The public offerings actively participated in the number of listed companies, and the participation in July has nearly 3 billion yuan

Author:Capital state Time:2022.07.20

Data show that as of July 19, 2022, public fund products on the market have participated in the fixed increase projects of 67 listed companies on the market since the beginning of the year, and the total subscription has reached 14.027 billion yuan. Among them, the participation in July to the present has reached 2.837 billion yuan Compared with March (3.764 billion yuan), it ranked second in the year.

From the perspective of the fund company, on July 19, Guangfa Fund issued an announcement on its fund investment in well -off shares (601127) non -public issuance stocks. Innovative hybrids, Guangfa value piloting one year holding, Guangfa Ruiyu holding one year, and the selection of 6 fund products in the Guangfa manufacturing industry, all participated in the subscription of the non -public offering of the shares of the well -off shares.

In addition, on July 15th, products owned by many fund companies such as Caitong, Qianhai Open Source, Fuguo, South, and Huaxia all issued the announcement of the company's fixed increase announcement. For example, Huaxia Panrui, a subsidiary of Huaxia Fund, was settled in one year, and Huaxia Panyi made a year to participate. The subscription of the non -public offering of the stock.

From the perspective of single -funded products, Huaxia Panrui is scheduled to be the fund with the highest total cost during the year, and a total of 23 listed companies including Jerry shares will be issued, with a total of 1.25 billion yuan; The Huaxia Panyi was fixed in a year, and the total amount of 16 listed companies was issued for a total of 846 million yuan. In addition, there are 10 funds with a cumulative increase in fixed increase in the fixed increase in the year, and 10 are preferred by Wanjia industries.

From the perspective of listed companies, the larger amount of raising amounts during the year is mainly new energy, pharmaceuticals, coal and other industries. For example, on June 22 this year, the Ningde Times disclosed a fixed increase result. The issue price was 410 yuan/share, with a total funding of nearly 45 billion yuan. A total of 22 institutions became the target of the strategic distribution of the Ningde Times, including JP Morgan Stanley, Morgan Chase, Guotai Junan Securities, Taikang Assets, Ruiyuan Fund, Gao Yan and many other well -known institutions at home and abroad.

Some fund people said that in the context of the market this year, due to the need to have a certain discount space for investors to choose from, it will naturally fluctuate the rhythm of distribution. Since the second quarter, the market has fluctuated, and the fixed increase has also recovered.

- END -

The first anniversary of the investment in Tianfu, Chengdu, nearly 3 million passengers in Eastern Airlines served

At 7:45 am on June 27, the first out -out flight at Tianfu International Airport o...

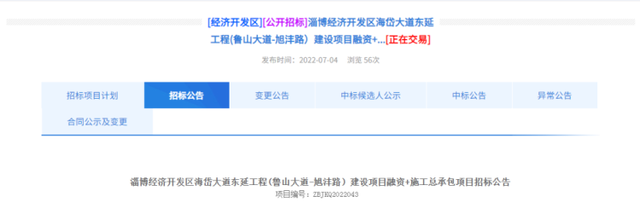

East extension!Involved in the main road of Zibo Central City

July 4Zibo Public Resources Trading Network releasedZibo Economic Development Zone...