Hong Kong and US stocks IPO Weekly | Drama Production Company Ningmeng Film and Television Through the Hong Kong Stock Exchange

Author:Capital state Time:2022.07.26

Last week (July 18, 2022-July 24), one company was listed in Hong Kong, and there was no Chinese stocks listed in the US stocks.

During the period, 1 company hear through the Hong Kong Stock Exchange.

In terms of hand delivery, last week, two companies planned to list the IPO to the Hong Kong Stock Exchange. The following is the full list:

1. List of Hong Kong stocks: China Graphite landed in Hong Kong stocks, the first day of listing rose exceeded 143%

On July 18, 2022, China Graphite was officially listed on the Hong Kong Stock Exchange. As of the closing day of the listing, the China Graphite was HK $ 0.79, an increase of 143.08%. China Gramid plans to sell 400 million shares worldwide, with 10,000 shares per hand.

China Graphite Group is a company selling scales graphite concentrates and spherical graphite in China. It is mainly engaged in processing unpaid graphite processing into scale graphite essence and spherical graphite.

As of 2019, 2020 and 2021, for the three years, the company generated total revenue of approximately RMB 124 million, 169 million yuan and 198 million yuan, respectively, and the net profit of about 24.5 million yuan, 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan and 37.9 million yuan. 53.3 million yuan.

2. Hong Kong stock hearing and prospectus: Ningmeng Film and Television passed the hearing

On July 19, 2022, Ningmeng Film and Television Media Co., Ltd. heard it through the Hong Kong Stock Exchange. According to the information of Fhstrisana, according to the income of 2021, the company ranks fourth among all Chinese drama companies.

According to the information of Fhstrishalvin, from 2019 to 2021, six of the eight copyright dramas broadcast by the company belong to high ratings, and the high ratings episode rate is about 75%, far exceeding the previous five major competitors in the same period. About 45.9%of the average high ratings.

These six high ratings include "Little Happy", "Thirty Thirty", "Twenty Not Confusion", etc., which has received more than 16.3 billion times during the premiere of the online video platform, and during the same period on the TV channels, the annual viewing of the year's channel viewing Both rates exceed 1%.

During the track record, the company generated income from the following three major business lines: copyright dramas, content marketing and other businesses. In the three months ended March 31, 2022 in 2019, 2020 and 2021, the company's revenue was RMB 1.794 billion, 1.426 billion yuan, 1.249 billion yuan and 471 million yuan; within the period The profits were 80.398 million yuan, 62.545 million yuan, 60.913 million yuan and -2123 million yuan.

3. List of listing of Hong Kong stocks: Unburdable Biomedical Company 3D Medicines Delivery Table Portrait

Last week, two companies submitted a prospectus to the Hong Kong Stock Exchange. In order to see entertainment and 3D Medicines, both companies planned to go public on the motherboard.

On July 22, 2022, 3D Medicines (Thinking) submitted a prospectus to the Hong Kong Stock Exchange.

3D Medicines is a biomedical company established in 2014 with research and development capabilities. In response to the future trend of slow disease treatment, it is committed to developing and commercialized tumor drugs with differentiated clinical manifestations. The company's core business model is to develop and commercialize tumor products and candidate drugs in combination with joint development, permission introduction and independent discovery.

As of the last actual possible date, the company has established a pipeline that includes a core product and 11 candidate drugs, of which Evol Mippitive (brand name: Enda Da ®) as a pillar product was obtained in November 2021. The approval was commercialized in December 2021, and there were seven more in the clinical stage.

In the first five months of 2021 and as of May 31, the company's income was 60.26 million yuan and 161 million yuan, respectively. In the first five months of 2020, 2021 and 2022, R & D expenditure was 264 million yuan, 371 million yuan and 138 million yuan, respectively.

In the first five months of 2020, 2021 and as of May 31, the business loss was 635 million yuan, 1.462 billion yuan and RMB 293 million, respectively.

- END -

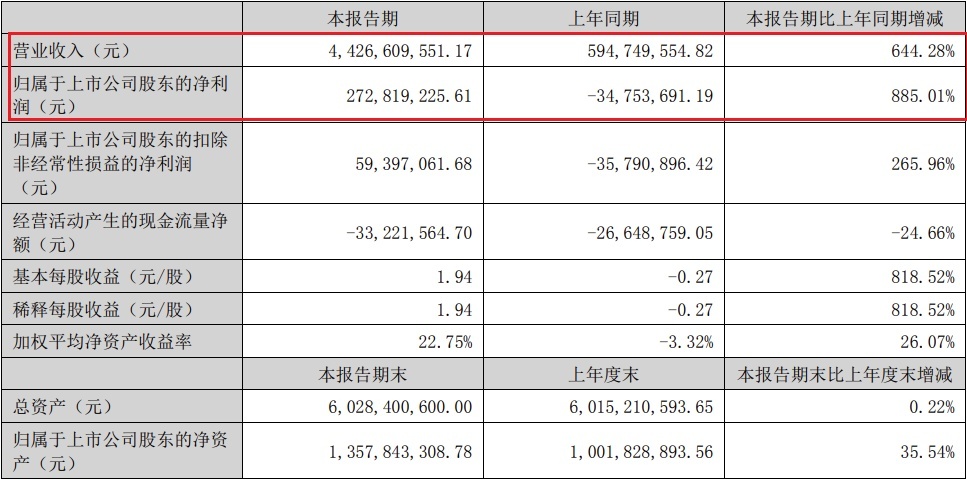

Focusing on the main focus of the photovoltaic industry, Junda's net profit in the first half of the year increased by nearly nine times year -on -year

On July 19, 2022, Junda (002865.SZ) released the semi -annual report in 2022.In th...

Helping the development of the service industry 丨 Episode 8 of the Tax Story of the Express Station

SMEs are important forces to expand employment, improve people's livelihood, and p...