Tune Vane | Galaxy Fund Zheng Weishan: In the third quarter, continuing technology track investment pays more attention to industrial fundamental research

Author:China Fund News Time:2022.07.27

China Fund News Sun Xiaohui

Editor's note: Recently, the Fund's second quarterly report has disclosed that the positioning movements and position changes of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

Since the beginning of this year, the A -share market has been suppressed and then promoted. The net value of the product managed by Zheng Weishan, deputy director of the Galaxy Fund stock investment, has also appeared to have a large retracement. Large differentiation, the net value of the Milky Way and the United States increased by more than 24%in the second quarter, and the representative of Galaxy's innovation growth and net value rebound increased less than 3%.

The second quarterly report of the 2022 disclosed showed that the stock positions he managed at the end of June were slightly raised, up to 94%.

In terms of positioning combination, the main force is still configured with the technology track, but it reduces the configuration of the electronic industry chain, increases the positions of high -quality semiconductor design companies, and new energy positions.

Regarding the market outlook, Zheng Weishan said that in 2022, the investment of science and technology tracks will continue to pay more attention to industrial fundamental research. As always, the method of continuing the fundamentals of individual stocks will be actively looking for high prosperity and strong growth definition. Science and technology.

In this issue of [Corps Vane], Fund Jun will explain the second quarterly report and position changes of Zheng Weishan, the manager of the Galaxy Fund Fund.

Keep the high position operation

Reduce consumer electronics new energy new energy

Affected by the regulation of growth stocks, Zheng Weishan's products managed by the products of Zheng Weishan were largely retracted in the early stage of this year. Due to the different position structure, in the subsequent market rebound, the blood recovery rate of different funds was significantly differentiated. Among them, the net value of the Galaxy and the United States increased by more than 24%in the second quarter, while the representative of the net worth of the galaxy innovation growth increased by less than 3%. However, from the perspective of medium and long -term performance of one, three, and five years, it still has a significant winning benchmark.

From the perspective of management scale, the total scale of Zheng Weishan has exceeded 20 billion yuan in the management fund, an increase of nearly 1.5 billion compared with the 18.553 billion at the end of the previous quarter. From the perspective of the fund share, in addition to the Galaxy's innovation growth, the rest is mainly based on net redemption, but due to the rise in net value, the scale has not changed much.

Among them, Galaxy's innovation growth increased from 17.132 billion yuan at the end of the first quarter, an increase of 18.393 billion yuan, and during the period, it received 142 million net subscriptions to 2.934 billion yuan; Galaxy and American life increased from 598 million yuan at the end of the last quarter to 830 million yuan.

Zheng Weishan is in a list of management funds

Zheng Weishan strictly follows the contract configuration in different funds and matches the theme. For example, the configuration of its representative Galaxy's innovative growth is the technology field with innovative attributes, and the main investment direction is the field of hard technology. Galaxy and Meimei's living allocation are mainly science and technology and new energy. The main investment directions are new energy, semiconductor, consumer electronics, new materials, cloud computing, etc. Galaxy industry upgrade mainly focuses on the concept of industrial upgrading. The theme of Galaxy Zhilian mainly focuses on the concepts of smart wisdom, information technology, and high -end manufacturing industries.

Among them, the just -released fund second quarterly report showed that the Galaxy innovation growth optimized the position of semiconductor in the second quarter, and continued to increase the positions of high -quality semiconductor design companies. In the second quarter of Galaxy and the United States, the configuration of new energy in the second quarter and American life reduced the configuration of the electronic industry chain.

The power configuration of the Galaxy industry is relatively balanced, reducing the configuration of traditional consumption, and increasing the proportion of information technology, high -end equipment, photovoltaic, and semiconductors. The theme configuration of Galaxy Zhilian is also relatively balanced, reducing traditional consumption configuration and increasing information technology and new energy ratio.

