29 funds under the asset management of Zhongtai Securities (Shanghai) Asset Management disclosed the latest quarterly report

Author:Capital state Time:2022.07.21

On July 20, 2022, the latest quarterly report of China-Thailand Securities (Shanghai) Asset Management Co., Ltd. disclosed the latest issue of its 29 fund products (separate share calculation) (April 1, 2022-June 30, 2022).

According to data, Zhongtai Securities (Shanghai) Asset Management Co., Ltd. was established on August 13, 2014. During the reporting period (April 1, 2022-June 30, 2022) just.

Among them, the fund products with the largest net value growth rate are the value growth of China and Thailand, with a value of 9.79%. The relative performance benchmark of the fund is the yield of the China Securities 800 Index*50%+Hang Seng Index yield*20%++++20%+++20%+++20%+++20%+ The yield of the China Bond Comprehensive Index is*30%, and the current fund manager is Tian Yan.

During the reporting period, the investment strategy and operation analysis of the above fund: & nbsp; in the second quarter, there were some changes in the combination. The position is generally higher, almost reaching the highest level of history, and there are some adjustments in the variety. The price that meets our standards is cheaper in the market adjustment process. The opportunity to buy more and more, and the positions have improved accordingly. What is even more worthy is that after experiencing market structured adjustment, some companies with excellent texture have entered our range. The changes in positions and varieties means that the long -term implicit return rate of combination has further improved. For a long time, the requirements for the texture of the enterprise are our most important criteria. It is our basic principle for making decisions for buying and selling for long -term risk compensation. As far as the current market is concerned, our long -term views have not changed. Investment is a bit similar to boxing to some extent. To anyone in their own rhythm is a better choice. In the fields we are good at, we are continuously cultivating and creating income. We still like to do the market " outsider".

- END -

Hema "wildness" is not tame?

@新 新 新Author 丨 Gu FuEdit 丨 Yi PageSupermarket online is an inevitable trend, ...

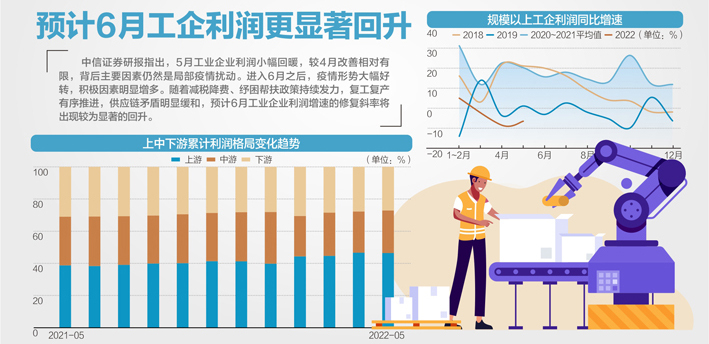

Production and operation gradually restore the decline in the profit decline in the industrial enterprise in May

The latest industrial enterprises' profit data is fresh.On June 27, the website of...