CRO performance high increase in stock price?CSI medical valuation has shrunk to a record low, and the manager of the top flow fund sounds!

Author:Capital state Time:2022.07.19

Following yesterday, Kang Longhua dragged the CXO sector market, and today CXO concept stocks have been adjusted again. Tiger Medicine fell more than 5%. The pharmaceutical industry fell more than 3%, Yaoming Kant fell more than 3%, and the SCR medical index fell more than 2%.

Compared with the sluggish market, the CXO sector's interim report previewed a fierce transcript as a whole! The maximum profit growth rate of 6 ingredients stocks in Boteng shares is as high as 465%, and Kailei Ying also increases by 283%-306%year-on-year. Jiuzhou Pharmaceutical's interim performance growth is also around 70%. It can be said that it shows high prosperity. Only non -main factors such as investment have dragged down performance.

The largest medical ETF (512170) of the two cities fell 1.78%, with a transaction of 340 million yuan. Show in a net inflow.

[Performance to the left valuation to the right, the medical sector's valuation has a record low, and the cost performance gradually prominent]

At the same time that the profit continues to increase, the level of valuation of the medical sector has continued to refresh the historical low during the year. As of July 18, the Chinese Stock Exchange Medical Index valuation (price -earnings ratio) level remains 30 times, and the number of historical points is 0.25%, and the valuation of valuations The level is less than 99%of the time interval, and even lower than the valuation level of the end of 2018.

With the release of the latest 2 quarterly reports, the views of each current fund manager have disclosed one after another. Yinhua Fund Li Xiaoxing said that for the pharmaceutical sector, innovation is the future of the development of my country's pharmaceutical industry. CRO/CDMO is still the most powerful and certain section of the pharmaceutical sector, which continues to be optimistic about the stable performance and sustainable high increase. In addition, with the economic recovery in the third quarter, the demand and the optional medical beauty, medical services, etc. are expected to have good excess returns in the third quarter. Other sub -sectors, such as vaccines, medical devices, and high -quality stocks in Chinese medicine, will also participate moderately to maintain a balanced configuration of the combination.

[Since the beginning of the year, funds have been continuously borrowed from ETF low -inhalation layout. .

Since the beginning of the year, funds have continuously used the ETF low -suction layout to perform a medical sector with outstanding performance valuations. As of July 18, the share of the medical ETF (512170) increased by more than 5.3 billion yuan, and the latest share exceeded 26.1 billion copies. Since the listing!

At the same time, the Shanghai Stock Exchange data shows that the largest medical ETF (512170) has achieved net capital inflows exceeding 930 million yuan in the last 20 trading days. Obviously ~

The latest research report of the National Lianlian Pharmaceutical Report states that the performance of CXO interim report performance is bright and policies are favorable for innovative services! As of July 17, 2022, 103 SW -Pharmaceuticals have issued 103 agencies in the 2022 interim results. Home growth is 50%-100%(including 50%), 10 are 0%~ 50%(including 0%), and 41 <0%. On the whole, partial exit pharmaceutical companies, CXO, and medical device endoscopy segmentation have achieved better growth, showing good demand prosperity. We continue to be optimistic about the follow -up growth of these companies, and high growth is expected to continue.

Continue to pay attention to high -growth track/innovation/medical services, 1) innovative drugs and CXO; 2) medical devices, focusing on companies with continuous overseas capabilities, including Mai Rui Medical; Oral and other tracks ushered in the summer season. Beijing's "DRG Innovation Exemption" policy encourages innovative medical services, and key specialty medical services chain leaders.

Guolian Securities said that the performance forecast of CDMO company interim reported is excellent, reflecting the high prosperity of the industry. The industry's demand is strong. The domestic CXO companies have sufficient orders in hand, and the customer structure is constantly optimizing. The global competitive advantage has continued to expand. The overall performance of the industry has maintained a high speed growth and continued to be optimistic about the growth of CDMO.

Medical ETF (512170) tracking CSI Medical Index (399989) ingredient stocks have comprehensively covered the subdivision leader in the field of medical devices and medical services. High -growth areas such as aging, medical consumption upgrades, and medical beauty have long -term national demand growth.

- END -

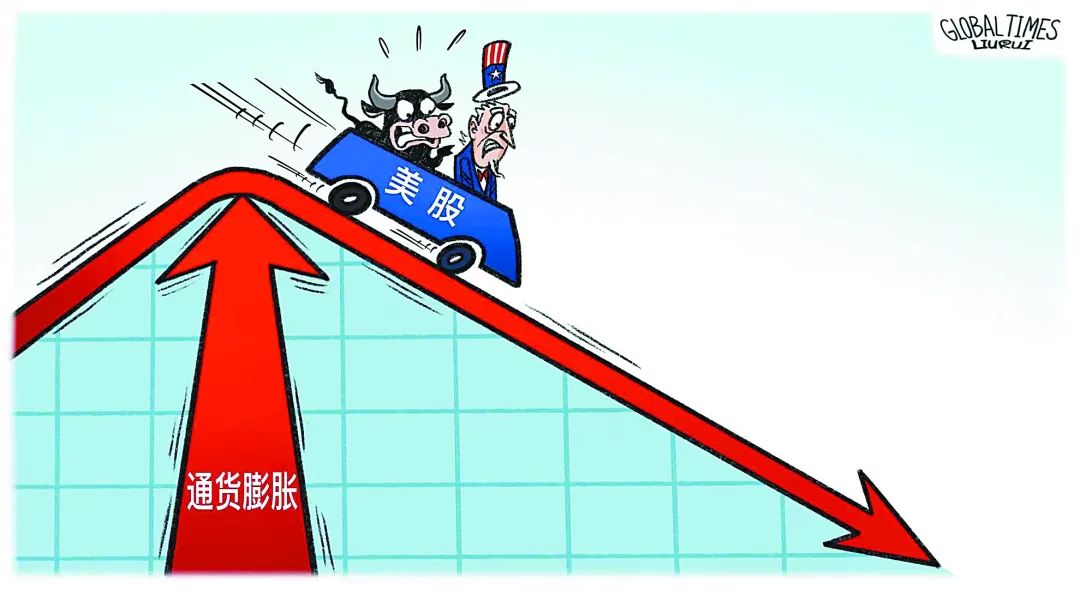

American confidence was severely damaged

The faint light has disappeared and welcome to the bear market -A American media i...

Tong'an first!10 o'clock today, set the alarm clock

Live BeltTogether with the future to the future!At 10:00 am on June 24th, the Ente...