Junle Bao's high -end story is not too stable

Author:New entropy Time:2022.07.22

@新 新 新

Author 丨 Bai Yan

Edit 丨 Monthly

"We have launched the IPO project and won the sales of 50 billion sales in 2025."

This is the expression of Junlebao Vice President Zhong Yan in the interview with the Shijiazhuang Daily recently. In order to accumulate enough profits to go public, Junlebao prepared three arrows, namely:

1. Milk powder among the leading brands of infant milk powder in the world;

2. Yogurt becomes the first brand of low -temperature yogurt in the country;

3. Fresh milk becomes the number one in the country's fresh milk category.

Among them, infant milk powder is a key category of Junlebao's impact. In 2014, Wei Lihua, the founder of Junlebao, took blood and vowed to use Xiaomi -style low -cost play to subvert the ecology of the infant milk powder market with deformed price interval in the Sanlu era. Wei Lihua once complained in his speech:

"At the beginning, no one dared to drink our milk powder, and we could only send it for free. Some people said that it was given to the dog first. There was no one for the dogs to eat again. Our employees listened to tears and shed tears."

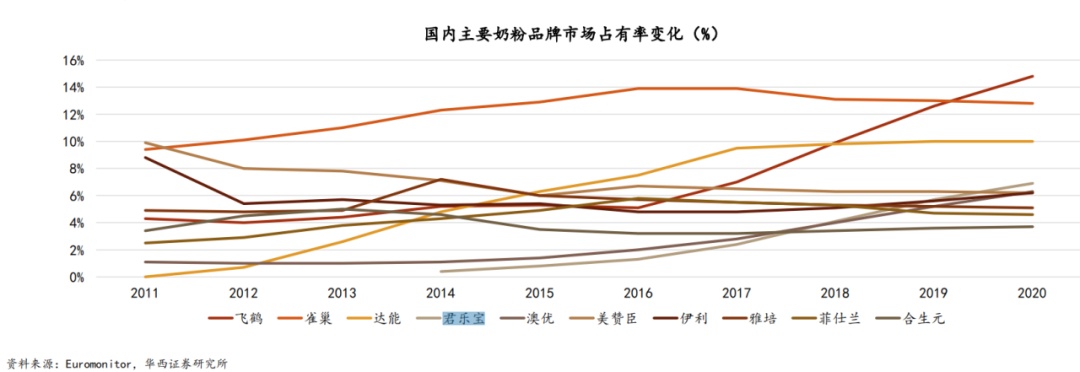

To this day, Junlebao Milk Fan, who started from the low -end, has opened the clouds, and has established a foothold in the sinking market with a high cost performance. Euromonitor data shows that Junlebao has already become a domestic brand that has statistics on sales based on sales, with market share second only to Feihe. Song Liang, an analyst of the dairy industry, told "new entropy" that Junlebao milk powder has been sold to 100,000 tons, and the volume is the first place in China.

This logic changed after Junlebao's departure from Mengniu. According to public reports, as early as 2016, the Hebei Provincial Government negotiated with Mengniu and its major shareholders COFCO to seek "single flying" by Junlebao. In 2019, the acquisition of Fang Penghai Fund and Jun Qian received 51%of the equity of Junlebao from Mengniu, and Wei Lihua, who held more than 40%, recaptured Junlebao's actual control.

After independence, Junlebao accelerated the high -end impact. In the eyes of Liu Simiao, general manager of Junle Bao Milk Fan Division, in 2014, Junlebao swept the low -end milk powder market at a price butcher's attitude; after 2020, Junlebao will subvert the organic milk powder market.

In May of this year, Junlebao released the three major milk powder products of Zhenyai, Zhenwei Ai, and Xinle Zhen in one breath. The sword refers to the high -end milk powder market controlled by foreign investment and heads of domestic brands. However, in addition to the disruptor, Junlebao is also subverted by the domestic milk powder market that is rolled in and shaking.

01 The price fluctuates, and the high -end milk powder that dare not buy

In the eyes of many Baoma, the positioning of Junle Bao milk powder makes people understand.

"Look at a domestic milk powder in two stores. The same thing, the family sells a thousand in his early one, the family is nearly two thousand, I dare not buy it."

Azhu only bought milk powder in the mother and baby shop, and the online channels were resolutely not touched, because they were afraid of buying fakes. Her child has just transferred to the second paragraph (milk powder is applicable to age, the second section is 7-12 months). In her eyes, the brand of the milk powder market is messy, the selling point is cumbersome, and the mother's decision -making is difficult.

