Ding Zuyu: The price of mainstream housing companies during the year has fallen by nearly 50 %

Author:Zhongxin Jingwei Time:2022.07.21

Zhongxin Jingwei July 21st: The price of the US dollar bonds of mainstream housing companies during the year fell nearly 50 %

Author Ding Zuyu Yiju Enterprise Group CEO CEO

Since July, the price of Chinese -funded real estate US dollar bonds has continued to fall.

The price of 34 US dollars in the mainstream housing companies monitored by Kerri Periods decreased by 45%from the beginning of the year. From July 1st to July 15th, the price of 34 US dollars fell 14%on average, and the price of 22 US dollars fell by more than 5%from the beginning of the month.

In the past week, it has experienced a dark moment. The real estate dollar bonds were sold by crashes. It is generally believed that the main body of private enterprises with better credit qualifications and stronger financial strength was not spared. This means that when the industry recovery is relatively weak, investors' expectations for Chinese housing companies are still pessimistic.

The index drops over 40 % during the year

The last time Chinese -funded real estate USD bonds were sold in October 2021. At that time, individual housing companies accidentally defaulted, causing investors to fall in panic selling.

At that time, the prices of bonds of a number of mainstream housing companies plummeted for a long time, and it was new since it was listed. China -owned real estate US dollar bonds hit the biggest decline in at least eight years. Data show that from September 30, 2021 to October 12, 2021, the Markit IBOXX index of Chinese -funded Chinese -funded US dollars fell 12.62%

Since then, the US dollar bonds have continued the trend of shocks.

According to data of Keri Voucher, from October to July 15th, 2021, the price of Kerri China Real Estate Bonds fell from $ 104.27 to $ 53.63, a decrease of 51%. The leading index of real estate bonds fell by 40%.

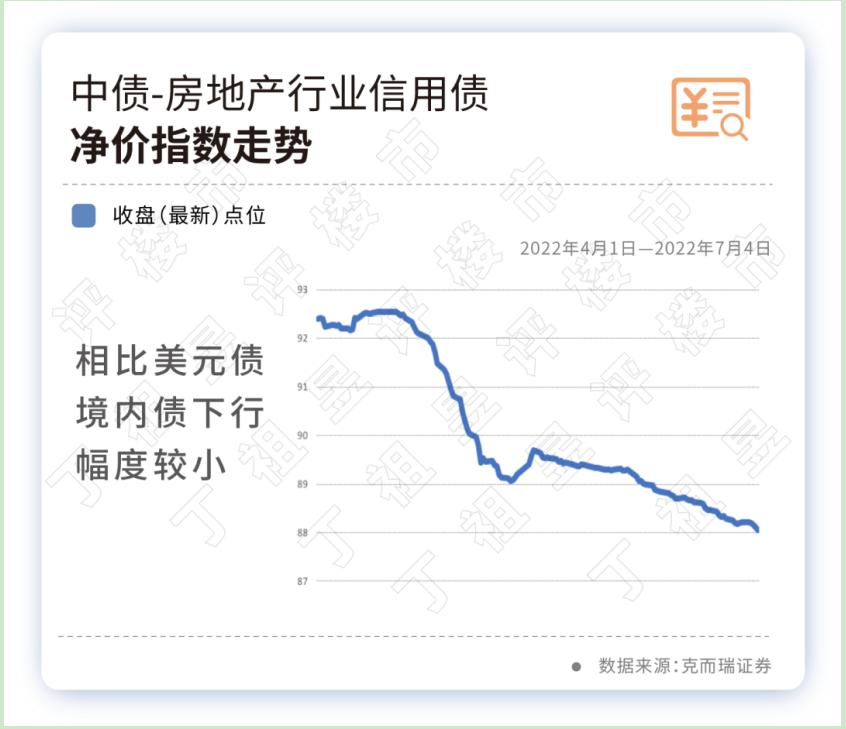

In addition, from the perspective of domestic bonds, our Chinese bond-the net credit bond net price index of the real estate industry has changed. Since the first decrease of the point of this index, the point has decreased day by day. As of July 15 Compared with early January, the cumulative decrease of 4.66%.

The small downside is because of the US dollar bonds, the price of domestic bonds is much stable, due to the credit rating of the issuance entity and the purpose of the investment purpose of bond purchase objects.

During the year, the price of mainstream housing companies US dollar bonds fell nearly 50 %

Since July, negative news such as suspension of loan has continued to affect and fermented. The Chinese US dollar bonds ushered in a new round of selling tide, and the price of multiple long debt fell below the 30 -dollar mark.

The average buying price of 34 US dollars in the mainstream housing companies monitored by Kerri Performance was 45.63 US dollars on July 15, a decrease of 33 cents per 1 US dollar at the beginning of the year, and the average buying price decreased by 45%. Compared with early July, the purchase price of 34 US dollar bonds fell 5.69 cents per month.

