The top 20!Management active equity fund scale totaling 1.1 trillion yuan

Author:Capital state Time:2022.07.25

On July 25, 2022, the public offering was officially disclosed a few days ago. With the announcement of the latest scale data of the fund, the management scale rankings of active equity fund managers on the market are also fresh. Choice data shows that as of the end of the second quarter of 2022, the top 20 active equity fund managers in management scale were 1.1 trillion yuan, an increase of 127.544 billion yuan from the previous month, an increase of about 12%.

In addition, the management scale of 71 fund managers exceeded 20 billion, 22 -bit fund manager management scale exceeded 30 billion, and 9 fund manager management scale was more than 50 billion yuan. Regarding the rise of the total scale of active equity fund managers in the second quarter of 2022, the market believes that on the one hand, it is due to the rise of the total scale of equity funds in the background of the market recovery, and on the other hand, due to the popularity and recognition of these fund managers due to the popularity of these fund managers It is relatively high, and the size of the management fund is relatively large.

Specifically, Gelan, Zhang Kun, Liu Yanchun, Xie Zhiyu, Zhou Weiwen, Liu Gezheng, Hu Xinwei, Li Xiaoxing, Xiao Nan, Zhang Ping and other well -known fund managers ranked at the top of the active equity fund management scale in the second quarter of 2022.

From the perspective of fund companies, these well -known active equity funds managers mainly come from fund companies such as China -Europe, Yifangda, Jingshun Great Wall, Central Europe, Guangfa, Huitianfu, Yinhua, Yifangda, Yinhua and other fund companies.

Among them, the Central European Fund Manager Gran, as of the end of the second quarter of 2022, reached 101.751 billion yuan, becoming the only 100 billion -level public fund manager at the end of the latest quarter. Followed by the fund manager Zhang Kun, Liu Yanchun, Xie Zhiyu, etc., the management scale is more than 80 billion yuan.

From the perspective of the top ten heavy stocks of the fund, as of the end of the second quarter of 2022, the top ten of Gelan's fund's comprehensive positions were: El Eye Department, Yaoming Kangde, Kang Longcheng, Tiger Medical, Mai Rui Medical, Kaile British , Tongmei Medical, Pianzi, Jiuzhou Pharmaceutical, Tongrentang. Looking forward to the future, Gelan said that innovative -related markets have not yet touched the ceiling of the domestic market, and overseas markets are gradually charging. Specific to the company's level, the trend of corporate transformation and innovation is still continuing, and the number of clinical applications for innovative drugs hit a new high year by year. In terms of innovation quality, in recent years, the overall research and development pipeline layout has become more rational, resources are inclined in differentiation, and innovative types of innovation with global competitiveness have been born.

- END -

Whenever the hot comment | "Abe Economics" to the "red and black" bill left to Japan and the world

On July 8th, former Japanese Prime Minister Shinzo Abe was assassinated and died in Nara, 67 years old. While all parties expressed their condolences on this unfortunate incident, they also paid atten

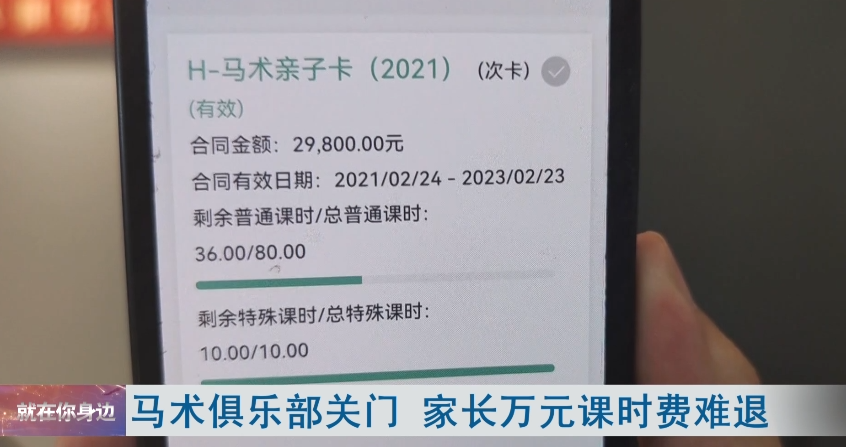

In order to learn equestrian for children, parents pay nearly 30,000 yuan for tuition fees. Just a few lessons, the other party ...

Whether it is a training institution or a so -called equestrian club, it is reason...