"Second" moved the balance of destiny, they are pursuing the "balance" of investment!

Author:Capital state Time:2022.07.27

In the past two days, the "Ershi ruled the mental internal consumption" to swipe the screen, and the fate joked the Erji who lived in Dashan, causing his physical disability, but he practiced his unyielding will and his spiritual life in virtue. The wealth of us is moved and cured by people who are in metropolises and their limbs.

God always maintains its balance in some fair way. Take the investment market, when you are obsessed with the popular track of heavy warehouses, rising up to "strong mountains and rivers", and when you fall, you may also be "destroyed". Through the "balanced" configuration, it is easier to control fluctuations and stabilize.

In the fund circle, there are many fund managers who are good at "balanced" allocation and industry stock selection, but the three fund managers of China Merchants Fund have to mention -Zhu Hongyu, Wang Jing and Li Yan [yín]. Their investment styles have their own advantages, but they also have similarities, that is, regardless of stock debt matching or industry choices, they have brought good historical returns to the combination because they pay attention to "balance".

Zhu Hongyu: The entire industry covers, layout of the trend!

Let's talk about Zhu Hongyu first, he is the chief researcher at the China Merchants Fund, and the core competitiveness of China Merchants Management (Fund Code A Class 014412 C Class 014413) was established on April 13, 2022. A senior investment -research general, Zhu Hongyu dared to go against the trend to "base", which has achieved outstanding results so far. According to Wind data, as of July 26, 2022, the core competitiveness of China Merchants has been established for more than three months since the establishment of more than three months.

Data source: Wind, Statistics Division: 2022.4.13-2022.7.26

From the perspective of industry configuration, the second quarter report shows that there are 9 industries with the core competitiveness of investment promotion, including manufacturing, consumption, technology, real estate and many other different fields. Zhu Hongyu believes that those who truly realize medium and high income and low fluctuations are the diversity of the industry. Therefore, he will not concentrate over the industry.

Data source: Wind, time as of: 2022.6.30

Regarding the asset allocation strategy of the core competitiveness of China Merchants, Zhu Hongyu said, "It is mainly through the direction of tactical allocation and different asset allocation strategies to make full use of the market's wrong pricing, the opposite layout, cover the entire industry, weaken the industry's correlation, and then then Reduce the degree of fluctuations of the combination. "

Wang Jing: Balanced combination configuration, make more benefits with minimum risks!

Next, Wang Jing is a rare "all -weather equilibrium famous general" that has a rare stock debt double golden cow. Wang Jing, who has nearly 20 years of investment and research experience, has been managed by Merchants Antai and China Merchants An Rui for progress. The "One -year Open Stock Type Taurus Fund" and "One -year Open Bonds Taurus Fund" issued by the China Securities Journal in 2014 can be described as the Boshen Stock Connect and Rouzhong Belt.

In recent years, Wang Jing has put more energy on the rights market. Her managed investment manufacturing transformation (fund code A category 001869 C category 004569) was established on December 2, 2015. After experiencing unilateral decline in 2018, After the sharp adjustment since 2022, the fund is still "brilliant." According to Wind data, as of July 26, 2022, the cumulative income of China Merchants Manufacturing Industry's transformation of 201.01%(similar rankings: 30/757), which is also a significant winning benchmark and similar.

Data source: Wind, Statistics Division: 2015.12.2-2022.7.26

Look at the top ten heavy stocks of the transformation of the investment manufacturing industry. The proportion of the net value of the fund's net value is not more than 50%. In terms of its industries, there are both popular photovoltaic and batteries such as new energy industries. Evaluation industry. Obviously, Wang Jing's holdings are not concentrated, and the investment style is relatively balanced.

Data source: Wind, Fund regular report, time as of: 2022.6.30

When talking about the maximum value of the fund manager, Wang Jing said, "My goal is to earn more benefits at the minimum risk, so I belong to the relatively balanced fund manager in terms of investment style. In a certain style or an industry, it is more of a relatively balanced combination configuration strategy to avoid non-systemic risks and obtain excess returns. My top ten heavy stocks account for between 40%-50%, holding 5-6 industries, the proportion of a single industry will not be high. "

Li Yan: The macro micro -micro is not biased, and find the long board to create Alpha!

