yuan, of which 441 million yuan is used for the construction project of the Intelligent Manufacturing Center of South China Headquarters, the construction project of R & D center of South China Headquarters, and 100 million yuan to supplement mobile funds.

By inquiring the prospectus, it was found that the contradiction between the multiple financial data disclosed in the Weifeng Electronic Planning and the inquiry letter was worrying. Not only that, there were investment institutions on the eve of Weifeng Electronics IPO "assault", and the gambling agreement was cleaned or incomplete. In response to the above issues, I found that the network sent an interview letter to the Weifeng Electronics to send an interview letter to the request to be interpreted, but as of the press release, Weifeng Electronics did not give a reasonable explanation.

Financial data "fight", the quality of the letter is worrying

The prospectus disclosed that Weifeng Electronics is mainly engaged in the research and development, design, production and sales of industrial control connectors, automobile connectors and new energy connectors, and is committed to providing high -end precision connectors products and solutions. From 2019 to 2021, Weifeng Electronics' operating income was 232 million yuan, 273 million yuan, and 409 million yuan, respectively, with a year-on-year growth rate of 1.12%, 17.90%, and 49.41%. , RMB 61 million and 100 million yuan, a year -on -year growth rate of 63.47%, 40.59%, and 64.08%, respectively.

Picture source: Wind (Weifeng Electronics)

Among them, the industrial control connector business contributes a lot, sales revenue accounts for over 70%, the sales revenue of automobile connectors business accounts for about 14%, and the sales revenue of new energy connectors accounts for relatively low. %about.

Weifeng Electronics said that the business field of new energy connectors is still in the early stages of business expansion, and the sales scale is still smaller than that of industrial control connectors.

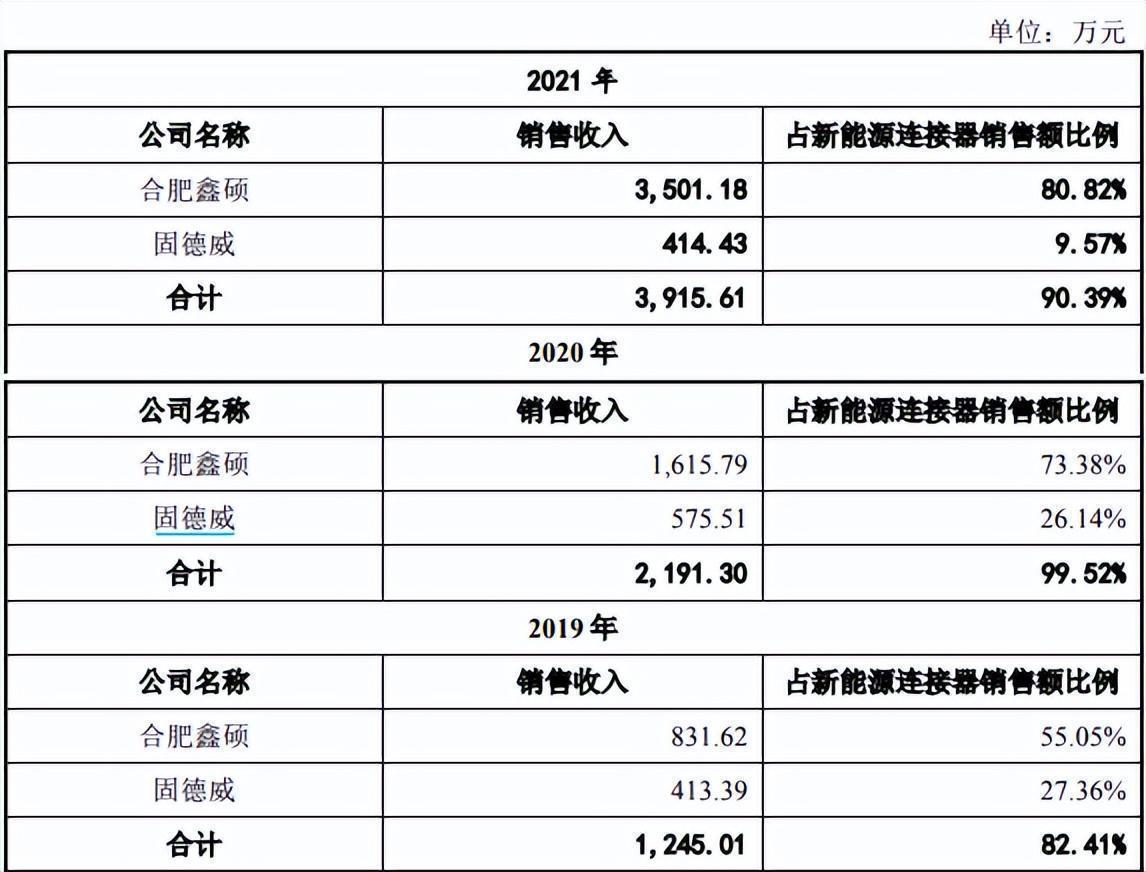

It is worth noting that in terms of sales of new energy connectors, Weifeng Electronics has a high concentration, mainly concentrated in Hefei Xinshuo and Gudewei. By querying the prospectus, it was found that during the reporting period, the two customers accounted for more than 80%of the sales of new energy connectors.