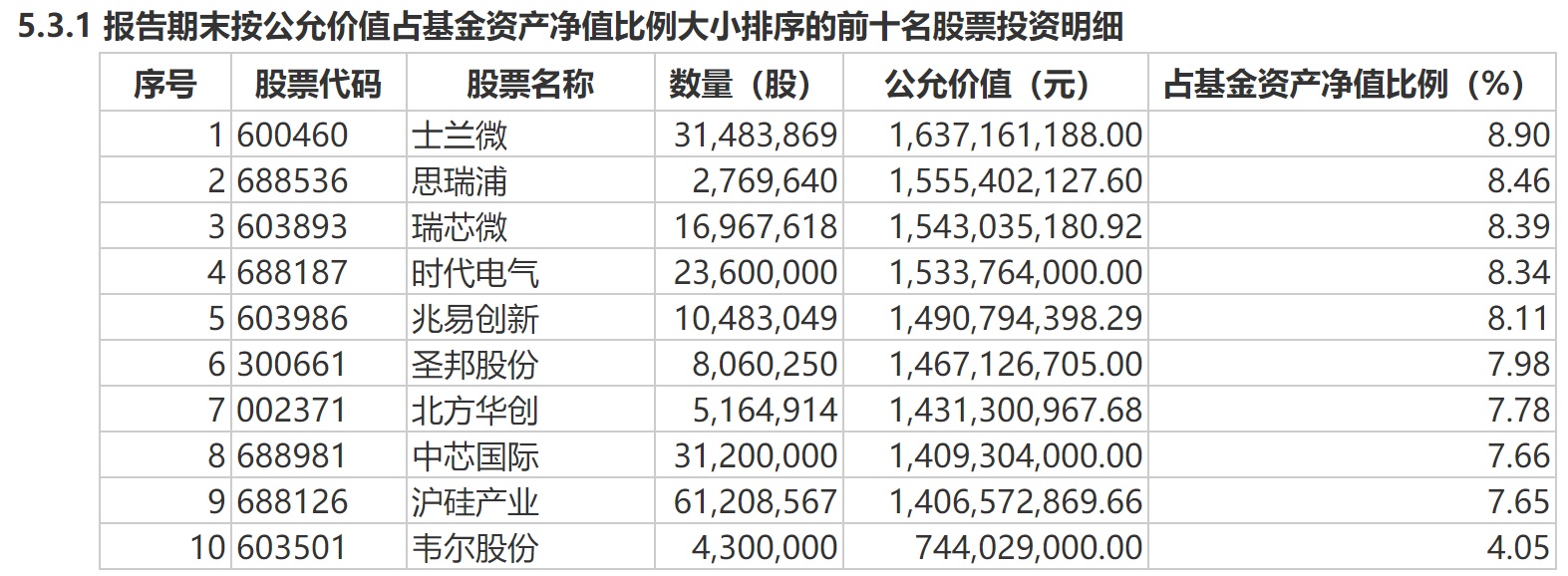

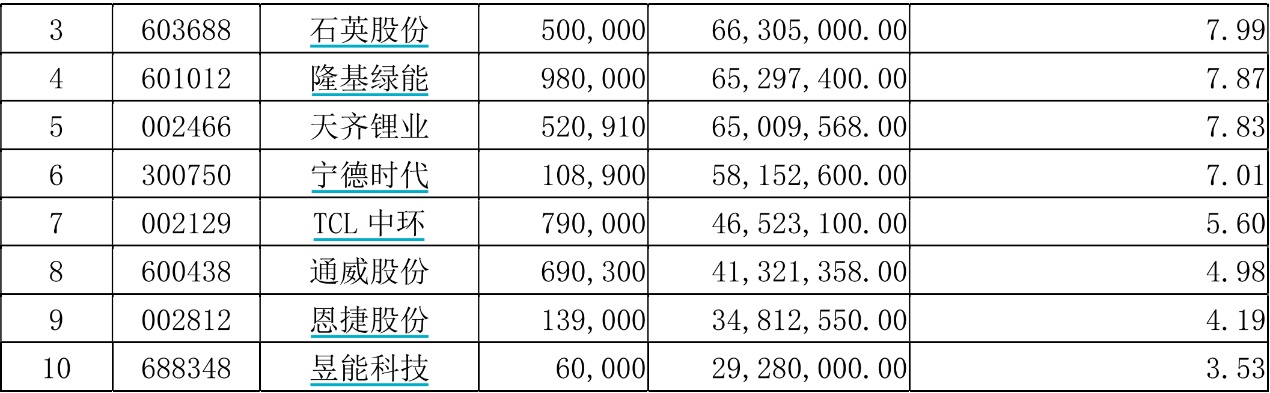

Galaxy Innovation Growth at the end of the second quarter of the top ten heavy warehouse stocks

Specifically, among the top ten heavy warehouse stocks in Galaxy's innovation growth, Silan WeChat has increased its holdings into the largest heavy positions, Siruipu, Rockchi, Time Electric, Shanghai Silicon Industry, Northern Huachuang, and Times Electric. Holding, Weir shares and Shengbang shares have reduced their holdings, and SMIC's holdings remain unchanged.

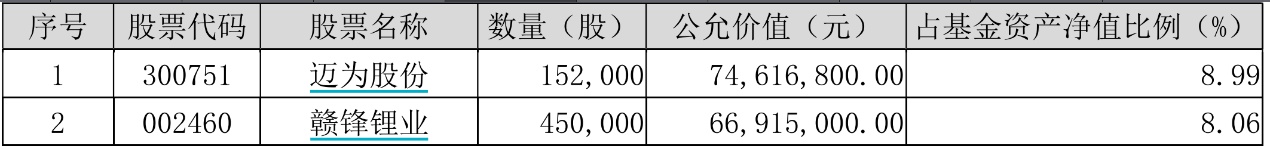

Galaxy and Meimei Life in the top ten heavy warehouses in the end of the second quarter

Among the top ten heavy warehouse stocks in Galaxy and the United States, the largest heavy positions in Ningde in the first quarter reduced their holdings. Increasing holdings, quartz shares and Tianqi lithium industry holding shares remain unchanged. Silanwei and Shanghai Silicon industry faded out, Tongwei and Yuneng Technology's top ten heavy stocks.

