Visit the gold price of the gold market in Chengdu, the gold investment and consumption and consumption are welcoming the "small boom"

Author:Cover news Time:2022.07.26

Cover Journalist Zhu Ning

Since the international gold price in early March this year, it has touched high to a high of 2070 US dollars per ounce, and then has begun to fluctuate. The recent price has fallen by more than 15%compared with the high point during the year. %, Setting a new low for nearly ten months.

Under the temptation of continuous decline in gold prices, investors who are concerned about precious metals are also eager to try. Cover reporters visited and found that the sales volume of various gold products at present has risen to varying degrees, and investment gold bars are particularly favored.

Gold price lower

Drive "Gold Gold Hot"

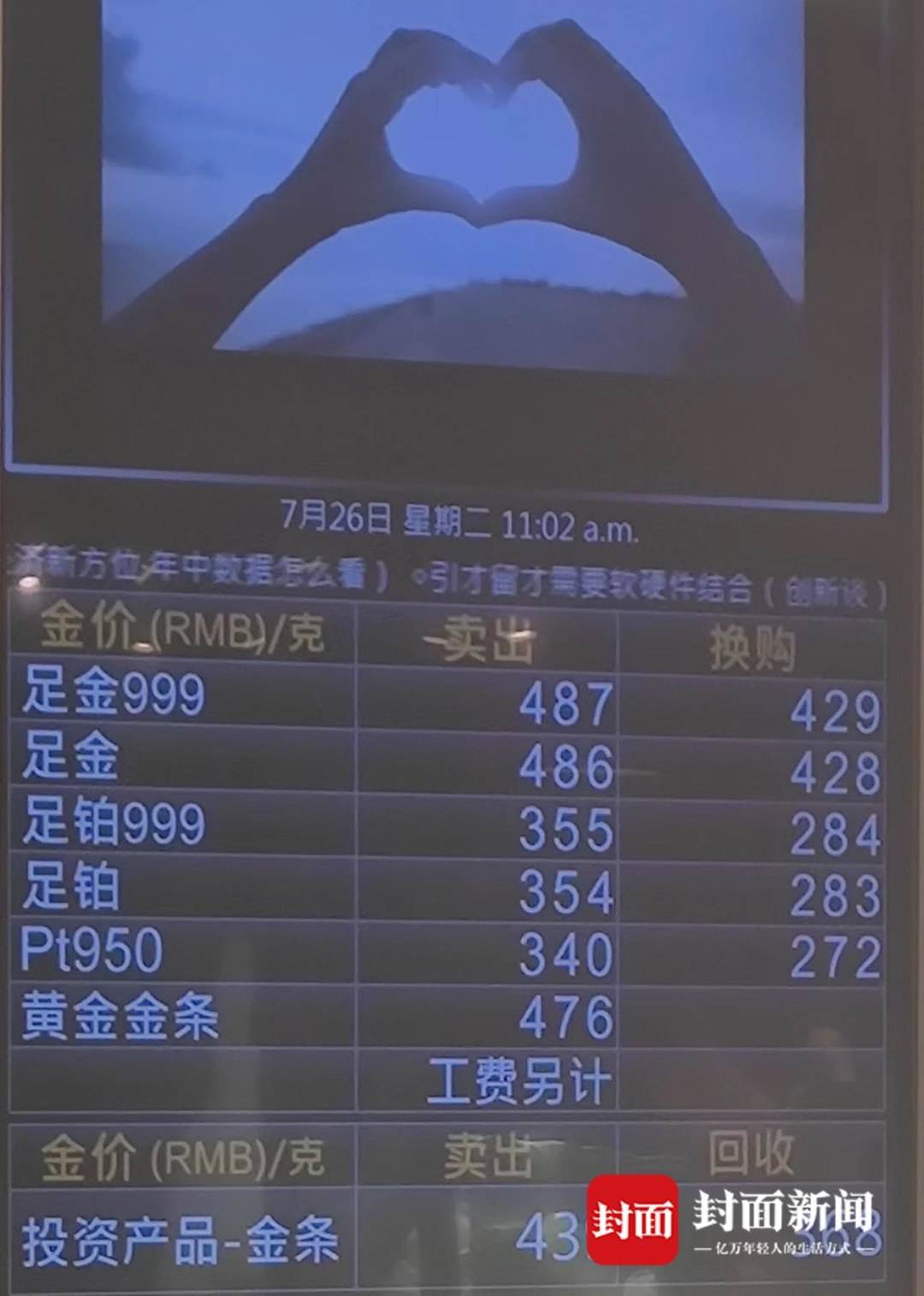

On the morning of July 26, the reporter visited a number of bank gold sales outlets. Some salesperson told reporters that investors who have recently paid attention to gold have been much more than before, especially since last week, investors who have invested in physical gold have begun. increase.

The reporter visited the gold sales outlets such as CCB and the Bank of China, and found that the price was generally around 390 yuan per gram. Among them, CCB purchased more than 200 grams a gram of 391 yuan to reduce 3.5 yuan per gram. , Buy more than 5,000 grams, which can be reduced by 6.5 yuan per gram.

Some salespersons told reporters that the gold spot market has the saying of "Golden Nine Silver Ten", and the price of September will be relatively higher, so industry investors will pay more attention to the gold market in July and August. Many investors come to bank outlets to inquire about the reason.

