Liang Xing: Analysis of investment value of the vaccine sector, vaccine ETF issuance

Author:Capital state Time:2022.07.26

Live theme: Analysis of investment value of vaccine sector

Live guest: Director of Liang Xing Cathay Pacific Quantitative Investment Department

Live time: 10:00 on July 21st

Hello everyone, the vaccine ETF (159643) was released from July 25th to 29th. So today we want to introduce the situation of the vaccine and the vaccine market in detail, including what stage it has developed in the end.

Today, I mainly introduce you to the market conditions of the vaccine ETF targeting index and the market situation of the vaccine segment.

1. Introduction to the National Certificate Vaccine and Biotechnology Index

Vaccine ETF tracks the National Certificate Vaccine and Biotechnology Index (980015.cni), which is also very characteristic.

Judging from the top ten heavy warehouses, Hengrui Pharmaceuticals, Yaoming Kangde, Mai Rui Medical, Changchun High -tech, Zhifei Biology, Watson Biology, Tiger Pharmaceutical, Fosun Pharmaceutical, Kaile British, and Kang Long became into the intoarity. There are vaccines and biotechnology stocks in it, a total of 50 stocks together.

Some people may think that only two vaccine stocks are seen in the top ten. This is the case. There are more than 300 pharmaceutical stocks, of which vaccine stocks are relatively small. If the vaccine index is pure, the number of stocks is not enough, so a vaccine and biotechnology index is made. We believe that with more and more vaccine companies listed in the future, the business development of the vaccine is getting better and better, and the proportion of the ingredients of vaccines in the index will also effectively increase.

Let's take a look at the distribution of the index industry and the past income. From the perspective of industry segmentation, CRO is also 23%of medical research and development outer packages, 18%of chemical preparations, 14%of vaccines, 11%of in vitro diagnosis, and some other things.

Figure: The distribution of the vaccine index industry

Data source: Wind, as of July 15, 2022, the distribution of the index industry may fluctuate, for reference only.

Some people may ask why there are chemicals in the vaccine and biotechnology index, because many biotechnology companies now have composite business, both biomedicine and chemicals. Because the index will take your main business, such as 30%-40%, but the index classification is pulled from thousands of items. For reference, he will see where most of your operating income comes from. For example, if you are more than 50%of your chemicals, you will be classified as chemicals. This is the reason.

The reasons for the 14%of the vaccine have also been briefly explained. Indeed, the vaccine stocks are relatively small, and its market value and proportion are relatively less. The proportion will also become larger and larger.

Let's take a look at the income of various sub -industries in the pharmaceutical industry. We will find that the returns of the vaccine are also very good. Medical equipment, medical consumables, and other subdivided industries.

Figure: Three -level segment industry in the pharmaceutical industry in the past five years yields

Data source: Wind, data interval July 16, 2017 to July 15, 2022. The operating time of my country's stock market is short, and the exponential past performance does not represent the future.

Let's take a look at the performance differences between the vaccine index and the pharmaceutical biological (Shen Wan) index in the past five years. Cumulative increases have increased by more than 11 times since the day. In the past five years, the annualized income exceeded 12%, far exceeding the pharmaceutical creature (Shen Wan) index and the CSI 300 index.

2. Analysis of investment value in the vaccine industry

Next, let's take a look at the investment value of the vaccine and biotechnology industry.

1) Classification and technical route of vaccine

Let me tell you the basic concepts of the vaccine. To put it simply, it is made by pathogenic microorganisms (such as bacteria, Lixin, virus, etc.) and its metabolites. It can provide active infectious diseases such as artificial poisoning, active or using genetic engineering methods, etc. Sexual immune biological preparation.

So everyone will see that it will generally have vaccines in the innovative drug or biomedical index because it is one of the biological agents in itself. Everyone should also know that vaccines are generally divided into one type of seedlings and two types of seedlings. One type of seedlings are vaccines that the country pays for you. For example, we have a lot of vaccines to be used since childhood. Some of them must be vaccinated by the state. This is a category of seedlings that belong to the country. There are also two types of seedlings that are not within the scope and route of the country. The consumption attributes of the second type of seedlings are relatively strong, a bit like consumer goods. Therefore, the examination of the second type of seedlings will look at the penetration rate, which is the market share. To put it simply, people who have hit this vaccine account for the proportion of all people who can beat this vaccine.