The prospectus shows that from 2019 to 2021, Weifeng Electronics' sales revenue from Hefei Xinshuo was 8.366 million yuan, 16.55 million yuan, and 36.55 million yuan. And Guedway did not enter the top five customers of Weifeng Electronics, so the prospectus did not disclose the specific transaction data between the issuer and Gudewei.

Picture source: prospectus (Weifeng Electronics)

However, in the prospectus and inquiry letter, Weifeng Electronics discloses the disclosure of Hefei Xinshuo's sales revenue. In the inquiry letter, from 2019 to 2021, Weifeng Electronics' sales revenue from Hefei Xinshuo was 8.316 million yuan, 16.1579 million yuan, and 35.18 million yuan. Compared with the prospectus, the income difference between the two was 50,500 yuan, 197,100 yuan, and 1,538,300 yuan.

Picture source: Question letter (Weifeng Electronics)

Not only that, in terms of automotive connectors, Weifeng Electronics's letter also has contradictions. The prospectus shows that from 2019 to 2021, the sales revenue of Weifeng Electronics's largest customers Hong Kong Kichenda's largest customers was 14.125 million yuan, 12.736 million yuan, and 13.5659 million yuan, respectively. In the inquiry letter, From 2019 to 2021, the issuer's sales revenue to Hong Kong Kichenda was 14.0946 million yuan, 12.736 million yuan, and 13.5159 million yuan, respectively. Among them, in 2019 and 2021, the prospectus and inquiry letters have a gap between 30,400 yuan and 50,000 yuan.

Picture source: Question letter (Weifeng Electronics)

In this regard, analysts said that Weifeng electronic prospectus is inconsistent with multiple data and inquiry letters, and it is conflict with each other. The quality of the letter is worrying, which will inevitably worry the regulatory authorities and investors.

On the eve of the IPO, many institutions "assault their shares" to clean up or incomplete the gambling agreement

According to the prospectus, on December 14, 2020, Weifeng Electronics conducted the fourth capital increase. Weifeng Electronics has issued approximately 44.373 million shares to Wuanjin Investment Investment, Fumin Venture Capital, Decai Yufeng and Qu Shuizhi Tong, with a shareholding ratio of 1.0279%, 0.4406%, 4.4053%, and 2.2026%. 12.39 shares/shares.

Picture source: prospectus (Weifeng Electronics)

It is worth mentioning that in the newly released "Application Guidelines for Supervision Rules -About the Disclosure of Shareholders' Information Disclosure for the First -Listing Enterprise", the shareholding of the IPO companies involved It is clear that the new shareholders generated within 12 months before the company's declaration were identified as "assault shares". According to the time node of the prospectus on June 15, 2021, Wanjin Production Investment, Fumin Venture Capital, Decai Yufeng, and Qu Shuizhi are all "assault shares".

In addition, during the third capital increase, Weifeng Electronics also signed a gambling agreement with Wanjin Gold Investment, Fumin Venture Capital, Decai Yufeng, and Qu Shuizhi. Before the 31st, the Chinese A -share IPO was listed or has not been acquired by the listed company. Investors have the right to request all or part of the equity of the issuer held by the actual controller Li Cultural. In addition, the gambling agreement Yu Weifeng Electronics submits the automatic suspension of the formal IPO application materials to the China Securities Regulatory Commission or the Stock Exchange. Withdrawing, the clauses signed by themselves will be restored by themselves. Or in order to be able to go public smoothly, in March 2021, the two parties supplemented the gambling agreement. On the basis of the above agreement, Ruo Weifeng Electronics was successfully listed. Arrange two agreements or agreed or repurchased properties.

However, according to public information reports, the regulatory layer issued a new window guidance on the situation of the gambling agreement on the IPO company. In the IPO project of each sector, the issuer has been used as the "gambling obligor" to arrange the gambling agreement arrangement. All are required to terminate irrevocable, and relevant shareholders should confirm that the arrangement is invalid from the beginning.

This also means that if Weifeng Electronics fails the company's IPO as the terms of restoring the gambling agreement, it is likely to affect the company's IPO process.

(Reporter Luo Xuefeng Financial Researcher Tenghui said)

- END -

Xinhua News Agency | Focus on high -quality development -Shijiazhuang: Urban changes and reshaping u

Henan starts the pilot of the disaster insurance!Zhengzhou Anyang and other 6 cities first tried first, and 7 insurance companies underwritten

[Dahecai Cube News] On June 28, the General Office of the People's Government of H...