"Fold": Half -Le, Half of Le Gao?

Author:Financial Story Hui Time:2022.07.23

It seems that Lego's impulsive reckless husband -at the moment when the economy has not yet been out of trouble, its products will raise prices across the board, with a range of 5%-25%.

But Lego is full of anger.

After all, even Google co -founder Larry Page is the Le High Speed Fan. Page used it to create a programmable inkjet printer. Even, when a conflict with partner Bollinger, Lego bricks also acted as "peacemaker "-" One Play ".

In 2021, the fierce epidemic failed to stop the pace of Lego's growth -revenue and net profit increased by 27%and 34%year -on -year, respectively.

Users who are "interested" are willing to generate electricity for hobbies, pay for happiness, and make money for Lego.

Look at another counter -example -Dollar General, US discount retailers.

The number of Chinese people with a slightly strange Chinese store has exceeded Wal -Mart, Starbucks, KFC, etc., ranking first in the United States.

Unlike Lego, Dollar General sells practical and rigid products, and high cost performance is the core reason for its invincible. In the past few years, the market value of Dollar General has three times the market value, which has exceeded 50 billion US dollars. At the same time, Wal -Mart's market value has only been up to 30 %.

Dollar General and Lego are like two sides of the coin -people are willing to pay for cost -effectiveness, and they are willing to satisfy their hands for the spirit.

In China, the famous and innocent products that have just completed the double -listing list have made a high cost performance. Two years ago, the founder Ye Guofu raised the banner of "interest consumption".

In 2020, Ye Guofu first proposed the era of "interest consumption" in the industry. Two years later, "interest consumption" has become the golden tactics of the consumer industry, and even Douyin also lifts the banner of "interest e -commerce".

The cost -effectiveness of the left hand, the interested in the right hand, and the new story of "Dollar General+Lego"?

After the epidemic rebound, "worth" the most pressure -resistant, "interest" is a long tail

Under the epidemic, all retailers were affected, and Dollar General failed to be out of trouble. But the division is whether it can rebound quickly after the epidemic.

From 1990 to 2020, Dollar General has achieved the same growth in sales of the same store for 31 consecutive years. But in 2021, under the pressure of the epidemic, Dollar General's same -store sales fell for the first time.

The company explained that "the epidemic has caused the Dollar General supply chain to interrupt, insufficient production capacity, and the cost of distribution and transportation have also risen sharply. The quality and type of product are reduced."

Right now, the challenges faced by American retailers such as Dollar General are not there. The current inflation rate in the United States is about twice the increase of wages.

Under high inflation, US retailers were forced to lower pricing and gross profit.

However, this just gives Dollar General's opportunity -under pressure, many supermarkets and other retailers go bankrupt, and the shop receivers have become Dollar General. Dollar General has quietly become the largest number of retailers in the United States.

Under inflation, high oil prices, in order to save fuel saving money, the U.S. -bottom people are unwilling to drive to a long -distance store. The Dollar General nearly three to five kilometers has become a priority.

Thanks to this, with the relief of the U.S. epidemic, Dollar General's revenue rebounded rapidly. In Q1 2022, revenue increased by 4.2%year -on -year.

Like Dollar General, Mingchuang Youpin has also experienced a shock in the epidemic. The pressure it encountered includes rising transportation costs, rising raw materials, and some stores.

However, after the epidemic was relieved, by the Q1 of 2022, Mingchuang Youpin turned around. It is estimated that the gross profit margin of domestic business was increased from 25.7%in the same period last year to 26.6%. In the first quarter of this year, Mingchuang Youpin Single Store The performance has returned to the level before the epidemic.

In addition, in the United States, the gross profit margin of Mingchuang Youpin's direct -operated stores far exceeds 50%of the domestic level, which is also higher than those of the United States. Under an analogy, Five Below's gross profit margin is about 35%, Dollarma's gross profit margin is about 40%, and Dollar Tree and Dollar General gross profit margin is about 30%.

The higher gross profit margin given the flexible Tengshi space. Moreover, the famous supply chain in China is not affected by inflation. With the expansion of the number of stores and the expansion of the business scale, the relative advantages of Mingchuang Youpin in the US market are further increasing.

Therefore, the commonality of Dollar General and Famous and Create -is to rely on the ultimate cost -effectiveness to become the "rigid" choice of the target group. Although the performance of the epidemic is shock, it can rebound quickly after the epidemic.

