new progress!Core electronic sprint scheme innovation board IPO obtained the Shanghai Stock Exchange inquire

Author:Capital state Time:2022.07.18

On July 18, 2022, Suzhou Xinton Electronic Technology Co., Ltd. (hereinafter referred to as "Citron Electronics") science and technology board IPO entered the "inquiry" state.

Picture source: Shanghai Stock Exchange official website

Citron Electronics is a professional integrated circuit design enterprise. The main business is the research and development, design and sales of simulated chips such as lithium battery protection chips and power management chips.

Financial data shows that the company's revenue in 2019, 2020, and 2021 was 135 million yuan, 184 million yuan, and 245 million yuan, respectively; net profit corresponding to mother -in -law at the same time was 28.053 million yuan, 49.907 million yuan, and 71.3458 million yuan, respectively.

Compliance with the company and the selection of the "Shanghai Stock Exchange Science and Technology Innovation Board Stock Issuance Listing Regulations" Article 22 (1) and the "Listing Rules for the Listing of the Shanghai Stock Exchange Science and Technology Innovation Board Stocks" ) Item standard: The estimated market value is not less than RMB 1 billion, and the net profit in the past two years is positive and cumulative net profit is not less than RMB 50 million, or the estimated market value is not less than RMB 1 billion. In the past year For positive income is not less than RMB 100 million.

According to the "Audit Report" issued by the accountant of Rongcheng (Rong Cheng Zuoto [2022] 230Z0175), the issuer achieved operating income of 24,490,300 yuan in 2021, and the net profit attributable to shareholders of the parent company in 2020 and 2021 (to deduct the deduction Those who are low before and after non -recurring profit or loss are calculated as calculated) 48.4295 million yuan and 65.1539 million yuan, respectively. At the same time, combined with the company's external investors' investment valuation and comparable company valuations in the same industry, the company's estimated market value is not less than RMB 1 billion.

This time, it is planned to raise funds for the research and development and industrialization projects of lithium battery protection chips, industrialization of power management chip development and industrialization projects, lithium battery measurement chip research and development and industrialization projects, and supplementary mobile funds.

As of the signing of this prospectus, the core enterprise management holds 39.7123 million shares of the company, accounting for 61.01%of the total share capital before the issuer, and is the controlling shareholder of the issuer. Stocks; indirectly holding 61.01%of the issuer's shares of the core enterprise management of Hong Kong Cither Shin; 0.72%of the issuer's shares of the issuer are held through Sai Chi information, and a total of 66.13%of the issuer is held.

Since the establishment of the issuer, Mr. Jiantan (Tan Jian) has been responsible for comprehensively planning the company's daily production and operation, which has a substantial impact on the issuer's operating decision -making. Therefore, JianTan (Tan Jian) is the actual controller of the issuer.

The second phase of the Great Fund holds 3.3565 million shares of the issuer, accounting for 5.16%of the total share capital of the issuer; Yuanhe Puhua holds 1.7981 million shares and holds 2.76%of the shareholding. The shareholding ratio is 2.58%.

It is worth mentioning that the large fund and Goer shares have been newly added shareholders in the past year.

- END -

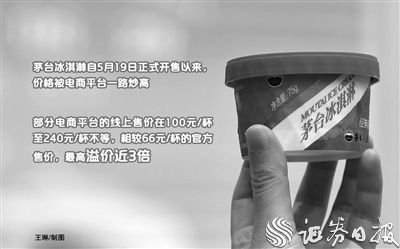

Moutai ice cream is frying to the back of the sky: "Because you can't buy it, you will be fired"

'Classic Original × 12 Cup price is 2253 yuan, SF cold transportation, and quickl...

Ruier Gai County Supply and Marketing Cooperative organized a training meeting for "Welcome Twenty New Supply and Sales to Sales and Sale"

In order to effectively implement the key tasks of serving agriculture and rural a...