Among them, TOP10-TOP30 housing companies' US dollar debt has gone through several rounds of significant adjustments. The overall decline in the overall decline from the beginning of the year to July 15th, the purchase price of 11 US dollars was 29%, and the purchase price during the month decreased by 9.6%. Essence The total purchase price of TOP10 housing companies average 8 USD bonds decreased by 31.5%, and the average purchase price of the monthly decreased by 8.7%.

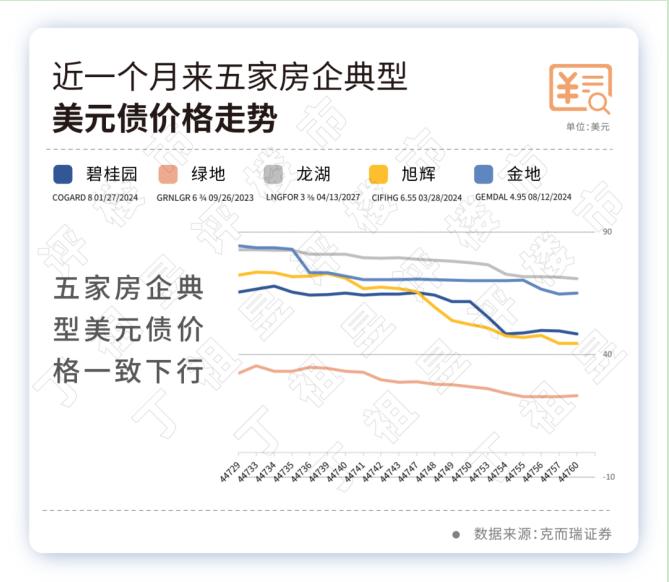

The price changes of the five typical housing companies in the five typical housing companies we have compiled have shown that from June 17 to July 18, most US dollar bonds have fallen 9-30 cents. Among them, Country Garden, Xuhui and Goldland's medium -to -long -term US dollar bond prices have decreased by more than 20%.

The pressure of US dollar bond expires does not decrease

The price of US dollar bonds has a lot to do with the current real estate market environment. In particular, the US dollar debt in the US dollar is frequently defaulted, and some hundreds of billions of housing companies show that liquidity difficulties have caused market confidence to fragile.

The market situation is still not optimistic.

In the past six months, most of the newly issued Real Estate US dollar bonds were exchanged for offer, that is, existing bills were exchanged into new issuance notes, and the exhibition period was disguised. According to Kerry's research data, as of July 18, 170 housing companies issued a total of USD 11.6 billion in US dollars, and from December 31st, 170 households' USD $ 18.9 billion in US dollar bonds expired.

Because many housing companies' US dollar debt exhibition period was mostly one year in 2022, in January 2023, it entered a small peak of US dollar debt repayment. The amount reached $ 12.1 billion, an increase of 30%from the fourth quarter of 2022.

It is foreseeable that in the context of the fundamentals of the real estate industry and the context of negative events broke out, investors' pessimistic expectations also put pressure on real estate bonds.

Let's look at the fundamentals of the real estate industry.

According to data from the National Bureau of Statistics, from January to June 2022, the sales area of commercial housing was 689.23 million square meters, a year-on-year decrease of 22.2%; the sales of commercial houses were 6607.2 billion yuan, a decrease of 28.9%. Although the single month was eased in June, some of the watch demand for watching the house was re -entered, but the sales scale of the release was still at a low level of history. Real estate development investment is still declining, and the overall fundamentals have not improved.

The price fluctuation of the US dollar debt of real estate companies has also verified the fragile side of the current real estate industry, and confidence in all aspects of the industry still needs to be rebuilt. The secondary market of real estate US dollar bonds is shocking, which means that real estate companies' re -financing and current capabilities are facing tests, and industry credit risks are exposed again.

At present, with the loose trend of regulatory policies, the transactions of the property market in some cities have now recovered. At present, the sales of commercial housing in the country have bottomed out, and industry confidence is gradually recovering.In the past two days, real estate US dollar bonds have been repaired compared to before, but before the industry did not really recover, the real estate dollar bond market will still face tremendous pressure.(Zhongxin Jingwei APP) This article was selected by the Zhongxin Jingwei Research Institute. Due to the selected works, the new Jingwei copyright generated by the selected work, without written authorization, no unit or individual may reprint, extract or use it in other ways.The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Musk "regret marriage", Twitter hired a top lawyer group: see the court!

Bloomberg reported that on Sunday evening local time, Twitter has formed a heavywe...

16 illegal facts!Didi was fined 8 billion, and Cheng Wei and Liu Qing were fined 1 million!

According to news on July 21, according to the conclusions and clues of the conclu...