Looking back at Lego -Under the impact of the epidemic, why can you increase the income and increase the profit?

The answer is also very simple, because Lego aims at interest consumption -not price sensitive people who pay for them, and they have not reduced consumption in the epidemic, which allows Lego to easily cross the epidemic storm.

And build a "three good" products, incubate Top Toy Dream Factory, carry out the famous creation of the "Interest Consumption" banner, and is slightly the same as the heroes see. Lego focuses on building block products and goes deeply in narrow interests; and the category of famous and innocent products is greater, and it is widened in the broad interest consumption. Ammunition can shoot all aspects.

Interest consumption and cost -effective consumption strategies have different pricing strategies.

Earlier, for a long time, Mingchuang Youpin has always adhered to about 50%of the gross margin pricing strategy.

Starting in 2021, interest -based products represented by IP products, the gross profit margin has been increased by at least 5%, and in the product pool of Mingchuang Youpin, the proportion of interest consumer products has increased to about 30%.

Under this strategy, Mingchuang Youpin does not need to raise prices in a full range -in fact, in recent years, the average price of products in the Chinese market in the Chinese market has maintained stability. Improve the overall gross profit margin.

Summary -discount retailers like Dollar General to meet the cost -effective public needs, strong anti -cycle capacity, once economically good, can rebound quickly; As long as the users and markets are fully "controlled", they can easily cross the Bull and Bear cycle and go all the way up.

Early famous and innocent products were more like Dollar General. Today's Mingchuang Youpin is aimed at the complex of "Dollar General+Lego".

Dollar General VS Name Chuang Youpin: Different Roads in the same direction

There are many similarities between Dollar General and Famous and Create, which once pointed to high cost performance. Therefore, to some extent, the status quo of Dollar General is likely to be the future of famous and innocent products.

But in fact, the path of the two is not completely consistent, and there are some differences.

First, the positioning is not exactly the same.

Relatively speaking, Dollar General is more sinking and positioned as one dollar store. The target group is the "Fifth Ring Road" crowd in the United States. Most stores are distributed in American towns. The positioning outside the Five Ring Road allows Dollar General to follow the "cost -effective" road to the end.

Unlike Dollar General, the famous and innocent business is a "five ring" business.

Although the groups in the Five Ring Road also have rational cost -effective demand, this is the key to the early opening of the market in Mingchuang Youpin -even today, Mingchuang Youpin has not deviated from the basic attributes of "cost -effectiveness". Non -interesting consumer products, as well as old mature products, maintain stable prices, and even reduce prices because of the scale effect.

However, at the same time, the people in the Fifth Ring Road also have a high level of purchasing power, which can support the "interest consumption" that is not just needed. What can be matched is that Lego serves mid and high -end users.

Therefore, the strategy of Mingchuang Youpin is to penetrate basic consumption with cost performance, meet the "good" life demand, and high cost performance, depend on the scale effect, dig in the deep protection of the city; Interest rate; one by one, form a encirclement for the entire market.

Second, in the store opening mode, the two are also different. Dollar General mainly adopts a direct business model, while the famous and innocent products are mainly partnerships and agency models, supplemented by direct operations.

The reason is that Dollar General was founded in 1939. The market is in short supply. It matches a relatively slow direct -operated expansion model and can also retain higher gross profit margins.

From the perspective of categories, in the past two years, Dollar General has expanded large -scale expansion of fresh categories, and the operating of fresh categories is extremely difficult, and it is also more suitable for direct business models.

Unlike Dollar General, Mingchuang Youpin played the partner and agent model.

