Latest position exposure!Liu Ge 聚 Focus on the advantages of high -end manufacturing industry chain

Author:Capital state Time:2022.07.20

On the evening of July 19, 2022, Guangfa Small Drive Growth (LOF), managed by the Star Fund Manager Liu Gezhang, disclosed the latest 2022 second quarterly report. 14.36%, the net share of the Class C fund share was 14.24%, and the reference yield rate of the performance comparison of the same period was 3.00%.

In terms of scale, as of the end of June this year, the fund's latest scale has reached 11.605 billion yuan, an increase of 1.734 billion yuan compared to 9.871 billion yuan at the end of the first quarter.

In addition to the dazzling scale and performance, from the perspective of the positioning period during the reporting period, the fund manager Liu Gezhang did not make significant adjustments, and the overall operation of the high position was still maintained. The fund is still focused on the high -end manufacturing industry chain that has established a global comparative advantage, and some core target holding cycles are longer.

As of the end of the reporting period, the top ten heavy warehouses in the Gangfa Small Plate Growth (LOF) include: Xiaokang shares, Jing'ao Technology, Longji Green Energy, Jinlang Technology, Shengbang Co., Ltd., Yimei Lithium, Guolian Co., Ltd. Flerat, Kangtai creatures. Among them, the number of positions of Yiwei Lithium and Longbai Group remain unchanged; Guilian and Flyite have newly entered the seventh major heavy positions and the ninth largest heavy positions; The number of holdings of Bangli and Kangtai Biological has increased from the end of the first quarter.

In the latest fund report, Liu Gezhang said that the volatility of high -end manufacturing direction represented by photovoltaics, new energy vehicles, and electronics exceeds other types of assets, but it believes Fully release, the fundamental trend force is expected to re -become the core of asset pricing. In the second half of the year, the capital market may show a colorful situation.

In addition, Guangfa Ruiyang, which was controlled by Fu Youxing, another fund manager of Guangfa Fund, was set up in three years. The top ten heavy stocks in the second quarter of this year were also two.

Fu Youxing said that in the second quarter, although the price of commodities was still relatively high, it was weaker. Although the economy is still in the early stages of repair, the profit impact of upstream raw material prices has risen on A shares formed has begun to improve the dawn of improvement.

- END -

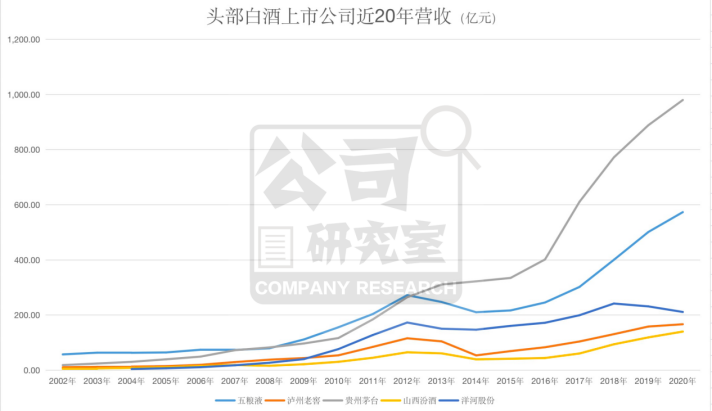

New commander Liu Miao: 30 years old in Laojiao's multiple background colors and character changes

Source: Company Research Room Wine Industry GroupText: Huai last monthAmong the wa...

National Development and Reform Commission: A total of 121 billion yuan in total investment and approval of fixed asset investment projects

China Economic Net, Beijing, June 16th Meng Wei, deputy director and spokesman of the Policy Research Office of the National Development and Reform Commission, said today that from January to May, the