CBRC: Small and medium -sized banks are running stable risks and controllable

Author:Zhongxin Jingwei Time:2022.07.21

Zhongxin Jingwei, July 21st. On the 21st, the National New Office held a press conference on the operation and development of the banking insurance industry in the first half of 2022. In response to the risk issues of individual small and medium -sized banks, the spokesperson of the CBRC and director of the Regulations Department said that the overall operation of small and medium -sized banks in my country is stable, and the risks are controllable; it will steadily and orderly promote the risk disposal of small and medium -sized banks.

A reporter asked: Since this year, what are the progress of small and medium -sized bank reform insurance? In response to some small and medium -sized banks "negative rumors and rumors", how can the CBRC be resolved?

According to Xiang Xiang, since this year, the CBRC has firmly grasped the general tone of steady progress and solidly promoted the reform of small and medium -sized banks. Mainly carried out the following aspects:

The first is to improve corporate governance. Promoting the organic integration of the party's leadership and corporate governance, most small and medium banks have established a "two -way entry and cross -service" leadership system. Strengthen the supervision of shareholders' equity, promote the introduction of qualified shareholders, clear up issues of shareholders, and optimize the equity structure. The CBRC is also carried out special rectification of normalized equity and affiliated transactions, focusing on cracking down on illegal shareholders and executives of small and medium -sized banks.

The second is to promote deepening reforms. Promote the reform of rural credit cooperatives in depth, and accelerate the reform process in accordance with the principles of "one province and one policy" in accordance with local conditions. In April of this year, Zhejiang Rural Commercial and Commercial United Bank has officially opened, marking the reform of the agricultural credit cooperatives focusing on the reform of the provincial party's party agency.

The third is to steadily promote risk disposal. We continue to arrange the actual risk of small and medium -sized banks and vigorously promote the disposal of non -performing assets. In the first half of the year, small and medium -sized banks dispose of 594.5 billion yuan in non -performing loans, which were disposed of 118.4 billion yuan over the same period last year. The regulatory authorities also support mergers and reorganizations, optimize market layout, and enhance the development momentum of small and medium -sized banks. In particular, promoting the "one province, one strategy", "one party and one policy" to deal with the risk of small and medium banks. For example, for example, we approved the Central Plains Bank and absorbed the combination of Luoyang Bank, Pingdingshan Bank and Jiaozuo China Travel Bank, which marked the staged progress of the risk resolution of the city commercial bank.

Fourth, multi -channel supplement capital. Capital is an important line of defense for banks to resist risks. Since the beginning of this year, the China Banking Regulatory Commission has actively accelerated the issuance of special bonds for local governments with the Ministry of Finance and the People's Bank of China to supplement SMB capital. In the first half of the year, with the approval of the State Council, it had distributed 103 billion yuan in the four provinces (cities) of Liaoning, Gansu, Henan, and Dalian. Various social capital, including foreign capital, improved the capital and quality of small and medium -sized banks.

来 体 pointed out that in general, the overall operation of small and medium -sized banks in my country is stable and risks are controllable. In response to the risk issues exposed by individual institutions, the CBRC will continue to implement the decision -making and deployment of the Party Central Committee and the State Council, and deeply understand the political and people's nature of the work of finance. We will adhere to the supervision of the people, steadily and orderly promote the risk disposal of small and medium -sized banks, effectively protect the safety of the people's financial property, so that the people are satisfied and the society can rest assured. (Zhongxin Jingwei APP)

- END -

Ensic Co., Ltd. held hands in Ningde Times Welcome Progress: It is planned to build 16 production lines in Xiamen, with a total investment of 5.2 billion

Lithium battery diaphragm leading enterprise Ensijie (SZ002812, stock price 242.15 yuan, market value 216.1 billion yuan) disclosed the progress of cooperation with power battery leading company Ningd

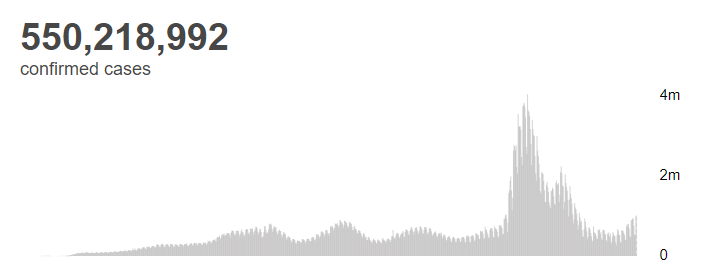

WHO: Global New Crown Pneumonia's confirmed cases exceeded 550.2 billion cases

According to the latest real -time statistics from the WHO, as of 17:03 on July 7,...