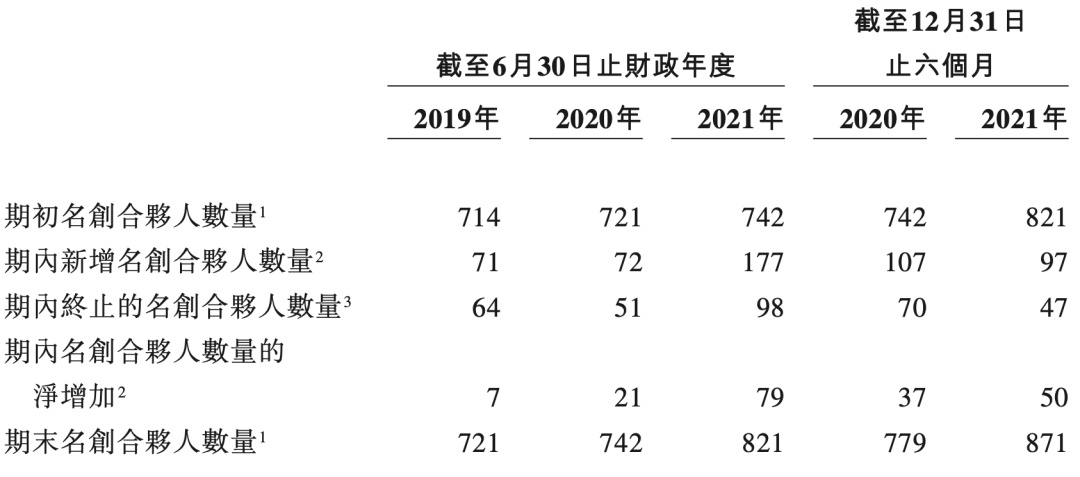

Compared with direct operating, the agent and partnership model expand faster. Dollar General opened 18,000 stores for more than 80 years, and 9 years of famous and innocent products have been opened, and more than 5,000 stores have been opened.

Today, Mingchuang Youpin has explored a feasible partner model. For example, during the epidemic, actively let the profit to franchisees sell decoration materials at lower gross profit margins.

According to the investigation of Fhstrishalvin, Chinese partners who are famous for their famous products can be recovered within 12-15 months after opening the store. Because of this, the partners are extremely loyal. As of December 31, 2021, 860 famous partners have invested for more than three years.

In the overseas market, Mingchuang Youpin is a latecomer. The partner model can help them open stores worldwide and achieve catching up.

Third, the brand and category expansion paths are different. One is mainly cost -effective, and the other consumer to expand it to non -rigid interests.

Dollar General is aimed at the "just -in -demand market". As a result, the category of food, freshness, etc., hoping to eat the share of players such as Wal -Mart.

Mingchuang Youpin turned his head up -walking with Lego, playing in the tide, extending to the field of interest.

The prospectus shows that as of December 31, 2021, there were 89 stores in TOP TOY, ranking third in China Chao Games track. In 2021, the single store GMV was RMB 7.1 million, which also ranked third in China. According to Ferrisana, the GMV from 2022 to 2026 will increase its annual growth rate of 24.0%, and will increase to 110.1 billion yuan in 2026. Overall, Tide Play is an extremely scattered market, and there is no unique one. The top three market share in the industry is only about 14%. Waterfish big, TOP TOY If the operation is good, it is expected to eat a considerable bonus.

The above two brands cooperate with each other. On the one hand, they can eat the dividends of the entire market. On the other hand, globalization, the path of famous and innocent products is broader, and can be eaten to eat low medium and high -income countries.

Fourth, Dollar General is based on North America, and the famous and innocent layout is global.

At present, Dollar General is mainly based on the United States. Outside of the homeland, more than ten stores have been opened in Mexico. Its growth logic, one is to expand the category, the other is to open new stores to increase layout density and increase the local market share.

Mingchuang Youpin is a global cloth point. As of the end of 2021, Mingchuang Youpin has opened 1,900 stores overseas and has settled in more than 100 countries and regions.

Why do famous and innocent strategies be so high?

First, it is closely related to its "interest consumption" positioning. Both Disney and Lego have fully globalized. Lego has entered 120 countries and regions around the world, and the scale of overseas revenue between the two is higher than the local area. It can be seen that interest consumption can pass the global market.

Secondly, it is also related to the absolute advantage of China's supply chain, which can meet the personalized needs of different global markets.

In short, although Dollar General and Famous Innochia are in the same direction, the path is very different. It is essentially based on their own positioning, advantages, and resource differences to explore their optimal solutions without absolute excellence.

Dollar General VS is famous for its prospects?

How to solve the way to solve future growth in different ways with different ways?

First, channel expansion is the common choice of both parties.

Although the number of stores in Dollar General is the first in the United States, its pace of opening the store has not slowed down and is accelerating.

Today, its average of three new stores per day, and three -quarter stores are located in a community with a population of no more than 20,000.

According to GlobalData Retail, as early as 2019, 75%of the US population only took 5 minutes to reach any Dollar General.

Forbes reported, "If there is any iconic scene in the United States in 2022, it may be a suitable person in the aisle of Dollar General."

Of course, Dollar General is also developing e -commerce business. However, overall, the e -commerce business is only supplemented by the business because the cost of logistics in the United States is high. Fresh categories, e -commerce models are difficult to get through, so the basic disk is still offline.