Ah Da said to "New Entropy" that when buying Junle Bao Le Zhen milk powder, she encountered similar problems. The same 800g of Junle Bao Le Zhen's second -stage milk powder, Jingdong flagship store priced at 350 yuan; shop A store for sale The price is 358 yuan a can, but there are buying gifts, buying a large number of about 270 yuan per can; the B store is about 150 yuan a can, but you cannot scan the inner code. Nervous: "Everyone said, you are afraid you will buy fake goods."

This is a common psychology in the Bao Ma group. Prior to this, the best label for distinguishing the high -end of infant milk powder is the price. Before the melamine incident, the domestic milk powder occupied the dominant position of the market; after the accident, the daddy and the nurses bought foreign brand milk powder. China has become an absolute beneficiary, and other domestic brands have also risen rapidly through high -end products, such as Feihe milk powder.

However, with the "collapse" of the pricing system of major brands, the concepts of "low -end" and "high -end" are being confused. A consumer said he saw the price of the same milk powder in three channels, which were 100 yuan, 200 yuan and 300 yuan. The price of distribution channels is often much lower than the brand direct sales, which makes him do not know how to "start".

In fact, this is the overall collapse of the pricing system of dairy companies. A Junle Bao milk powder dealer Jiajia told the "New Entropy" that Junlebao Milk Powder is divided into currency and controlled goods. Low hair is used to obtain customers. The stores are profitable. The cost price of a can of milk powder is about fifty or sixty dollars. The profit margin of the mother and baby store is generally high, but it is expected to be willing to put profits to customers, but also faces manufacturer supervision:

"Now the manufacturer's price control is very strict, and the channels are too low to be fined."

But this cannot block the intention of the channel. Some mother and baby shopkeepers accused that some unscrupulous maternal and baby shops were even lower than the purchase price in order to seize the market share, which overwhelmed the living space of the personal mother and baby shop.

Song Liang told the "new entropy" that since the second half of 2020, the entire milk powder market has fallen into a price campaign. At first, it was channel -led, that is, the price was disguised by a large number of gifts. However, it was led by the brand since 2021, especially the three major domestic leaders joined the war.

High -end milk powder is the hardest hit area of this round of price war. As more and more maternal and infant stores choose to join the "Buy X Gift X" army, the profit space originally reserved by the brand to the channel has begun to release to consumers.

This is another consequence of the price system. Prior to this, high -priced milk powder means high -end and guaranteed quality. In the past two years of price melee, all the dads and nurses have seen a fact -buying high -priced milk powder is responsible for children, but it is more for the profit of sales channels. Since 2008, the "high price = rest assured" user's minds established by the market are collapsed, and Junlebao is the time point for the victim of this landslide -the brand to enter the high -end market, which is catching up with the collapse of high -end milk powder myths.

02 "Milk Powder Inner Code" three -party game

In fact, this is the Red Sea crisis that belongs to the Chinese infant milk powder industry. High -priced milk powder aura is retreated, but it is only one of the clinical symptoms of crisis.

The external cause of the crisis is the downturn. Wind data shows that since 1990, my country's birth rate and number of births have decreased year by year. Since 2016, the decline is more obvious.

The cause of the crisis is the high homogeneity of the industry. Song Liang told the "new entropy" that the marketing methods, product system, and sales channels of head milk powder brands are highly homogeneous:

"You can't kill me too, I can't beat you, and then consume it."

Junlebao used to focus on the sinking market of third -tier and below cities, but after high -end power, it inevitably entered the inner volume of the high -end market. On the one hand, foreign brands are still strong in the high -end market, and domestic brands are more "surplus shares" for foreign investment; on the other hand, the price war since 2020 has dragged down the water in foreign -funded brands, which has made the industry's competitive trend more even more Anxious.

In the chaos, an important concept is "string goods". That is, the dealers in region A will sell the product to the B area in order to complete the sales assessment, which will impact the brand's pricing system.

Jiajia told the "new entropy" that the brand's policies are different. The purchase price received by different agents and stores is different. For example Shang can get more than a superior agent to get the factory price:

"People you know in the brand can find the manufacturer to get the goods. The better the reputation, the lower the price of the goods."

Inner rolls of the industry, the driving brand is driven to more dealers. Song Liang introduced that in 2020, a large brand has replaced the task of completing the pressure of the goods, causing a large number of dealers to lose money. At the same time, it did not adjust the performance standards of dealers' rebates and rebates, which drove dealers to crazy and even sale.

The development of new sales channels is also accelerating the string of goods. After a mother and baby shop owner opens an online store, the price of milk powder is only 30 % of the brand pricing. In her opinion, if the epidemic does not run on the line, you can only watch it. Milk powder expires.

The solution of Junlebao is related to the traceability code.

The traceability code comes from the 2016 National Milk Powder New Deal. The milk powder after the milk powder formula is passed by the State Food and Drug Administration will implement one tank and one code. The code scan can be obtained by the name, packaging, production date, shelf life, origin, place of production, and place of production. Comprehensive data such as production batches.