The technical route of vaccines can be divided into several types. Earlier, the most mature technology is the activity vaccine. In addition, there is a type called poisoning vaccine. What is the difference?

The active vaccine is to cultivate this virus, kill him, and then treat it into your body. In this case, your body's immune system remembers what this virus looks like. In the future, it can be defensive to clean this virus. The benefit of extinguishing is mainly to remove the pathogenicity of this virus, but it leaves its immune characteristics. The poisoning vaccine, as the name implies, is to make the toxicity of the virus weak, so how to get very weak? In fact, it is necessary to make the virus's toxicity weaker through the cultivation of generations and one generation. It is a bit different from the living, but it is mainly through small -dose toxicity to make your immune system be activated, recognize it, and then resist the virus that invades future invasion. It should be speaking, the dysentery vaccine is the earliest vaccine type. For example, it means that the vaccine is the ceiling vaccine. It is in 1798, which is very early.

In addition to these two vaccines, what else is there? There is also a restructuring protein vaccine. It is actually a genetic engineering. What else is there in gene engineering? There is also a virus -like particle vaccine. The current 4 -valent HPV vaccine is used more. The reorganized protein vaccine and virus -like particles are the reorganization seedlings of genetic engineering. This is another technology route.

There is also a nucleic acid vaccine. The adenovirus vector vaccine is a virus vector vaccine, including the previous Ebola vaccine, which is also a virus vector vaccine. Another is often appeared in pneumonia. This vaccine is called MRNA vaccine. These are nucleic acid vaccines. Nucleic acid vaccine also has a very prominent advantage. For example, the MRNA vaccine can achieve rapid replication through the repair and adjustment of this gene, but it will work only at your nuclear peripherals, and it will not change some of your genetic information. There is still certain safety. Sexual information should be relatively high. That is to say, virus variation can quickly cope with this mutation by adjusting.

In fact, the launch of the biomedical market in 2020 is more related to the clinical news of the adenal virus vector vaccine of a Hong Kong -listed company.

Figure: Different technical platform vaccines classification

Source: Wikipedia, FROST & AMP; Sullivan, Chinese Inspection Institute, Southwest Securities

2) The growth of domestic and overseas vaccine markets

Let's take a look at the growth of the entire vaccine in the global market and the domestic market.

According to data from overseas institutions, the global vaccine market size increased from US $ 27.5 billion in 2016 to US $ 36.5 billion in 2020, accounting for 2.8%of the global pharmaceutical market, with a compound annual growth rate of 7.3%. The efforts of international institutions such as WHO, in this process, the annual compound growth rate of global vaccine markets can reach 17.3%by 2025. From 2025 to 2031, the growth rate of the vaccine market predicted during this period was about 9.1%.

Source: Shalvin, Shen Wanhongyuan Research

This has obviously exceeded the growth rate of the world. Why is there such a big growth rate? The main is the increase in the popularization rate of vaccine. We can see a lot of data proves that in addition to the popularization of vaccines, we also have many new vaccines. The introduction of varieties. We will introduce this later. After looking at the data around the world overseas, let's take a look at domestic data. It is also a prediction made by Shalvin. If it is not counted as a category of seedlings, the growth rate of the second type of seedlings from 2016 to 2020 is very high, which is 33.09%. What is the forecast growth rate of the two types of seedlings from 2020 to 2025? It is 22.88%. The second -class seedlings predicted from 2025 to 2031 were 10.87%.

Source: Shalvin, Shen Wanhongyuan Research

On the one hand, this growth rate in China is still very high, and on the other hand, it is far beyond the average level of the entire world. This prediction is definitely not a blind shot, it is based on the change of population base, changes in income levels, and increased consciousness of vaccination.

3) Demand for vaccine

On the whole, the level of vaccine growth is still very high. To sum up the high -speed growth of the vaccine, in terms of demand, the demand is still very broad.

