Deep planning | 20 years of opening up in China's gold market

Author:China Gold News Time:2022.07.25

With the official opening of the Shanghai Gold Exchange on October 30, 2002, my country's gold market was officially opened. This year is the 20th anniversary of the opening of the gold market. Over the past 20 years, my country's gold market has gone through the glory of the first spot trading market in the global field. It has witnessed Shanghai Gold as a Chinese standard and Chinese plan that affects the world's gold market. It has also encountered brutal growth and fanatic investment.

What experience and lessons have we gained in these 20 years of development? How to better participate in the diverse discourse system of the international market, contribute Chinese wisdom, and make a Chinese voice? How to plan the road in the next 20 years? The Chinese gold market in 2022 is at a new stage of meeting the people's high -quality golden needs, and also takes the journey of surpassing regional centers and moving towards the global center.

1

Fireworks full of fireworks: catch up with the world average consumption level

The opening of the Shanghai Gold Exchange in 2002 is a milestone in the history of the development of China's gold market. Looking back at 2002 in 2022, we can now clearly see that the Chinese gold market in 2002 is at a moment of starting point, and the international gold market is at a starting point of a 10 -year big bull market. China Gold The rapid development of the market from 2002 to the present seems to be taken for granted. However, when standing forward in 2002, when looking forward to the future, the weakness of the Chinese gold market is undeniable, and the prospect of the international gold bull market is not undoubted.

The Chinese gold market in 2002 is a market that has great potential and weakness: On the one hand, China is brewing a round of economic growth in 2002. The high -speed economic growth will inevitably give birth to the gold consumption high -speed gold consumption high -speed in traditional gold countries. Growth; on the other hand, even compared with India, which is also a major developing gold consumer country, the Chinese gold market is relatively late, and there is quite room for improvement in the full meet of the people's gold consumption needs.

In 1981, the Sixth Plenary Session of the Eleventh Central Committee of the Communist Party of China proposed that my country's main contradiction is that "the increasing people's increasing material culture requires the contradiction between backward social production", and this precise description of my country's historical development stage focuses on gold. The market is manifested as "the contradiction between the people's growing gold consumption demand and the gold market that is issued."

