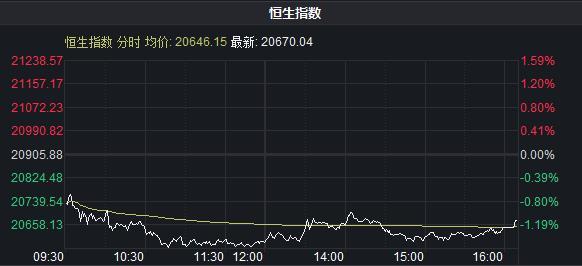

The Hang Seng Index fell by more than 1%, and the stock market in Hong Kong generally declines

Author:Zhongxin Jingwei Time:2022.07.27

Zhongxin Jingwei, July 27th. On the 27th, the main stock index of the Hong Kong stock index shocked at a low level after the early trading was low. As of the close, the Hang Seng Index fell 1.13%to 20670.04 points; the Hang Seng Technology Index fell 1.30%to 4536.62 points; the state -owned enterprise index fell 1.30%to 7091.47 points; the red chip index fell 0.46%to 3733.00 points.

Source: Flush iFind

On the disk, building products, e -sports and other sectors have risen, and tobacco, internal housing stocks and other sectors have fallen.

Source: Flush iFind

The general stocks returning to Hong Kong generally declined, fell exceeding 10%, graffiti intelligence fell more than 6%, New Oriental fell nearly 5%, shells and data of Irson fell more than 4%. Alibaba and Bilibili fell more than 3%. Essence

Auto stocks fell, ideal cars fell more than 4%, Weilai and Geely Automobile fell more than 3%. Xiaopeng Automobile, Great Wall Motors, BYD shares followed.

Internal houses and property management stocks weakened, Country Garden fell more than 15%, Xuhui Holding Group fell more than 11%; Country Garden services fell more than 21%, Xuhui Yongsheng service fell nearly 10%, and Sunac's services fell more than 8%.

Hong Kong stock markets fluctuated in the afternoon, and Air China and China Oriental Airlines rose over 1%.

Ping An Securities Research Report believes that investors are advised to continue to prefer industries and companies. This method is suitable for markets at different stages. The interim report is approaching. The high prosperity sector and the company will become the main direction of market attention in the future. In the context of structural interest rate cuts and liquidity in the Mainland, it is difficult for the Hong Kong stock market to fall into a downturn again. It is expected that the Hong Kong stock market will show more plate -oriented investment opportunities. It is recommended to continue to actively increase positions and layout every divation.

Anxin International Securities Research Report reminded that overseas markets have not caused significant adjustments to the market after the announcement of CPI data. The debt yield remained around 3%, and the expected performance of TIPS and hidden long -term inflation is also relatively stable. The Fed will announce the results of July this week. Investors need to pay attention to the results of the results of the short -term market fluctuations increase. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

- END -

Can the Chinese economy achieve positive growth in the second quarter?

China's economic recovery in the second half of the year may go through the proces...

Directly hit the Moutai annual shareholders' meeting, the product and channel layout further improved, and the release of price increase signals?

On June 16, Moutai, Guizhou held a 2021 shareholders' meeting.At the meeting, Ding...