For example, some people may say that this example is a bit outdated, but I think this example is good, that is, you can see the number of vaccinations from everyone to get this vaccine to the end. It does rise Very fast. This is the HPV vaccine. In the past, there was no way to play directly in China. At that time, it was not only two -price in Hong Kong. There were already four -valent HPV vaccines. It seems that from 2014-2015, the 4-valent HPV vaccine in Hong Kong has been launched. Then by 2018-2019, 9 prices can be played in Hong Kong. At that time, the domestic two prices were not even listed. Domestic in China is also about two -price HPV in 2021. Including 4 and 9 prices can now be played in a very small range in China. Now the price is relatively easy to hit, and the subsequent countries may also have some procurement plans for two prices. It can't be regarded as a type of seedlings, that is, it will enter the country's procurement plan, then it will have a price reduction at the same time. In recent years, we will see it, for example, like 2017, there are agents and vaccines developed by their own. In 2017, HPV vaccine represented by a domestic vaccine enterprise may only have a batch of issuance of hundreds of thousands a year a year. Essence By 2020, the total batch issuance volume is close to 10 million. So the volume in recent years is very fast. This example shows that the vaccine market in our country does have a huge space for consumption upgrades and import substitution. The two logics of the demand side are very firm.

Many people say that the HPV vaccine is now very high, and the future growth prospects are not so high. It's true, but it's not right. First of all, after the HPV vaccine, you can play another 4 and 9 prices after you hit two prices. Even now overseas manufacturers are studying at 11 or 13 prices. It can still become a new growth point. In another aspect, the popularity of vaccination awareness is still very fast.

Including a potential situation now is a shingles vaccine. The inoculation group of shingles vaccine is also a fixed age, which is more like HPV vaccine. It is a proposed age range. Then the shingles vaccine is generally recommended for people over 50 years of age to take vaccination. Of course, it does not mean that everyone will definitely get it after 50 years old, but once you get shingles, it is really very painful. When you treat it, hormones are needed, and the impact on the body is still relatively large.

Therefore, theoretically, the benefit of inoculating shingles vaccine is still obvious. This vaccine is also the main force of imported seedlings overseas. It is also constantly developing herpes herpes vaccines in China. After listing, domestic alternative logic should also be quickly capsule.

This is what we want to say. With the improvement of national economic income in recent years, the market's demand for second -class seedlings is still very large. The vaccine is actually a bit like a body insurance, but it is actually small.

For example, we will still see many women in the past 20 or ten years. She may die from cervical cancer caused by human papilloma virus. In fact, this will also form an educational foundation for the public. With the popularization and improvement of market awareness, the rate of volume of these vaccines is still very fast. For example, the HPV vaccine used to go to Hong Kong, China before, but after being introduced in the Mainland, it can quickly measure it in such a short period of time. The number of issuances for one year, such as 12 million in the first half of this year. The next thing that may be hotter is this shingles vaccine.

In addition, there are other vaccines, such as 13 -valent pneumonia vaccines, and now there are manufacturers who are studying higher prices such as 23 -valent pneumonia vaccines. Including people who are currently doing influenza, in fact, the pipelines are still very rich in the future.

On the whole, consumption upgrade and import substitution are the main logic of vaccine demand. In addition, the penetration rate of many vaccines now is relatively low. For example, the penetration rate of 9 -valent HPV is only 2%, the penetration rate of 4 -valent HPV is 1%, and the penetration rate of 13 -valent pneumonia is only 8%. The penetration rate of influenza vaccine is only 2%.

Figure: Most types of seedlings have low penetration rate

Source: WHO, annual reports of each company, Chinese inspection institute, CDC, Southwest Securities organized. Note: The penetration rate is estimated at the batch of the caliber

The per capita vaccine in our country is only RMB 54, and then the per capita consumption of the US market is $ 61.6. So we are about six to eight times poor. Our penetration rate is indeed lower.

In the context of consumption upgrade, this improvement space is still very large. Let's take a look at the space for import substitution. There are 46 domestic vaccine companies, and only a dozen are listed. From the perspective of the competitive pattern, domestic production can account for about 58%, and imports account for 42%. Our prospects should still be considerable, and the domestic penetration rate is very low, and then many imported vaccines are still imported on the basis of low penetration. Increasing it can also have a better market share.

