CBRC: Strengthen financial services in weak links, support the main body of the employment and guarantee of residents

Author:Zhongxin Jingwei Time:2022.07.21

Zhongxin Jingwei, July 21st. On the 21st, the National New Office held a press conference on the operation and development of the banking insurance industry in the first half of 2022. Ye Yanfei, the person in charge of the Banking Regulatory Commission Policy Research Bureau, said that the CBRC will strengthen financial services for weak links and support the employment of residents' employment and insurance market.

A reporter asked: Under the pressure of steady growth, what are the work of the China Banking Regulatory Commission to urge bank insurance institutions to increase support for the real economy? How effective is it? What is the key work in the second half of the year?

Ye Yanfei said that the current stable growth pressure is great. The CBRC has also done a lot of work, mainly to resolutely implement the decision -making and deployment of the Party Central Committee and the State Council, and introduce a number of refined practical policies and measures around a set of policies that stabilize the economy. Effectively promote bank insurance institutions to improve the quality of the real economy.

First, the effective supply of funds in the real economy increased steadily. Promote bank institutions to accelerate the disposal of non -performing assets, free up more credit resources; supplement capital for multiple channels, and enhance the capital strength of banking institutions. Through these measures, credit support for the real economy continues to increase. In the first half of this year, RMB loans increased by 13.68 trillion yuan. At the same time, optimize the arrangement of equity assets of insurance companies, and provide supporting support for direct financing in various ways. The balance of insurance funds at the end of June reached 24.46 trillion yuan.

The second is to support the effectiveness of employment in enterprises. Clarify the regulatory requirements of small and micro enterprises, especially to strengthen the category assessment and urge, continue to improve the coverage and accessability of small and micro enterprises 'financial services, and actively meet new citizens' financial needs in entrepreneurial employment, house purchase, education and training, medical and pension, etc. Essence

The third is to continuously optimize financial services in key areas. Strengthen national strategic financial services, support key projects and major projects, and continuously expand credit offering of manufacturing and science and technology enterprises, and expand scientific and technological insurance services. Vigorously develop green finance and support energy resources to maintain stable prices.

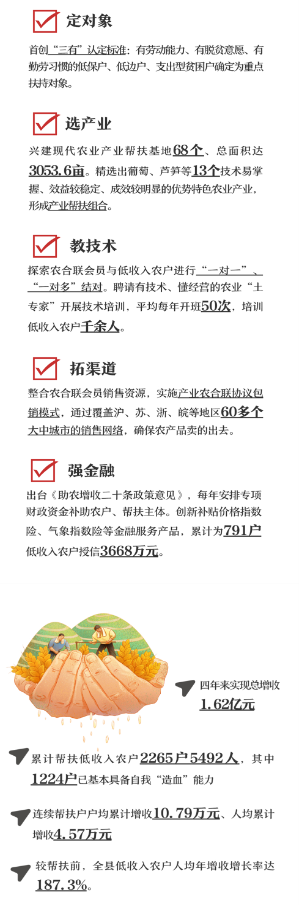

Fourth, the results of helping poverty alleviation and the achievements of rural rejuvenation are significant. Strictly implement the requirements of the "four non -picking", maintain the overall stability of the banking insurance industry assistance policy during the transition period, improve the rural revitalization financial service policy, promote the increase in credit offering of key areas of "agriculture, farmers", and encourage the development of rural revitalization insurance products. At the end of June, the balance of agricultural loans was 47.1 trillion yuan, an increase of 13.1%year -on -year, and the growth rate was relatively high.

The fifth is to help companies and individuals make positive progress. Introduced a new round of financial assistance policy, encouraging banking institutions to implement loans for small and medium -sized enterprises, individual industrial and commercial households, and truck drivers who are temporarily trapped in the epidemic. It does not affect customer credit and no penalties. Promote bank institutions to meet the reasonable financing needs of serious industries such as centers, catering, retail, cultural tourism, transportation, etc., and strive to achieve steady growth of loans in related industries.

Ye Yanfei pointed out that in the next step, the CBRC will effectively enhance the political and people's nature of financial work in accordance with the decision -making and deployment of the Party Central Committee and the State Council, and implement various policies to implement them, and fully support the stable macroeconomic market and high -quality economic development. The first is to promote the improvement of quality and efficiency of financial supply, and continue to meet the effective financing needs of the real economy. The second is to strengthen financial services for weak links and support the employment of residents' employment and insurance market. The third is to strengthen industrial transformation and upgrading financial support and stimulate new momentum of economic development. The fourth is to support the construction of infrastructure and major projects to help expand effective investment. Fifth, focus on dredging the cycle of the national economy and support the construction of a new development pattern. (Zhongxin Jingwei APP)

- END -

Agricultural Issuance Yima Municipal Sub -branch carried out "popularization of financial knowledge and keeping money bags" activity summary

Agricultural Issuance Yima Municipal Sub -branch carried out popularization of financial knowledge and keeping money bags activity summaryIn order to help financial consumers use legitimate ways to

The Communist Party's WeChat Report 丨 "Baihelian Qianhu", the income "gang group" is great

Zhejiang News Client Planning/Editor Xiao Yanwen reporter Li Shichao produced Xie ...