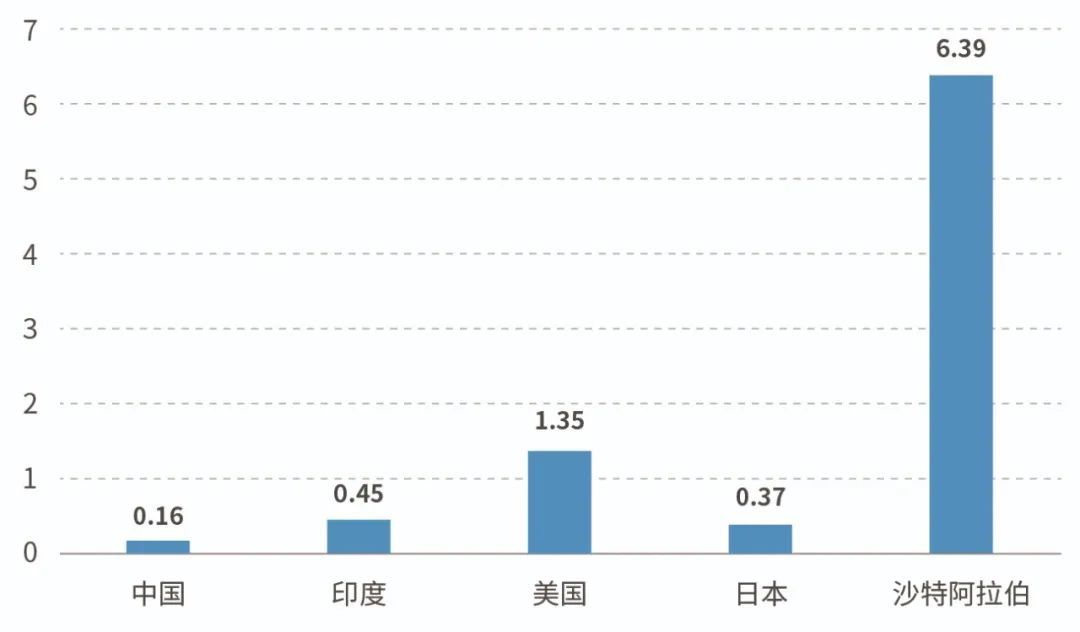

Figure 1: Comparison of the consumption of the per capita gold jewelry of China, India, India, and Japan in 2002 (unit: gram)

In 2002, China's gold jewelry consumption was 199.6 tons, and India's gold jewelry consumption, which is also a large gold consumer country, was 490.2 tons. The consumption of gold jewelry in Europe and the United States was 248 tons and 388.1 tons, respectively. Jewelry consumption is 139.3 tons. The vertical international is relatively easy to see that in 2002, there is still a considerable gap between my country's gold jewelry consumption compared to developed countries in Europe and the United States. India, which is also developing countries in developing countries, also exceeded the total consumption of gold jewelry in my country. Comparison of jewelry consumption (Figure 1) highlight the urgency of my country's gold market because of post -issuance. In 2002, China's per capita gold jewelry consumption was only 0.16 grams. It was only one -third of the per capita consumption of India, which is also a large population country and a large gold consumption power, and only the per capita consumption of Japan, which is also the East Asian cultural circle, 40 %, there is a huge gap with the per capita consumption of the United States and Saudi Arabia, which not only shows the reality of the market, but also implies the potential of China's rise. However, how to convert the implicit potential into real strength, this requires the unremitting exploration and efforts of the Chinese gold market builders and participants.

After 20 years of struggle and development, the core of the Chinese gold spot market constructed by the core of the Shanghai Gold Exchange includes banks, gold mining enterprises, jewelry processing enterprises and gold retail companies in which China has met the increasing people in China's rise. Gold consumption demand has made a answer that attracted worldwide attention. In 2021, China's gold jewelry consumption was as high as 673.35 tons, ranking first in the world. Figure 2 compares the consumption of gold jewelry per capita in China, India, and the United States in 2021. After comparing with Figure 1, you can clearly see that after 20 years of development, the consumption of Chinese gold jewelry per capita can already be compared with the shoulder India and the United States. The Chinese people. Gold jewelry demand has achieved a qualitative leap.

Figure 2: Comparison of the consumption of the per capita gold jewelry consumption of China, India, the United States and Japan in 2021 (unit: gram)

In the past 20 years, the Chinese gold spot market has a mission to meet the increasing demand for gold consumption. It is in the market atmosphere full of fireworks that China's gold spot market has begun to pursue quality excellence on the basis of a large amount of quality. The rise of the national tide design at present is just here.

2

China's Gold Market, which is tall: towards the International Price Center

The Chinese gold market in 2002 is the latecomers in the international gold market system. The gold price of RMB pricing is a new thing in the international gold pricing system. Although Asia has gathered gold consumer countries such as India, China, Japan, and Saudi Arabia, and Asia also has gold pricing centers in regional regions such as Mumbai, Tokyo, Dubai, etc. Although the gold spot standards in China and India are different from the European and American standards, it has formed for a long time. The east -pricing pattern has rarely changed, that is, the Asian gold market is based on the Golden US dollars in London and New York. When it comes to gold pricing, it must be called London Gold and New York.