4) Supply of vaccine

Let's take a look at the supply side. In fact, many large vaccine varieties are not enough. The overseas vaccine market is relatively mature, and each track may have a large factory standing here. Looking at the country, many of them are still blank, that is, the very good vaccine for the overseas is that we have not been able to produce in China. Source: Company announced that Shen Wanhongyuan studied that individual stocks were for product layout explanations, and non -stock recommendations

Therefore, there is also a big growth space for the supply side. Domestic vaccine companies are not able to fully develop and produce with Shanghai outside Shanghai. Many overseas vaccines are also more expensive, and its production capacity will be more limited, because it is developed overseas, and production must be produced in China. In fact, the production of vaccines is very, very strict. For example, in 2018, everyone knows that there is something wrong with a vaccine factory, and this stock is delisted. In 2019, the new vaccine management law was introduced in China in 2019, and the requirements are very, very strict. It has very strict regulations on each link of the vaccine R & D, production and sales. Therefore, the new vaccine management law will actually strengthen the survival of the entire vaccine industry.

In fact, the threshold of the vaccine industry itself is very high. I just told you that there are more than 40 vaccine factories across the country, and there are more than a dozen people listed. Everyone thinks about it, if an industry is completely open and there is no threshold, will everyone be embraced? Because the vaccine itself is related to the national economy and people's livelihood, the vaccine is a needle for healthy people. High, so its entry threshold is very high. Vaccine is not a pharmaceutical manufacturer who wants to produce casually. It also needs to get licenses, and it is also very strict. This is the situation of the supply side, and there are relatively few vaccine manufacturers. Now that we have worked very hard, we have not even been able to keep up with R & D and production. Although overseas vaccines are also sold in our country, their production capacity is limited.

Under such circumstances, the supply of vaccines and demand in the future are still relatively large. I just showed you a lot of vaccines with the top 10 global sales rankings. In 2020, there are 13 price pneumonia vaccines, HPV vaccines, and influenza vaccines. The top five varieties of our country are Bai Baipo, hepatitis B, meningitis polysaccharide, rabies, and spinal ashgines vaccine.

Compared with overseas conditions, our country's vaccine varieties are mainly in the stage of meeting basic needs. In terms of varieties, the leadership of overseas is relatively stronger. But in the future, we can also catch up. Let's summarize the vaccine industry a little. From the perspective of policy, industry perspective, and talent perspective, we feel that they are still in a relatively friendly stage.

First of all, the policy is more supportive. In particular, the policies have strict control and requirements for vaccine quality. Secondly, in terms of industry, I just told you the situation of demand and supply. There is still room for continuing efforts at both ends. Finally, in terms of talents, the supply of talents in our country is relatively sufficient. For example, graduates have a "four major sky pit" majors before, and even one of biomedicine. In recent years, everyone has obviously felt much. In the past, students from biomedical majors may go to overseas laboratories to do Ph.D. before there will be projects. There are already many biomedical positions in China now, and you can take this path to study and develop. Therefore, talent reserves are also very good now, which is very different from before.

3. Analysis of investment value in the biotechnology industry

I just introduced the ingredients industry of the Vaccine Index to in addition to the vaccine industry, there are CXO or CRO, which are medical research outsourcing support, etc., as well as in vitro diagnostic IVDs, so we will tell you CXO and IVD to everyone to tell you A lecture.

1) CXO

CXO is a collective name for CRO, CMO, CDMO, and is mainly enterprises serving biomedicine and innovative drugs. Specifically, CRO provides research and development outsourcing services.

For example, a biomedicine, which we are very famous now, is called PD1. A CRO company to help other companies do PD1. What may be helpful? For example, how do this molecular formula get out? See how the overseas mature markets do, and how can we do it in China. Last year, these CRO companies have been hit, because in May and June last year, the state had a normative method of clinical clinical clinical. At that time, the interpretation of the market was that innovative drugs were regulated, and the number of CXO companies may be less in the future, so the CXO companies fell waves at the time. But in fact, we have been talking about repeatedly from last year to this year. This is not to make CXO companies unsure or encourage innovation. It is mainly to cut off those repeated useless innovations. Take PD1 as an example. Now there may be more than 100 PD1 projects in the research and plan to be reported. You will find that most PD1 projects are found. Its target is that PD1 is no different. The method of administration may be the same, that is, there is no difference. There are also indications that everyone may have reported the same. The people in front of this medicine have already made it first, and there is already a market share. You have to do the same thing again. Can you say that you can grab the market share? It is difficult. Because the previous medicine has a market share, occupying the market's cognition, and the price has also dropped very low. In this case, what else do you have to rely on others to pry out the market share of others? This innovative drug clinical method is to regulate some repeated research and development that cannot be won in market competition. In fact, we feel that this is the development of the entire innovative pharmaceutical company or the track of the track. For these CXO companies, it has not cut off your business. For example, do a little less PD1, you can do something, such as PDL1 or even if you change the method of administration or indications of PD1.