The reporter noticed that on July 15, ICBC issued a notice saying that from 8:00 on August 15th at 8:00, the account of account gold and the account of the account of the account will be suspended. The liquidation transaction of holding customers is not affected.

But in fact, banks' tightening of such businesses is not only because of the fluctuations in this round of gold. The tightening movement can be traced back to March 2020. The bank began to gradually tighten or even retreat to products with leverage attributes. According to incomplete statistics, since 2020, more than 20 banks have suspended new account opening applications for precious metal -related businesses.

"Investment gold bars are reliable than buying gold jewelry. There is no processing fee and brand premium, and the cost will be much lower." Mr. Yu, an precious metal investor who has invested in gold for decades, told reporters that in addition to a small amount of jewelry gold purchased for his wife and family, The others are investment gold bars.

Mr. Yu said: "According to my investment habits, when the price of gold exceeds 380 yuan, she will wait and see, not in a hurry to buy. When the gold price is lower than 380 yuan, the purchase will be considered. When it is good, if you fall further, you may consider buying. "

In the end, when the reporter asked Mr. Yu's view of the gold price of the market outlook, Mr. Yu said that as a long -term investment, there is only the right time to buy, and there is no need to find the lowest point. Even if the market outlook continues to fall, it will eventually return to reasonable value.

"Tanabata" encountered "gold rush fever"

The number of customers who buy gold jewelry significantly increased

When visiting the mall, the person in charge of the gold jewelery revealed in an interview with reporters that the golden sales of the mall recently have recovered from the high price of the gold price in April and May this year. At the least

The reporter learned that when the overall gold price fell, the price of jewelry gold also decreased a lot. At present, it has fallen to 480 yuan to 490 yuan per gram. In addition Ke reduced by 20 yuan to 30 yuan, and the actual price is 460 yuan to 470 yuan, which is undoubtedly a good thing for consumers.

Another gold brand sales told reporters that the price should be cheap now, and the previous words are more expensive. Now the price of gold is a bit declined and encountered the Qixi Festival, so there are more people recently. But if the sales volume in the same period last year, it should still be endless.

The reporter noticed that compared with the gold jewelry of the physical store, it is more cost -effective to buy online. Take a bracelet with a brand Football 999 as an example. After the calculation, the single gram price is 412.6 yuan; when browsing the gold jewelry, the reporter found that there are some small brands of gold jewelry, which can even reach about 405 yuan for jewelry prices made of foot gold 999 as raw materials.

Why is gold jewelry difference in price? When a brand counter salesman communicated with reporters, the operating cost of online stores was relatively low, and there would be many platforms for activities, so the price may be lower; in addition, as a shopping mall, the store is different, the store celebrations, the opening of the new store, etc. Special nodes and holiday promotion will also fluctuate the price.

There are many influencing factors

There are differences in the price of the golden market outlook

Is it a good time to invest in gold now? What is the trend of gold in the market outlook in the current situation of international economic fluctuations? In response, the reporter interviewed Mr. Chen, an independent analyst of precious metal, and believed that under the global financial environment where the fluctuations and uncertainty increased, gold as a different investment product with risk returns and conventional stock debt assets could be used as conventional conventional. Effective supplement of stock bond portfolio.

Although gold may continue to fluctuate at a low level due to the Federal Reserve's interest rate hikes; from a medium -to -long perspective, the interest rate hike itself has increased the operating cost of the US economy and has limited alleviation of inflation factors dominated by the supply side. With the gradual sign of the weakening of the US economic margin, it may make the current relative advantage of the current spread and the economy in the United States weakened, and gold assets may be rejuvenated. Interestingly, the mainstream views of the market are inconsistent about the price of gold price. Everbright Bank financial analyst Zhou Maohua told reporters that the price of gold has fallen in the near future. From the perspective of the environment, the European and American central banks lead the global interest rate hike cycle. The financial environment has tightened. The degree of decline.

From the perspective of trend, the trend of gold is still under pressure. First of all, the Fed's radical interest rate hikes and shrinkage, pushing risk -free interest rates to rise rapidly, weakening the attractiveness of gold -free assets; second, the US dollar liquidity is tightened, and the market is concerned about the continued deterioration of geopolitical conflicts to continue to deteriorate. The European economic prospects have a strong appreciation of the US dollar, which also puts pressure on gold prices at the US dollar.

Finally, Zhou Maohua reminded that the global geographical situation is repeated, global inflation, economic and policy prospects have high uncertainties, investors expect differences, market fluctuations are fierce, and investors need to prevent potential risks. From a prudential perspective, when the short -term market is facing large uncertainty, investors need to control positions with leverage or optimize investment portfolios.

- END -

Foreign media: South Korea ’s trade income and expenditure may turn into a deficit after 14 years

Zhongxin Jingwei, June 21st. According to the website of the Yonhap News Agency, the South Korean Trade Association International Trade and Commerce Research Institute predicted in a report released o

The 3rd multinational company leader Qingdao Summit issued a report that China is still an important destination of global investment in multinational companies, and the Ministry of Foreign Affairs responded

On June 20, 2022, Wang Wenbin, a spokesman for the Ministry of Foreign Affairs, pr...