Ruiyuan Fund Fu Pengbo's latest positioning emerged, and in the second quarter of 2022, the increase in the allocation of pharmaceutical stocks

Author:Capital state Time:2022.07.19

On July 19, 2022, the latest quarterly report of the three products under Ruiyuan Fund announced, and the latest positioning of the well -known fund manager Fu Pengbo emerged.

The financial report disclosed that Ruiyuan's growth value mixed (Class A: 007119; Class C: 007120) is now jointly managed by Fu Pengbo and Zhu Xi. As of the end of the second quarter of 2022, Ruiyuan's growth value mixed value was 32.487 billion yuan, an increase of 4.4 billion yuan over the end of the first quarter. The net value of the fund A fund shares was 1.7810 yuan, and the net fund share growth rate was 12.08%in the second quarter; the net value of the Class C fund shares was 1.7579 yuan, and the net fund share growth rate of the fund in the second quarter was 11.98%.

In terms of asset allocation, as of the end of the second quarter of 2022, the fund's stock position was 91.53%, a decrease of 0.82 percentage points from the previous quarter. In terms of industry, the configuration of medicine, coal, photovoltaic and new energy is added, while reducing the electronics and communication industries.

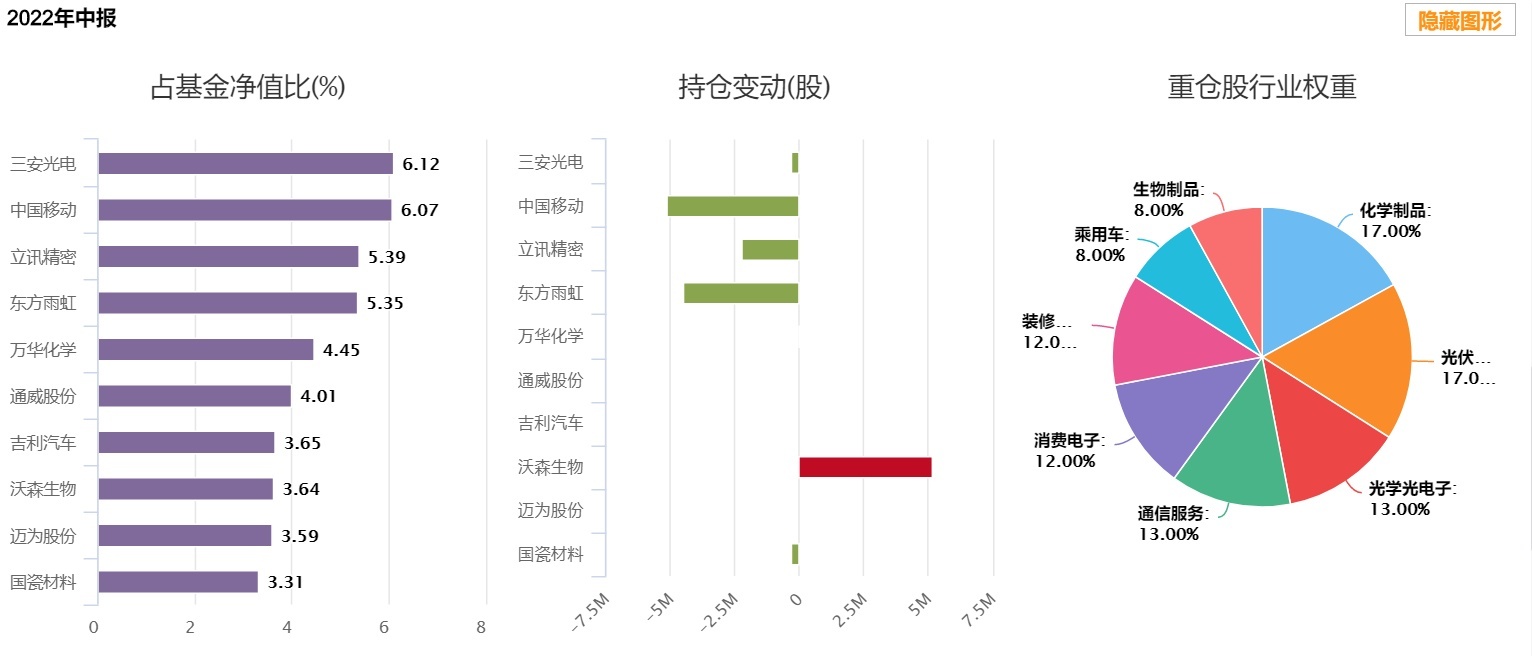

According to the financial report, as of the end of the second quarter of 2022, the top ten heavy warehouse stocks with mixed growth value of Ruiyuan were Sanan Optoelectronics (6.12%), China Mobile (6.07%), Lixin Precision (5.39%), and Oriental Yuhong ( 5.35%), Wanhua Chemistry (4.45%), Tongwei (4.01%), Geely Automobile (3.65%), Watson Biological (3.64%), Mai as shares (3.59%), Guori Materials (3.31%) The top ten stocks accounted for 45.58%.

In the second quarter of 2022, Fu Pengbo greatly reduced China Mobile, Oriental Yuhong, and Lixun Precision, with a reduction of 5.1255 million shares, 4.491 million shares, and 2.221 million shares, but Fu Pengbo also significantly increased its holdings of 5.161 million shares of Watson Biology.

Judging from the latest top ten heavy stocks, compared with the first quarter of 2022, Tongwei, Geely Automobile, and Mai are the top ten new entrances, while leading intelligence, big laser, and Weining health fell out of the top ten.

Chart source: choice data

In the analysis of the investment strategy and operation analysis of the growth value of Ruiyuan's growth value, Fu Pengbo and Zhu Xi of fund managers, whether the economy can return to the level of reasonable growth in the second half of the year, requires the effort of incremental policies. Real estate and infrastructure are visible specific grasps Essence Looking forward to the second half of the year, the dynamic adjustment and optimization combination is still the focus of work. For the comparison and screening between the company and the company, it will more comprehensively examine the long -term growth capabilities, including the growth and new growth curve of the stock, the performance of performance, and the management of management and internal execution. Level.

- END -

Zhejiang Jinhua Industrial Aid "Group Group" releases large energy

In May 2021, six cadres and talents in the group group of Jinhua City aid Xinjiang...

Cross difficulty, practice internal skills!Observation of some foreign trade enterprises in Hebei

Affected by factors such as rising raw material costs, increased maritime freight,...