Therefore, some challenges faced by CRO are more of less repeated projects, and do more projects that can really help or use their research skills and advantages.

What does CMO do? Mainly provide the production and packaging services of raw materials, intermediates and preparations after R & D and commercialization. CDMO has more customized R & D services than CMO. Probably like this.

The cost of the R & D session is very high, and the research and development of drugs can account for 70%of the entire new drug research and development cost. So out outsourcing R & D, because CRO itself is a link for many pharmaceutical factories to do research and development, and has rich experience. Finding it can take less detours for some small pharmaceutical factories and improve efficiency. Small pharmaceutical factories may not be enough for its talents. With the help of CRO, some of their advantages can be used, pharmaceutical companies can focus resources on the core business. For example, you go to study the mechanism of the disease and dig new targets. After you dig it out, find CRO to help you do some detailed follow -up, so that your efficiency will get a relatively large improvement, which can shorten the research and development cycle. , Improve the progress of product listing.

Therefore, CXO should still be very hot now, because the entire innovative medicine track is still booming. In China, 2018 is a big year of innovative medicines. Originally, the pharmaceutical market in 2018 rose well in the first half of the year, which was driven by innovative drugs. Because in 2016 and 2017, our country has been supporting the development of innovative drugs, and has produced many laws, regulations, and policy methods. The preferential review and approval system for innovative medical devices came out at that time. After it came out, many pharmaceutical companies were encouraged and indeed made many projects. 2018 was originally a big year, and it rose well in the first half of the year. In July, I encountered the vaccine. In September, I encountered the Shanghai 4+7 Belt Purchasing Procurement Plan. In December, the 4+7 plan was implemented. Although these staged stages brought some twists and turns to the pharmaceutical market, in the process of promoting the procurement of the band in 2019 and 2020, the vitality of the entire pharmaceutical sector was still very reflected. In fact, it was mainly driven by innovative drugs driven Essence In recent years, innovative medicines have been developed greatly, and pharmaceutical companies are still very positive. Last year, the pharmaceutical sector did not perform well, but in fact, the faith was severely hammer. In the past, everyone felt that you would be mixed with imitation medicines, and the price was cut very low. Then go to innovative drugs and biopharmaceuticals, and as a result, the varieties of growth hormone biopharmaceuticals were brought in last year. At that time, a relatively large shadow was brought to the secondary market. That is, my hard work is so hard to get rid of the shadow of the collection and get the freedom of pricing. As a result, biopharmaceuticals will still be collected. Therefore, at that time, the secondary market did affect the psychology of many investors. Compared with the collection of generic drugs, the cardiac stent in the medical device began at the end of 2020, and the cardiac stent in the medical device also began to collect it. In 2021, there were bone joint collection, and later IVD collection. Everyone in IVD is difficult to collect, because the standardization of IVD is not particularly high, especially the standardization of chemical glowing is not high. Under such circumstances, it was also collected, and then the growth hormone was also collected. So the market was very depressed last year, and many investors abandoned the medicine sector.

But anyway, if you have a very scarce variety in the field of innovative drugs or biomedical, in this case, we feel that you should still be reflected in the ability you keep the price or the ability to keep your lead. Therefore, in the past few years, in encouraging innovation, the entire pharmaceutical industry should still have a lot of results. In 2021, the number of drugs in the active R & D period can reach 4,189, which has become the second largest pharmaceutical research and development place in the world after the United States, so many CXO companies have a very good profitability. In recent years, we can see CXO's leading quarterly reports and annual reports very good. Some leading companies may have 60%-70%of growth. This also illustrates the enthusiasm of research and development behind the pharmaceutical industry, or its fullness. 2) IVD, let's tell you the IVD, which is in vitro diagnosis. What is in vitro diagnosis? Nucleic acid is also considered a type, and after blood drawing, it is analyzed by instruments in the laboratory, such as hepatitis B virus detection and so on. Although the entire market is relatively late, but because of the acceleration of the aging of the population now, the incidence of chronic diseases and infectious diseases has also increased, so the development of the entire IVD industry in China is also very fast. The market size in 2019 is 86.4 billion yuan, and it is expected that the development speed of the entire market size from 2019 to 2024 may be close to 20%. It also uses a lot of equipment in the in vitro diagnosis, not only in vitro diagnostic equipment, but also high -end equipment in other medical equipment. For example, CT machines and X -ray machines are relatively expensive. Of course, there are some cheap things, wheelchairs, and tongue plates. These things are actually in the stage of import substitution and innovation and upgrading.