Mingchuang Youpin is also accelerating the expansion. Offline, the expansion route of Mingchuang Youpin's new store is two -way parallel.

The first is to lay out the world.

After gradually exploring the global doors, in addition to the increase in the number of stores, the benefits of single stores are also better. In Q4 in 2021, the average contribution revenue of overseas stores was 390,000 yuan, an increase of 44%year -on -year, and the benefits of single stores increased significantly. By Q1 2022, the revenue of overseas business of Mingchuang Youpin increased by 17 % to 520 million yuan year -on -year, and the overall overseas GMV increased by 30 %.

Also doing interest consumption, the case of Lego's globalization case Zhuyu first, in the market in 2021, the American region accounted for 40%, and the Asia -Pacific region contributed 18%, which has long been more than dozens of times. The global market revenue, if it operates well, is expected to overtake or catch up with the Chinese market in the future.

The second is to continue sinking.

In order to capture the sinking market, Mingchuang Youpin has set up different levels of partnership thresholds.

For example, municipal stores' franchisees are 29,800 yuan/year, the goods margin is 350,000 yuan, the chartered trademark of county -level stores is 19,800 yuan/year, and the goods margin is 250,000 yuan.

At present, the growth rate of the sinking market is more fierce -in January this year, the number of famous and innocent products in third -tier cities increased by more than 25%year -on -year, and the store GMV in the store was higher than that of first- and second -tier cities. The GMV growth rate of Youpin Store is 10%, of which the GMV driving effect of the third -tier cities store is the most obvious, an increase of more than 30%year -on -year.

In the analogy, Dollar General currently opens 18,000 stores in the United States, while Mingchuang Youpin has only opened more than 3,000 stores in China, and the Chinese market is more vast and the population scale is larger. It is possible to make several times the famous creation.

Of course, layout sinking markets may lead to the decline in the performance of single stores, but it is not a big deal. The costs and rents in the sinking market are far lower than the first and second -tier markets. Can run through the business model. In addition, unlike the Dollar General category, 11 major categories sold by famous and innocent products, including home, beauty, toys, etc., are very suitable for e -commerce sales, so its online channels have entered the harvest period. In Q4 in 2021, the revenue of the "e -commerce+O2O business" of Mingchuang Youpin accounted for nearly 11%, of which, O2O business revenue increased by 130%year -on -year.

Lego, which relies on "interest consumption", is also accelerating the opening of the store. In 2020 and 2021, Lego opened 134 and 165 new stores. Nearly 40 %. It is not difficult to predict. Next, TOP TOY, which also focuses on interest consumption, will also enter the outbreak of the store.

Second, whether it can forge an efficient supply chain.

In the final analysis, the supply chain hidden in the back end is the core competitiveness of retail companies. Almost every iteration of retail formats is based on the reconstruction of the supply chain.

Dollar General benefits from this. Although the product pricing is lower than Wal -Mart, its profit margin is enviable, surpassing large chain supermarkets such as Wal -Mart and Tajit, as well as smaller competitors Dollar Tree.

The reaching lower pricing and high gross profit is derived from the efficient supply chain system of Dollar General.

The famous and creative products are expanded by partnership and the business is all over the world. To ensure the consistency of product and service quality, it is also inseparable from the forging of the supply chain.

On the one hand, relying on the overall advantage of China's supply chain -Raising is that although the United States is the largest market in Wal -Mart, as early as 2001, Wal -Mart settled its global procurement center in Shenzhen, which seemed to see it. China has a unique supply chain in the world.

On the other hand, it also depends on the initiative of Mingchuang Youpin. Today, Mingchuang Youpin has cooperated with more than 1,000 suppliers to ensure global commodity supply based on direct procurement, large -scale, and shortening accounting periods.

At the same time, the scale advantage of over 5,000 stores worldwide is used to use the strategy of "quantitative price" to establish long -term relationships with suppliers to reasonably distribute the interests of both parties.

Third, the rating agencies look high, but how will the capital market perform in the later period, and it will be effective.

Dollar General has been the love of Buffett for a long time, and was one of Buffett's highest retail stocks.

Berkhill Hathaway's shareholder Tripip Miller also publicly claimed that Dollar General is one of Buffett's potential acquisition goals, "a elephant worth hunting."

Under inflation, the Dollar General model was even more high -looking. Mark A. Cohen, a professor of Columbia University, believes, "As long as the United States still has a lower class, Dollar General will have a market.

