Go to two -way!High -quality stocks such as Alibaba and other high -quality stocks accelerate the two major listing and return to Hong Kong stocks

Author:China Economic Network Time:2022.07.26

Since the new chapters of the "Listing Rules" in the Hong Kong Stock Exchange in April 2018, China Stocks have gradually returned to Hong Kong stocks in different forms. According to incomplete statistics, 4 of which are privy listing after the privatization, including Chinese Fei Crane, Yaoming Kangde, Yiju China and Le Chao Games; 9 are Duel Primary Listing, including Baiji Shenzhou, ideal car, etc.; 16 for the second listing (Secondary listing).

Especially since this year, China stocks have accelerated to return to the Hong Kong stock market through dual listing, which is particularly noticeable.

Market analysis believes that in the current context, through the two major listing, it can objectively avoid cross -border regulatory risks and better cope with the uncertainty of a single market. It is the optimal business choice that protects investors' interests and expands investor foundation. Earlier, CICC expects that in the context of increasingly complicated external environment, superimposed the Hong Kong Stock Exchange will expand the dual main listing acceptance. In the future, more and more overseas issuers will choose to return to Hong Kong stocks in a dual major listing. At the same time Companies that have or have applied for twice may apply for the main listing position in Hong Kong stocks.

By returning to Hong Kong stocks through dual listing, China Stocks will open the second growth space and rely on the Chinese market to achieve better development. Compared with the previous volume, the choice of Alibaba, the head of the head, is more of the vane of the vane, and it is also expected to bring more positive effects.

Ali has added Hong Kong as a dual major listing place, reflecting the continuous improvement of Hong Kong's international financial center status

Since returning to Hong Kong for the second time in November 2019, most of Alibaba's circulation stocks have been transferred to Hong Kong to register. China and the Asia -Pacific region are the main markets for Alibaba's business, and Ali has always received great attention from Chinese and Asia -Pacific funds. This time, the newly added Hong Kong to the market as the main list of listings, the success of the water at the technical level, is also in line with the market expectations of the market for a period of time.

In recent years, relying on the huge Chinese market, Hong Kong's attractiveness has been increasing as a listing destination. Based on market value, liquidity and fund -raising scale, Hong Kong has become one of the world's largest listing destinations. Alibaba transformed Hong Kong from the second listing to its main listing place, confirming that Hong Kong's status as an international financial center continued to improve, reflecting its firm optimistic about Hong Kong's long -term development, and continuing to accelerate global exploration with Hong Kong as a foothold.

After Alibaba's realization of the main listing, the deposit stocks listed in the United States and ordinary shares listed in Hong Kong can continue to be converted to each other. Investors can continue to choose to hold Alibaba shares in one form, which will attract more international capital to transfer to Hong Kong.

The Hong Kong stock market has a bridge to connect Chinese enterprises and world investors, while interconnection with the Mainland is becoming increasingly mature. Chinese stocks choose to double the market in Hong Kong. Once it is included in the Hong Kong Stock Connect, it will also provide more options for mainland investors to better share the dividends of corporate growth and improve the efficiency of resource allocation in the domestic capital market.

Hong Kong and Chinese stocks go in both directions.

On July 22, the Singapore Exchange and the New York Stock Exchange jointly announced the signing of an agreement, and the two parties will cooperate on the two major listed issues of the enterprise. This will help compete for more reflux stocks.

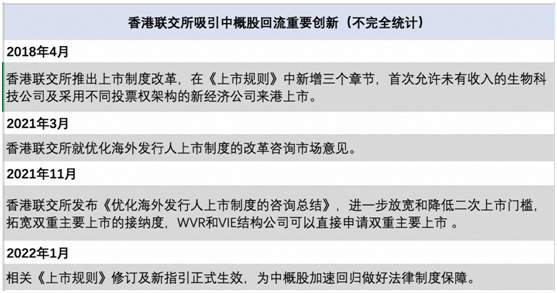

On the other hand, in recent years, the Hong Kong Stock Exchange has continued to focus on the development of global market development, launched a series of reform and innovation measures to create conditions for the return of high -quality and Chinese stocks, and gradually become an important financing center for new economic companies, international influence and competitiveness. constantly improving.

Since 2018, the Hong Kong Stock Exchange has launched the reform of the listing system to optimize and simplify the overseas publisher's listing system, allowing the publisher with different voting architectures (Weight Voting Right), and reduced the physical structure with WVR or variable benefits ( VIE) The threshold for listing of the issuer.

On March 31, 2021, the Hong Kong Stock Exchange further amended the system of Chinese -funded enterprises to go to Hong Kong to go public, published a consultation document to relax the threshold of overseas issuers.

In November 2021, the Hong Kong Stock Exchange issued the "Consultation Summary of Optimizing the Overseas Publisher's Listing System", further relaxing and reducing the threshold for second listing to broaden the acceptance of dual major listing. Among them, WVR and VIE structure companies can apply for dual major listing directly. The revision and new guidance of the relevant "Listing Rules" officially took effect on January 1, 2022, and paved the legal system guarantee for the return of China Stocks.

Hong Kong diplomatic relations are well -known for opening, tolerance, development and innovation. The series of reforms and innovation measures will help to enhance the reputation of Hong Kong as the preferred place of listing as an enterprise. It also greatly encourages more Chinese stocks and its two -way to go. Analysts believe that benefiting from these reforms and innovation measures, Alibaba's main listing in Hong Kong will also significantly increase technical indicators such as the profitability and scientific research investment of the Hong Kong Stock Exchange. For the Hong Kong Stock Exchange, more high -quality transaction targets including Alibaba, including Alibaba, will further enhance its attractiveness to global high -quality enterprises and capital.

- END -

Steel Maike -Mechanical Harvest Contest Binhai New Area Summer Harvest Corner

China Well -off, Tianjin, June 22 (Du Min) Mai waves are rolling, and the opportun...

Live trailer!Do n’t miss this time the training of beneficiaries ~

Taxation policies for science and technology enterprisesNational High -tech Enterp...