On the whole, the entire vaccine and biotechnology industry should be in the stage of booming whether it is the main vaccine track or CXO and IVD tracks. There is also a large logic of the entire pharmaceutical sector that is the aging of the population, and the process of consumption upgrade with the improvement of the people's living standards will be upgraded. Compared with the sixth census, the seventh census is increased by about 10%. Therefore, why is the pharmaceutical industry a evergreen track? It is because of the age of population aging, the per capita life span is continuously extended. And our body is like a machine, and it needs to be continuously repaired, and the needs of medicine will greatly increase. Under such circumstances, the existence of the entire pharmaceutical sector as an evergreen tree can be understood, because its demand does continue to appear, unlike some industries that may slowly disappear. And keep moving forward. This is the fundamental situation of the pharmaceutical industry.

4. Outlook for the performance of the secondary market in the pharmaceutical industry

Just now we have also talked about the pharmaceutical industry last year, which has been increasingly expanded. It gradually expands from the original generic drugs to equipment, biological products, and IVDs. After a sharp decline last year, this year should not have been adjusted so violently. For example, the seventh band purchases just passed, or the average price decrease is only 48%in the imitation drugs, which is the most gentle knife in the past seven times. Recently, there is still a classification of innovative drugs that can not be included in DRGS. The supervision still has a lot of policy space for innovative drugs. We will also see that in such a miserable situation last year, the performance of the entire pharmaceutical sector is still very good. For example, the performance of the biomedical industry last year's annual report, its net profit returning to the mother's net profit was still more than 50%year -on -year. Medical care may be a bit miserable last year, because the collection of collection has expanded to medical care, even if its performance has a growth rate of more than 30%. So the fundamentals of performance are still very good. However, in terms of valuation, because many investors evacuated from the pharmaceutical sector last year, the overall valuation reached a very low position. In the target index of biomedical ETF and medical ETF, when it saw its valuation segmentation reached 0%in history last year, it means that it is already at the lowest valuation, and it is really cheaper.

Recently, when we talked about the pharmaceutical sector, we also expressed a point of view: In the short term, we may be cautious and optimistic about the medical sector as a whole. Because its performance is still good, the valuation is very low, and this wave from the end of April to July has a very small number of rebounds. Therefore, it should be said that it still has the motivation to rebound or go up.

We also remind everyone earlier, such as the high -growth track sector that rebounded too quickly in the early stage of new energy vehicles and photovoltaic, may be adjusted in the third quarter. In this way Bounce. So at the time we said that the pharmaceutical sector was short -term and optimistic. But in the long run, we believe that the pharmaceutical sector is in the bottom of the bottom. As part of the pharmaceutical sector, the vaccine sector will definitely inevitably be affected by the performance of large pharmaceutical sectors. However, the vaccine sector also has its own logic. It was also said that in the past five years in the pharmaceutical detachment industry, CXO has risen the highest, followed by vaccines. So the vaccine prospects are still very good.

5. Interactive Q & A

Question 1: Is there any latest situation of the vaccine? Or is it the original vaccine, is there no latest results?

Answer: Yes, our domestic vaccines in the future should be relatively rich in reserves, not only the original results. For example, the HPV vaccine may have been imported overseas before, but now it may start many domestic ones. The top 10 major vaccines that are very popular overseas have not yet fully deployed our country. So many of these should be studied. If we go to see the product pipelines of several current head vaccine companies, you will also find a lot of new varieties. In addition to HPV and 13 -valent pneumonia, micro -card vaccines (micro cards are used to cure tuberculosis), There should be a domestic vaccine that just mentioned shingles just mentioned. So in fact, there are still many large varieties or things under research. If you care about it, you can see a lot of products in our domestic vaccine companies. When I just talked about the demand pattern and the supply structure, the demand was that everyone continued to increase the penetration rate, and there were domestic alternatives. There will be a lot of new varieties from the supply here, and this one will actually talk about it just now. Question 2: What are the differences between vaccine ETF and biomedical ETF?

