Innovation refers to the reddish daily limit, TOPCON batteries, energy storage and other concepts have risen sharply.

Author:Zhongxin Jingwei Time:2022.07.27

Zhongxin Jingwei, July 27th. On the 27th, the three major A -share stock indexes opened down and rebounded. As of the close, the Shanghai Index fell 0.05%, the Shenzhen Stock Exchange Index fell 0.07%, and the GEM index rose 0.03%. Flush iFind showed that over 2800 shares of the two cities rose and 100 stocks rose.

Source: Flush iFind

On the surface of the plate, integrated die -casting, industrial mother machines, photovoltaic batteries, new energy vehicles and other sectors have risen, and hotel catering, tourism, brewing and other sectors have fallen first.

July 27 Market Hot Overview Source: Flush iFind

The rising tide of the automobile parts sector has a daily limit of the 20cm of the shares. Eludi, Yinlun, An Technology, Xiangyang Bearing, Baolong Technology's daily limit, Jifeng rose by over 9%, Xinquan shares, Coboya and other significant rise.

The photovoltaic battery sector is active, the concept of TOPCON battery has risen sharply, crystal energy rose exceeded 10%, and the stock price hit a record high; Xin Po, Yihua, Lushan New Materials, Dongfang Shenghong, Lianhong New Kee daily limit, Yongfu shares rose more than 8%, and Tongling rose more than 7%.

The energy storage concept sector has a strong fluctuation, Igor, Sanhua Zhikong, Tuobang Co., Ltd., China Baoan's daily limit. Yongfu shares rose more than 8%, Zhenbang Smart, Tianneng, Tianhe Guangneng, etc. rose.

Semiconductor chip stocks stronger afternoon, Hechuan Technology's 20cm daily limit, Wanye Enterprise, Hanwang Technology, Opu Optoelectronics daily limit, Jiluang Technology rose more than 13%, Junxin technology, Liyang chip, etc. followed.

The attractions and tourism sectors have declined, Tianmu Lake fell more than 4%, and Western Regions Tourism, Yunnan Tourism, Zhongxin Tourism, Zhangjiajie, Songcheng Performing Arts, etc. fell more than 2%.

CICC Research Report pointed out that the performance of the social service company in the first half of the year has repeatedly undergo the performance of the social service company, but it is expected that the epidemic and prevention and control trend in the second half of the year are expected to continue to optimize marginalized. With reference to overseas experience and domestic experience, the social service industry is expected to usher in a clear recovery. After the economic stability and the repair of consumption power, we will further move closer to before the epidemic. It is recommended to pay attention to the elasticity of the epidemic and prevent and control the high -quality leader, and choose the layout.

Zhongyuan Securities Research Report believes that in the medium and long term, it is still the most determined and the greatest direction of growth in photovoltaic equipment, wind power equipment, lithium battery equipment, and semiconductor equipment, and continue to focus on the mainstream track of science and technology growth. In the second half of the year, lithium battery equipment has entered the bidding volume, and the fundamentals of construction machinery and general automation are expected to usher in a rebound. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

- END -

Inner Mongolia's "Slowing Rebate" policy helps enterprises to relieve the company

The reporter learned from the Human Resources and Social Affairs Department of the Inner Mongolia Autonomous Region that this year, the Human Resources and Social Security Department of Inner Mongolia

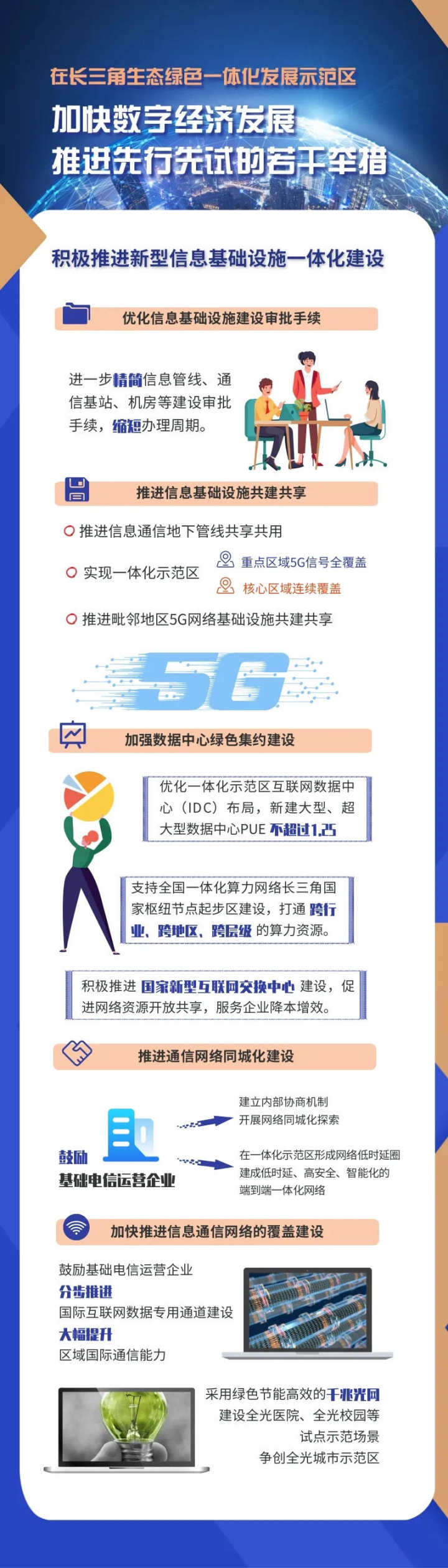

One picture reads 丨 20 measures to help the digital economy in the demonstration area

Zhejiang News Client reporter worshiped Zhe YeOn the 27th, this side reporter lear...