In the end, Li Yan [yín], he is a balanced investment expert in stock bonds, and has long -term performance in multiple balanced products in charge. For example, China Merchants Antai Balance (Fund Code: 217002), Li Yan began to manage this product on February 3, 2016. Wind data shows that as of July 26, 2022, Li Yan's total return of 92.50%was 92.50%, surpassing the benchmark returns 57.94%.

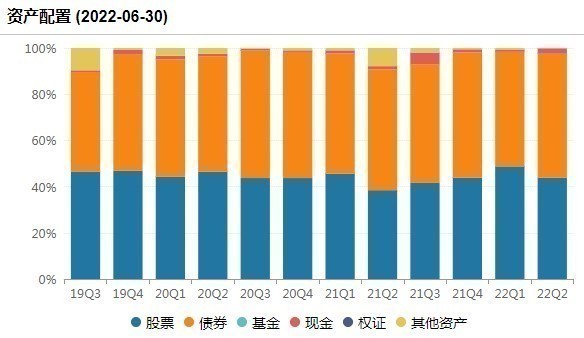

From the perspective of asset allocation, the ratio of investment in Antai balanced stocks and bonds is relatively balanced. The proportion of shares is less than bonds. Just looking at equity asset allocation, its top ten heavy stocks include coal, petrochemical, real estate, finance, etc. In the field of leading stocks, the top ten heavy stocks account for less than 40%of the net value ratio.

Data source: Wind, time as of: 2022.6.30

The relatively balanced configuration strategy allows the fund to have relatively stable performance under different markets. Haitong Securities counted the income performance and winning rate of China Merchants Antai Balance within different holdings. The results showed that the product can obtain positive absolute income and excess returns at a higher probability at a higher probability, and the average return is rich, the holding experience good. Source: Wind, Haitong Securities Research Institute, as of 2022.06.10

As shown in the figure above, as the holding period is extended from 1 month to 3 years, the absolute income and the average value and win rate of the excess income of holding products have shown a steady rise. Taking 3 -year as an example, the average absolute and excess income of holding products reached 51.2%and 33.2%, respectively, and the winning rate was as high as 100%and 84.7%.

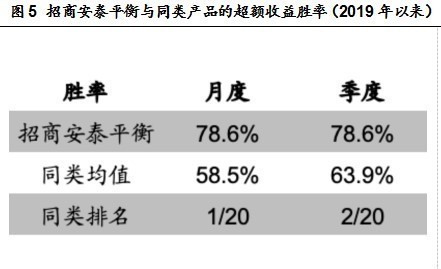

In order to further compare with the same kind, Haitong Securities has calculated the monthly and quarterly excess returns to the product since 2019, which far exceeds the average value of similar products, and is divided into 1/20 and 2/20. That is, compared with similar products, China Merchants Antai Balance also has higher excess returns stability.

Source: Wind, Haitong Securities Research Institute, as of 2022.06.10

When talking about his own investment philosophy, Li Yan said, "Our overall framework is still macro to micro and micro -macro to macro, and no direction can be biased, and then find out the stock that can create Alpha. In terms of industry allocation, we all try to find our own long boards, and we will not adjust the proportion of various types of assets very frequently. Once we determine our macro position, we should try to keep relatively stable. "

Thousands of netizens in the barrage's shocking pictures are still vividly remembered. We respect the spirit of the second and fascinating and optimistic spirit of Erji. While helping the village, the young and old in the village to replenish the west, and finally fix it. Iself, make my life "balanced", and even happier and fuller than ordinary people!

Similarly, our "balanced faction" fund manager is also committed to pursuing industry choices and the incomparable and just right, just right, and strives to bring longer rewards to the holders.

Risk reminder: The above views and opinions are made based on the current market conditions, and it may change in the future. The fund is risky, and investment must be cautious.

- END -

Gast China quantitative selection of long -distance running strength is outstanding, and won the evaluation of the three -year and five -year five -star fund of morning stars

After more than ten years of development, the quantitative market has gradually matured. Today, quantitative products have become an important part of public funds. As of the end of 2021, there were 4

Shenzhen's largest "vegetable basket" uses "numbers" to solve problems

Shenzhen Pinghu Haiji Xing International Agricultural Product Logistics ParkFocus ...