In the past three years, the dividend rate exceeds 10%, Taikang Insurance has completed the entire shares of the employee holding plan, and more than a thousand beneficiaries

Author:Capital state Time:2022.07.27

On July 25, 2022, the official website of Taikang Insurance announced that Taikang Insurance Group Co., Ltd. has repurchased the company held by Taikang Asset Management Co., Ltd. (representing "Taikang Insurance Group Co., Ltd. Core Package Employee Stock Plan"). 128 million shares (representing 4.69060%of the company's issued shares).

Taikang Insurance stated that after the repurchase was completed, the employee's shareholding plan no longer holds the company's shares, and the repurchase shares formed the company's "inventory stock".

(Taikang Insurance)

At the same time, Taikang Insurance also pointed out that the company's repurchase employee holding plan shares have signed a share repurchase agreement and completed the transaction process. The change of shareholders' matters requires the relevant regulatory authorities to complete the filing of the repurchase, the approval of the amendment of the articles of association caused by it, and take effect on the register of the shares attached to the company's articles of association.

It is understood that Taikang Insurance Employees' shareholding plan began in 2015, and its initial duration was three years, and it was postponed since then.

At that time, the regulatory level had published an article clearly stated that various insurance companies were encouraged to carry out employee shareholding plans. Since then, the employees of many insurance institutions such as Taikang Insurance, Ping An of China, Sunshine Insurance, Zhong'an Insurance have been launched, and Taikang Taikang is successively launched, and Taikang Taikang Insurance is currently the only insurance company that completes all shares repurchase after the shareholding expires.

According to the initial disclosure documents, the total amount of funds involved in Taikang Insurance employees' shareholding plan is not more than 2.890 billion yuan, and the subscribed shares of Taikang are 21.5 yuan/share.

From the perspective of dividend situations, since the launch of the employee shareholding plan, Taikang's insurance dividend is more objective. In the past three years, the dividends per share have reached 2.1984 yuan, 2.1984 yuan, and 2.9313 yuan, respectively. If calculated at the initial subscription price in 2015, the annual dividend rate has exceeded 10%.

In terms of the number of participants, according to Taikang Insurance, as of the end of 2015, Taikang Life's core backbone employee holding a total of 4612 employees. Essence

By the end of 2021, according to the information disclosure of Taikang Insurance's annual information, in 2016, a total of 117 employees were resigned from employees; 215 employees were left in 2017; 115 were withdrawn in 2018; The plan to be reported to be approved for supervision and filing is approved. Since 2019, the employee shareholding plan has entered the disposal period. In the year, a total of 668 people withdrew from the employee's shareholding plan; in 2020, a total of 96 people withdrew from the employee shareholding plan due to resignation; 2021 in 2021 A total of 38 people withdrawn from the employee's shareholding plan for resignation.

This also means that as of the end of 2021, the employee holding plan launched by Taikang Insurance finally participated in more than 3,000 employees.

- END -

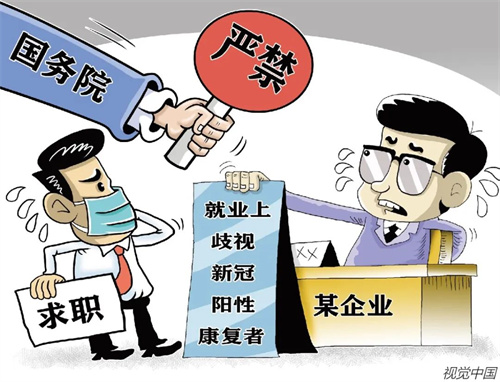

"History Yang" is discriminated against?We went to touch the situation offline

China Economic Weekly reporter Song Jie | Shanghai reportHistory has Yang can't wa...

Transaction is changing!Delivery Jintai: The daily closing price of the daily closing price within three consecutive trading days has exceeded 20% of the departure value

Every time AI News, the delisting Jinsai (SH 600385, closing price: 1.19 yuan) iss...