Stable Economic House • Financial experts said | Zhang Xiaohong, a University of Zhejiang University of Finance and Economics: The urgency of solving enterprises and farmers also needs "quick -acting" credit

Author:Science and Technology Finance Time:2022.07.26

In the case of opening: Since the beginning of this year, in order to cope with the economic downturn and the epidemic situation on the normal production and operation of market players, the Zhejiang Banking Insurance Regulatory Bureau has strengthened supervision and leadership, guided the banking institutions in the jurisdiction Renewal loans and other mechanisms, iterate up the establishment of a "continuous loan+flexible loan" model, comprehensively improve the sense of gain and sustainability, and boosts the development confidence of the enterprise. From July 19th, the Zhejiang Banking Insurance Regulatory Bureau and the Science and Technology Finance Times will open the "Story of Economic Observatory • Financial Experts" column to contribute financial talents and strength to the common prosperity and modernization of the provincial region.

Zhang Xiaohong, Dean and Professor of China Institute of Finance at Zhejiang University of Finance and Economics:

The urgency of solving enterprises and farmers also requires "fast -acting" credit

Zhang Xiaohong

"Continuous Loan+Flexible Loan" is a loan mechanism launched by Zhejiang Banking Insurance Bureau to match the loan cycle to match the production cycle of the enterprise, stabilize the financing expectations of enterprises, and reduce the cost of corporate financing. This mechanism was proposed in the era of actively creating a common prosperity demonstration zone in Zhejiang, which is compatible with the country's strategic orientation of promoting county financial development and promoting rural revitalization. The loan mechanism mainly has the following three characteristics:

Inclusion tolerance. On the one hand, from the perspective of supporting enterprise coverage, this loan mechanism not only supports high -quality enterprises with good credit qualifications, but also supports enterprises that are facing temporary production difficulties. After obtaining the loan, these difficulties can quickly restore production and operation and get out of their predicament. On the other hand, from the perspective of development goals, to the end of 2022, the "continuous loan+flexible loan" mechanism loan balance in the amount of inclusive small and micro enterprises accounts for more than 50%of the loan balance, which shows that small and micro enterprises, individual industrial and commercial households, and farmers are households. The main beneficiary object is enough to reflect its tolerance characteristics.

Flexible diversity. This is mainly reflected in its service mode. The "Continuous Loan+Flexible Loan" mechanism provides four basic service models, including non -repayment loan models, medium -term mobile fund loan models, "loop loan models with borrowing" and annual trial loan model. If the above model cannot match the needs of the enterprise, it also provides a customized X service model, which can well adapt to the production and operation characteristics of various enterprises. From the perspective of the current provincial banks, the types of continuous loans and flexible loan products are rich in types, short, frequent, and fast financing requirements for small and micro enterprises, flexible demand for individual operating households, and small amounts of farmers' guarantees and small amounts of funding demand. Very good targeted. In addition, the bank also effectively processed from the needs of customers and experience. In the process of running loans, the Internet, blockchain and other elements were combined, which greatly simplified loan information and procedures. Good products for market inspection.

Safety and stability. This is mainly reflected in the three stages of loan, loan, and after loan. Introduce positive+negative dynamic "list system" management before loan, strictly control the access standards; reasonably determine the credit limit and period according to the characteristics of corporate capital flow, and reduce the inconsistency of the production cycle of the enterprise Management, the use of loan funds, etc. monitor the use of loan funds. While these measures can meet the financing needs of enterprises, effectively reduce the risk of liquidation in financial institutions and ensure the long -term stable operation of the loan mechanism. This is of great significance for the financial industry to help the real economy climb over and stable.

- END -

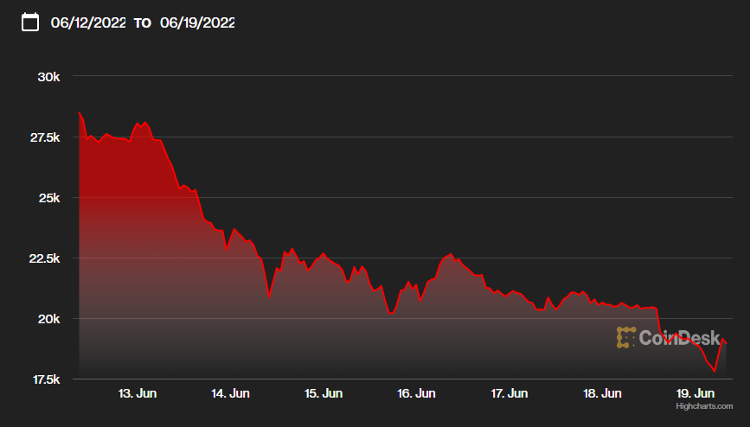

"Lehman Time" in the currency circle?Bitcoin fell below $ 18,000 and 150,000 people burst out

Seeing him from the tall building, seeing his banquet, seeing him collapsed ...In ...

Jiuquan Subei: More than 6,300 acres of heads of purple flowers are happy to get a bumper harvest

In the midsummer season, the grass and trees were lush, and the puppets in Dangwan...