And A Da mentioned that the "inner code" that the store did not let her scan is the exclusive creativity of Junlebao.

Prior to this, the traceability code was generally printed on the milk powder can packaging. And Junlebao's inner code is printed on the inside of the aluminum film in the barrel. To scan the inner code, consumers can get cash and consumer points incentives, and the company will obtain the product consumer terminal information, thereby supervising whether the batch of dealers will be whether the batch of dealers will String of goods.

The inner code brings a new three -party game to the brand, channel and consumers. In Jiajia's view, the essence of the inner code is the brand monopoly. The suppression of the string means "non -destructive pressure". The inventory pressure of dealers will be further enlarged. Eventually the low -cost milk powder on the market disappeared and consumers paid.

This observation comes from a large number of consumers feedback -after the implementation of Junlebao's internal code, more and more nanny complained that the price of milk powder is too high, and many old customers of Junlebao switch to other brands.

Stores and consumers have begun to reach a new tacit understanding -the store does not put on the shelves to set up a string of cargo milk powder to avoid supervision, but it still sells low -priced skewers milk powder for rewards. Consumers guarantee that they do not scan the internal code. On social media, "playing in the inner code" has become a bargaining technique that has been publicly shared.

To this day, the invented invented invented by Junlebao has become the industry's communication configuration. There is no doubt that this is the wisdom that belongs to the management of Junlebao.

But the internal code is still a strategy to cure the standard. As long as the industry crisis continues, the game of brands and channels that pass the crisis will not stop.

03 Drumming bombs, the crisis that cannot be resolved

The growth crisis of the milk powder market is letting the brand and channel start a game of "drumming flowers", but the flowers are replaced by a bomb.

Either the brand's sales are not available, the pressure of the goods fails, or the channel sales are not available, and the string of goods fails. In short, the slow -selling milk powder is often rotten in the hands of one side. When the drum sounds stop, the party holding the bomb is a loser.

Under normal circumstances, bombs always wander in the hands of the channel. Especially for head brands, consumers have high awareness and smooth sales, which will keep the brand away from the "explosion area".

But this is not always the case, bombs may also explode in the hands of the brand.

In the early morning of July 4, the dairy sector of A shares and Hong Kong stocks fell sharply, and the most decline was Aoyou, the head brand of the milk powder market. Australian Australia declined 8.45%on that day, and the market value of about 1.3 billion Hong Kong dollars evaporated on this day.

The decline originated from the profit early warning released by Australia the day before. Australia is expected to decrease by more than 73.1%in the first half of the year, because its high -end milk powder Hailipano 1897 sales strategy adjustment was adjusted. Under the pressure of the dealer's inventory, Australia Youyou had to reduce the goods to the distributor, which led to Australia's sales in the first half of the year decreased by more than 18%. In Australia's interpretation, the purpose of channel adjustment is to provide consumers with freshest and better products. Australia explained that reducing pressure on goods does not affect product development. In the second half of 2020, Australia Youyou reduced pressure on its goat milk powder products and returned the product to a double -digit growth rate. According to AC Nielsen data, the market share of Hyplino 1897 in the first April this year increased by 0.5%year -on -year.

But in fact, this is an indisputable thunderstorm. The relevant explanation did not touch investors, and Australian Youyou's stock was abandoned in the market. As of July 20, the Hong Kong stock market closed, Australia Youyou's cumulative decline has reached 19.81%.

For Grand Lebao, Australia's front car is vividly vivid. Once the dealer's inventory and funding pressure reaches a certain degree and no one takes it, the crisis will definitely be transmitted to the brand level, allowing the bomb in the hand to explode. Although Junlebao is in the IPO impact stage and does not have to bear the pressure of market value management, the thunderstorm itself will interfere with the rhythm of the IPO and affect investors' judgment on the company.

The difference is that the brand image of Junlebao is different from Australia. Australian Young is known for its ultra -high -end milk powder product matrix. The price system out of control has greater impact on the brand. Some high -end milk powder is still in the construction stage of consumer cognition, and has room for affordable sales.

But this does not mean that Junlebao has unlimited game time. Dealers in the contact of "New Entropy" generally expressed dissatisfaction with manufacturers, because they still maintain the original sales task assessment standards at the market period, and the internal code mechanism limits online channel sales.

In this era of "rotten", Junlebao also needs to find more paths to high -end.

(In the text, A -stayed, Jiajia is a pseudonym)

- END -

China International Geographical Mark Brand Cooperation Conference 7 projects online signing contract

China International Geographical Mark Brand Cooperation Congress Enterprise Line s...

The implementation scope of the implementation of social insurance premium policies in the city'

Five departments including the Municipal Human Resources and Social Affai...