It is worth mentioning that the second quarterly report showed that Zheng Weishan's products managed at the end of June were raised, up to more than 94%, and still maintained a high position operation.

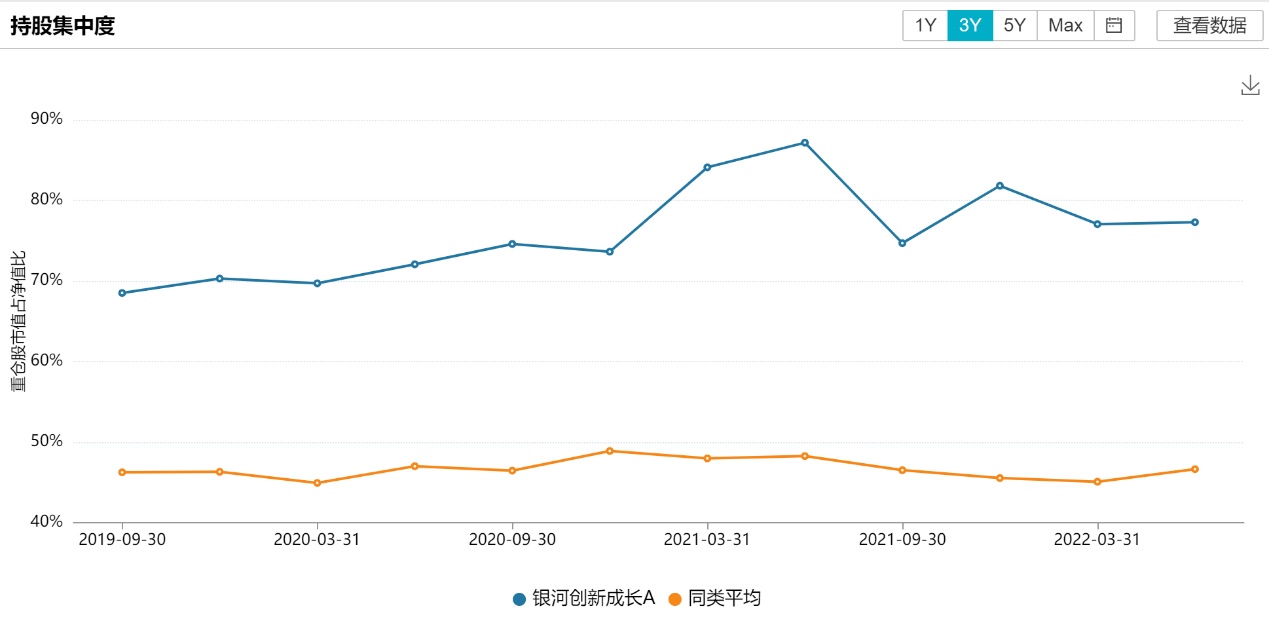

At the same time, the concentration of shareholding of the two funds has continued its decline since the second half of last year. Among them, Galaxy's innovation growth dropped from more than 80%at the end of last year to nearly 70%, and Galaxy and American Life dropped from more than 77%at the end of last year to 65%.

The prosperity of the science and technology industry is differentiated

Looking for the high prosperity and growth definition of technology

Zheng Weishan said that due to the impact of the epidemic, the short -term prosperity of the domestic semiconductor industry was affected, and the overall prosperity began to differentiate. According to the perspective of the global foundry leader TSMC at the shareholders' meeting on June 8th, the demand for downstream smartphones and PCs of semiconductor downstream may slow, but the demand for vehicle and high -performance computing is stable and exceeded its supply capacity. The view of TSMC further shows that the current semiconductor device terminal demand differentiation has begun. The comprehensive chip shortage of the past two years will turn to structural shortage, and global prosperity in the field of automobiles, high performance computing, and new energy fields will remain high. "We have always emphasized that the industry's prosperity will be differentiated this year. In the middle and long term, the short -term industry prosperity fluctuates or differentiated, and has not changed the trend of long -term domestic semiconductor. In addition, the trend of domesticization has not changed." Zheng Weishan said.

Zheng Weishan said that in the third quarter, the investment of science and technology tracks will still be continued, and the medium and long -term development trends in the fields of science and technology and new energy will still be optimistic. Methods, actively look for high -prosperity and technological standards with strong growth.

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Without the permission of the fire rescue agency to operate without permission, Uniqlo's shop was fined 70,000

Radar Finance | Editor Wu Yanrui | Deep SeaRecently, Xunwa (China) Trading Co., Lt...

A QC result of Lanzhou Power Supply was praised by the China Quality Association

honor certificate.New Gansu Client June 27th (New Gansu · Daily Gansu.com reporte...