In June of this year, "Baron Weekly" screened five stocks worth investing, and Dollar General is one of them.

Like Dollar General, the business model of Mingchuang Youpin has also been optimistic about many rating agencies.

On July 13, Goldman Sachs updated the research report and covered the famous H -shares for the first time and gave the buying rating. The target price was HK $ 23.2. The reason is that with the ease of the epidemic situation in various places, the famous and overseas businesses in China and the overseas business have rebounded rapidly, the storefront resumes expansion, and the sales efficiency of branches will be improved. At the same time, Goldman Sachs is also quite optimistic about the hybrid retail store model of famous and innocent products, with strong supply chain management capabilities and product development capabilities.

On July 20, Jefferies released a research report on Famous Chuangyou, maintaining the buying rating and raising the target price from 9.51 to $ 11.1. The report pointed out that with the recovery of overseas demand, the proportion of overseas revenue contributions of famous and innocent products will increase, and it will increase the level of gross profit margin.

However, although the rating agencies are optimistic, for the current famous and innocent products, there are also a lot of challenges. For example, whether the track can truly support it and lay out overseas. and many more.

In summary, Dollar General and Famous Innochia have a high degree of rearrassment, and now the fork is traveling. The way forward, opportunities and risks will be followed by shadow.

- END -

The last course of the "New Apprentice Training Course" of Jilin Liudingshan Industrial Co., Ltd. officially opened

In order to actively implement the policies of the new type of apprenticeship and ...

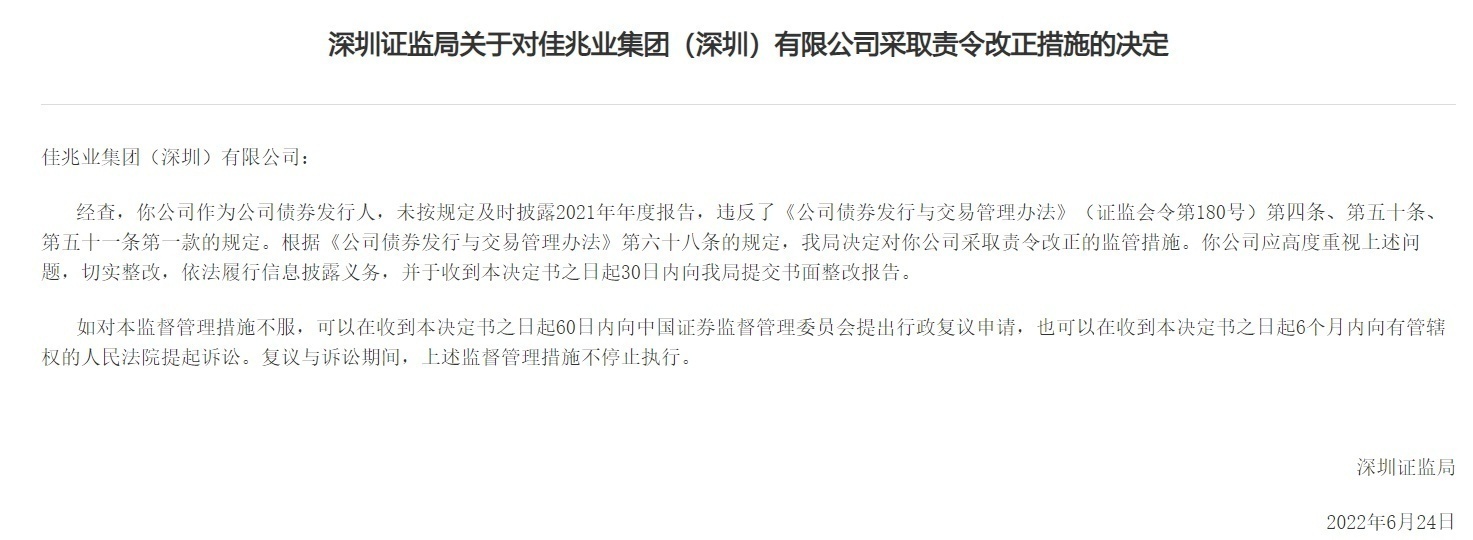

Continuously replaced key financial personnel, Jiazhaoye has not disclosed the annual report and was ordered by the Securities Regulatory Bureau to make corrections

On June 29, Capital State learned that the Shenzhen Securities Regulatory Bureau i...