However, from 2002, the Chinese Gold Market took the Shanghai Gold Exchange and the Shanghai Futures Exchange as the core. Relying on the huge gold import and active gold transactions, the Chinese standards and Shanghai pricing were gradually pushed to the international gold pricing system. The three poles, so far the Asian gold market has its own pricing benchmark. The efforts of China's gold market for international pricing power are based on the huge scale and liquidity of the domestic market. The cornerstone that supports the rapid development of China's gold market is China's demand and the rise of China's supply in the global gold market. According to the statistics of the World Gold Association, the global gold consumption demand (totaling and industrial demand) of global gold consumption in 2021 is 3304 tons. China ranks first in the world with 995 tons, and has a share of nearly one -third of the global gold consumption demand, far exceeding the exception, far exceeding surpassing European, American -Japanese and other developed countries. According to statistics from the U.S. Geological Survey, the global mining gold output in 2021 was 3,000 tons, and China topped the list with a 370 -ton output. It is driven by the rise of China's rise that the Chinese gold market with the Shanghai Gold Exchange and the Shanghai Futures Exchange has finally realized its pursuit of leading European and American markets in liquidity. In 2008, the average daily transaction volume of active gold futures contracts on the Shanghai Futures Exchange was 29.85 tons, while the average daily transaction volume of active gold futures contracts on the New York Commodity Exchange was 672.91 tons. 22.5 times; in 2021, the average daily transaction volume of active gold futures contracts on the Shanghai Futures Exchange was 130.12 tons and the average daily transaction volume of active gold futures contracts for New York Commodity Exchange was 1057.52 tons, and the average daily transaction volume of New York gold futures was only only It is 8 times that of Shanghai Gold Futures. In contrast, the rapid growth of the fluidity of China's gold market in just over ten years is evident.

It is based on the supply and demand status of the world's largest consumer and global gold -largest consumer and global gold, and is guided by the increasing demand for the people, and the Chinese gold market has the ability to influence the influence of outward radiation. The international board and Shanghai gold pricing of the Shanghai Gold Exchange are the manifestations of Shanghai's development center to the international pricing center. It is an inevitable result of the development of the domestic market. Therefore, although Shanghai's towards the International Gold Price Center cannot be achieved overnight, it will never be abandoned halfway.

3

The Chinese gold market that looks forward to the future: openness is still open, both internal and external

The Chinese gold market in 2022 has gone through 20 years, overcoming the difficulties of newborn, experienced the restlessness of youth, and an important point of life during life: the Chinese gold market in 2022 is meeting the people's high -quality gold needs At a new historical stage, it is also on the journey of surpassing regional centers and moving towards the center of the world. On the one hand, the Chinese gold market has been in the past 20 years to meet the number of people's gold demand. Such a original intention needs to be transformed into the quality of the people's gold needs under the new era; on the other hand, the Chinese gold market in the past 20 years Growing into Asia's most influential market, but it has not yet achieved a three -legged three -legged market with the New York market in London. To comprehensively reflect the market depth of futures contracts, at the end of 2021 at the end of 2021, the number of gold futures contracts on the Shanghai Futures Exchange was 179.61 tons, while the New York Commodity Exchange's gold futures contract holding was 1582.87 tons. long way to go.

At first glance, the firework gas that meets the needs of the people in the country seems to be separated by thousands of miles on the tall of international pricing power. However, through the open bond to the outside world, fireworks and tall are actually two sides of the Chinese gold market developing this coin. : Based on the gold demand of the Chinese people, the Chinese gold market has the attraction of external radiation. Only the Chinese gold market facing the world can better meet the upgrade of the people's gold needs. Chinese people's gold demand from the upgrade of quantity to quality requires opening up to meet diversified aesthetic needs, and the continuous expansion of people's gold demand is the lasting driving force for China's gold market to continue to catch up with the international pricing center.

- END -

Liqiao Township, Shandan County: Party building leads to the rejuvenation of the rural village at the time

The key to the rejuvenation of the rural rejuvenation of Zhangye Shanxun, Zhangye, China, is the party building. In recent years, Liqiao Township, Shandan County has adhered to the party building as a

Wind power and photoelectric companies have risen collectively or are related to this tens of billions of dollars energy subsidies.

Cover reporter Liu XuqiangOn Monday, July 18, the A -share market was just opened,...