Answer: There are still different things, although it seems that there is nothing different from watching. I have also asked the index company before, what is the difference between the top 10 ingredients stocks and biomedicine ETFs of the vaccine ETF target? Index companies have no way, because there are so many current vaccine stocks. But in the future, as long as more and more vaccine listed companies will increase their market value faster and faster, the vaccine ETF will focus on vaccines. In a biomedical index, the proportion of vaccines is almost 10%to 20%. But I believe that in the future vaccine ETF, its vaccine proportion and weight may be much higher than other biomedical indexes, which will be its difference.

Question 3: Why is HPV nine valent difficult to find?

Answer: Because the output is small. The two prices are made by the two types of papilloma virus together. The four valences are four types, and nine valences are nine types. Therefore, the two -price technical threshold is the lowest and the easiest to develop and produce. There is a listed company listed in the past two years. The main business is to do a two -price HPV. As soon as it is listed, it is in short supply and sells particularly well. But why do you say that the quadruple and nine prices come out slowly? Because the difficulty is more difficult, there are no manufacturers in our country that there are quadruples and nine prices in China. Now it is mainly overseas. question.

Question 4: What is the future of domestic vaccine companies' foreign sales prospects?

Answer: At present, many vaccines have not fully met domestic needs. I just show you before that the penetration rate of many vaccines in our country is not so high. Under such circumstances, you say that it is not particularly high for the time being, so it may not be particularly high for the time being, so it may not be so sufficient to cope with our domestic needs.

Question 5: Can biomedicine be added at this time?

Answer: I just talked about it just now that our conclusion about the overall pharmaceutical section is that it is cautious and optimistic in the short term, and the bottom is upward. I think it is to see what your investment goal is. If in the short term, because we are still cautious in the short term, although we are also cautious, we still have the words of optimism. You can bear it according to your own risk. Don't want to participate in the game. If you want to participate in the game, then you can buy it anyway, because the scale and liquidity of biomedical ETF (512290) are still very good, and it also supports you to do short -term games in the market. However, we may recommend that you can do biomedical ETFs, including vaccine ETFs, etc., as a very long -term variety. Because this industry is evergreen, the performance of the secondary market in the pharmaceutical industry has also proved that it is an evergreen tree. So we will think that if you treat it as a long period of pressing the bottom of the box, it is also very good.

Question 6: Will the number of R & D enterprises in the vaccine roll in the vaccine increase?

Answer: A class of seedlings in the vaccine must be very cheap. One type of seedlings are basically a few dollars. The second type of seedlings are tens to thousands of dollars. If the collection is used, hepatitis A vaccine has a collection of episodes, about 25 to 30 yuan. It is not called Ji Cai, anyway, it is national procurement. Because the vaccine we get, even if it is an active vaccine, is nothing more than these factories. We are hard to say a stock, so you can take a look at the preview of the operating performance issued by a factory, which is very profitable. So in fact, no one everyone thinks is so poor, and let's talk about research and development. It was said that the top 10 of the top 10 of the top 10 overseas sold, and some of our country has not yet been deployed. You may think that some varieties have been done by four or five, but everyone thinks about it. I just said that more than 150 people in the PD1 track are reporting to PD1. These four or five are not compared with it. What are you? To say the degree of volume, it is incomparable to innovative medicines. The threshold of the vaccine track is very high, so even if it is rolled, there is no innovative medicine. And the vaccine sales system is more complicated than the medical sales system, not so well. Therefore, in fact, in addition to research and development and production, your sales line is also a great advantage.

Therefore, our country's current vaccine company, which is very good to make the sales line well. What is the research framework of the pharmaceutical industry? Research and sales investment, in fact, you are also the same in contrast to put this framework into the vaccine. But the difference is that the pharmaceutical industry, especially innovative medicines, is indeed very rolling, because the threshold of the pharmaceutical industry is far lower than the threshold of vaccine. You see, I just said that PD1 can have hundreds of targets and medicines. But in the vaccine, we just watched it just now that a variety may be that five or six are doing it. Question 7: Can the MRNA vaccine be implemented in China? How can I see the technical difficulty of MRNA vaccine? Can it be solved?

Answer: Can you talk about the specific technical difficulties? Because some factories in our country are doing it, they may not be in their own factory, but to do it through their own subsidiaries. MRNA's overseas controversy is still quite large. It has its own advantages. For example, it is very fast, turning the gun head is fast, and the vaccine mutant MRNA can keep up at the fastest. remains. Then the virus has evolved, and you have to make a new wave. MRNA is not used, it is a new one in the laboratory and can be replicated quickly. This is the biggest advantage, and it does not affect your DNA. It will pass these genetic material information in the virus to your nucleus, but it will not occupy or change your DNA. Of course, MRNA also has many problems, but I don't know which problem you refer to. For example, some people say that it has a large response. Some companies in China are also doing MRNA, but indeed, in terms of the development of our country's vaccine and the level of overseas technology or intergenerational steps, it is indeed not as advanced as others. Vaccine. We also have a reorganized protein platform, and we are doing the virus carrier and mRNA we just mentioned. Of course, the hepatitis B of the reorganized protein is also available. There may not be a large number of approval and production yet. I think MRNA's carrier does need hard work. Because I saw some of the agents, or some vectors made by some overseas myself, the difference is still quite large, and some side effects will be relatively large. Some can help this technology better to pass the core information it wants to pass in. I think this is indeed a big problem and difficulty, and it should be difficult to break through in the short term. Because there are some companies in overseas itself doing well in this regard, I think it has also accumulated for a long time. In fact, the MRNA technology platform also has a relatively long controversy overseas. It has a long period of development, and its advantages and disadvantages should be obvious. Now it is mainly to worry about this kind of material that transmits nucleic acids. It has some toxicity. Indeed, I think it is still not so fast in China. The current situation is like this. There are many forms, including materials, polypeptides, and lipid nanoparticles, which are all done. But it feels now, such as the MRNA vaccine of Pfizer and BIOTECH is urgently launched. They use a kind of thing in lipid nanoparticles, that is, LNP, the effect it does, its body immunity response and activation vaccine will be Similar and the same safety. But then I watched some other data, saying that the effectiveness of the MRNA vaccine may still have a problem.

Overseas because their patented barriers are still higher, I think it should take longer to accumulate in China. I think that domestic development in this regard is not as fast as people, and now it is done on some small platforms. But these are all acquired in large companies, or with financial support. It will have a process of slow progress. This is what I know about this now.

Question 8: Biomedical is at a historical low of valuation. When will the valuation repair start?

Answer: It's hard to say. Let me review the past three years of biomedicine. In 2020, biomedicine has risen to August in the first half of the year, and the biomedical ETF rose the most from January 1, 2020 to August 5th, and increased by more than 100 % during that period. If you go back to see this round of market, what is its driver? It is the vaccine. In March, there is a Hong Kong stock that is vaccinated in March. Later, it was very fast for the first and second phases, which was equivalent to the entire biomedicine market. But then slowly went down. The main reason was that the adenovirus vector vaccine seemed to be required to do it again in Canada, so the whole was delayed. Later, the active vaccine began to come out, but the main force of the active vaccine was Beijing, Wuhan, and Kexing. These three were not listed in A shares. Later, the pharmaceutical sector began to adjust. This is the case. This is the approximate situation in 2020. By the end of 2020, the device collection was started, which was the heart bracket. In 2021, it was mainly dominated by the fear of collection, so the entire market adjustment was very powerful.

- END -

The total signing of the BRICS industry docking conference exceeds 10 billion yuan

Holding memorandum of cooperation in industrial projects. Reporter Zou Jiayi Photo...

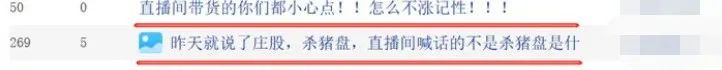

Is WeChat and live broadcasts reliable?Avoid the easiest way to "kill piglets"

According to media reports, there are some funds in the A -share market for killin...